What is a stocks and shares ISA and why choose one in 2025?

A stocks and shares ISA is a tax-efficient investment account in the UK that allows you to put money into shares, funds, bonds and other assets without paying income tax or capital gains tax on the profits. For growth-oriented savers in 2025, this makes it one of the best stocks and shares ISA options, especially with the annual allowance staying at £20,000, as confirmed by HM Revenue & Customs. Unlike cash ISAs, which offer lower returns in a low-interest environment, stocks and shares versions provide higher potential growth through market investments, averaging 8-12% annual returns over the past five years according to Money To The Masses.

Tax advantages of a stocks and shares ISA

The core benefit is tax-free growth: any dividends or gains within the ISA are exempt from tax, potentially saving you up to 20% on capital gains tