What is an ISA and how does it work?

An Individual Savings Account (ISA) is a tax-free savings or investment account available to UK residents, allowing you to earn interest or investment growth without paying income tax or capital gains tax. The main benefit is shielding your money from taxes, which can make a significant difference over time, especially for larger sums. For the 2025/26 tax year, the annual ISA allowance is £20,000, meaning you can contribute up to this amount across all your ISAs combined each tax year, running from 6 April to 5 April.

To open an ISA, you must be 18 or over and a UK resident. You can hold multiple ISAs but cannot exceed the allowance in total contributions. Withdrawals are flexible for most types, but some, like Lifetime ISAs, have restrictions. According to official figures from GOV.UK, around 15 million adult ISA accounts were active in 2023/2024, showing their popularity among savers.

Eligibility is straightforward: UK residents aged 18+ can subscribe, but non-residents may face limits. For more on what is an isa uk, see our detailed guide.

Cash ISAs

A Cash ISA functions like a regular savings account but with tax-free interest, making it ideal for low-risk saving. You deposit money into accounts offering fixed, variable, or easy-access rates, protected up to £85,000 per person by the Financial Services Compensation Scheme (FSCS), which safeguards your funds if the provider fails.

Current interest rates for 2025 vary, but easy-access options hover around 4-5%, while fixed-term deals can reach 5% or more for one year. This type suits those seeking stability, as your capital is secure and not subject to market fluctuations. However, inflation can erode real returns if rates fall below price rises.

Risks are minimal, with no investment volatility, but liquidity might be limited in fixed-rate versions. For comparisons of best isa rates uk, check our pillar page.

Tip: If you’re new to saving, start with a Cash ISA for its simplicity and FSCS protection. Shop around annually to switch to better rates via transfers, which don’t count towards your allowance.

Stocks and shares ISAs

Stocks and Shares ISAs let you invest in stocks, bonds, funds, or ETFs within a tax-free wrapper, potentially offering higher returns than cash savings but with market risks. Your contributions buy assets through platforms like Hargreaves Lansdown or AJ Bell, where any growth or dividends are tax-free.

Potential returns depend on markets; historical averages for diversified portfolios are 5-7% annually after inflation, but values can drop short-term. This type appeals to those comfortable with volatility and a longer horizon, say 5+ years. Unlike Cash ISAs, there’s no FSCS for investments, only for cash held in the account.

Investment options include ready-made funds for beginners or self-select for experts. Always diversify to manage risks.

Lifetime ISAs

A Lifetime ISA (LISA) is designed for 18-39 year-olds saving for a first home or retirement, with a £4,000 annual limit and a 25% government bonus up to £1,000 yearly. You can choose cash or stocks and shares versions, combining security with growth potential.

Withdrawals for eligible purposes (home under £450,000 or after age 60) are tax-free, but non-qualifying access incurs a 25% charge, reclaiming the bonus plus penalty. This makes it unsuitable for short-term needs. It’s a powerful tool for long-term goals, boosting savings through the bonus.

Suitability is key: ideal for first-time buyers or early retirement planners, but assess penalties carefully. For more, see Lifetime ISA: cash vs stocks and shares from OneFamily.

Junior ISAs and other specialised types

Junior ISAs (JISAs) allow parents or guardians to save for children under 18, with a £9,000 annual limit for 2025/26, maturing tax-free at age 18. Available as cash or stocks and shares, they offer tax-free growth until the child can control the funds.

Other types include Innovative Finance ISAs for peer-to-peer lending, offering alternative yields but higher risks. The Help to Buy ISA is now legacy, closed to new savers since 2019, but existing ones can transfer to LISAs. For child savings, JISAs provide a structured, protected path.

For details on JISAs, visit Best Junior Stocks & Shares ISAs at Good Money Guide.

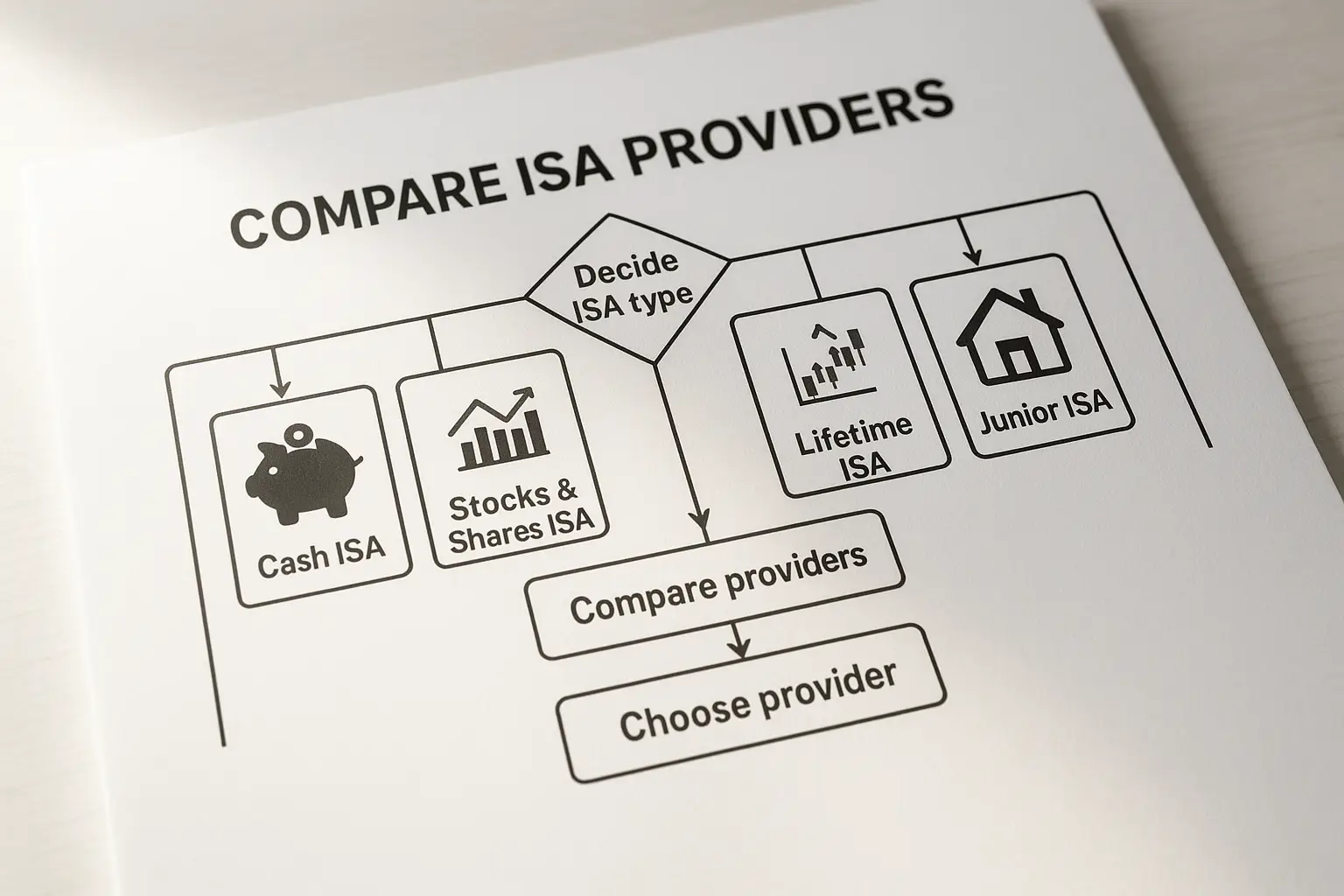

Choosing the right ISA for you

Select based on your goals, risk tolerance, and timeline: Cash for safety, Stocks and Shares for growth, Lifetime for specific milestones, or Junior for kids. You can split your £20,000 allowance across types in one tax year, maximising benefits.

Transfers between ISAs are possible without affecting your allowance, useful for better rates or providers. Compare via platforms or guides; consider fees, access, and protections.

| Type | Annual limit | Risk level | Best for |

|---|---|---|---|

| Cash ISA | £20,000 | Low | Short-term saving, stability |

| Stocks and Shares ISA | £20,000 | Medium to high | Long-term growth |

| Lifetime ISA | £4,000 | Low to high | First home or retirement |

| Junior ISA | £9,000 | Low to high | Children’s future |

For official rules, refer to Individual Savings Accounts (ISAs): Overview on GOV.UK. Statistics from Annual savings statistics: September 2025 highlight growing adoption.

Frequently asked questions

What is the difference between cash ISA and stocks and shares ISA?

Cash ISAs provide steady, tax-free interest on deposits with minimal risk, similar to a high-street savings account protected by FSCS up to £85,000. In contrast, Stocks and Shares ISAs invest in markets for potentially higher returns, but values can fall, offering no capital guarantee. Choose cash for preservation and shares for growth if you can tolerate volatility; both count towards your £20,000 allowance.

How much can I put in an ISA each year?

The ISA allowance UK for adults is £20,000 per tax year (6 April to 5 April), covering all types combined, as confirmed for 2025/26 by Forbes Advisor UK. Junior ISAs have a separate £9,000 limit. Unused allowance doesn’t carry over, so plan contributions wisely to maximise tax-free benefits without penalties.

Can I have more than one ISA?

Yes, you can hold multiple ISAs of different types in the same year, as long as total contributions stay under £20,000. For example, split between cash and stocks for diversification. However, you can only open one of each type per year, and transfers allow switching providers seamlessly.

What is a Lifetime ISA?

A Lifetime ISA is a specialised account for 18-39 year-olds, with up to £4,000 annual contributions earning a 25% government bonus for home buying or retirement. It can be cash or investment-based, but early withdrawals face a 25% charge. This bonus effectively boosts savings, making it attractive for long-term goals despite restrictions.

Are ISAs safe?

ISAs themselves are safe as tax wrappers, but underlying investments vary: Cash ISAs offer FSCS protection and low risk, while Stocks and Shares expose you to market dips. Lifetime and Junior ISAs follow similar rules. Always choose authorised providers regulated by the FCA for security.

Can I transfer my ISA to another provider?

Yes, ISA transfers are tax-free and don’t use your allowance, allowing moves for better rates or features. You can transfer all or part, even to a different type, but check for exit fees. This flexibility helps optimise returns; contact providers directly or use online tools for smooth processes.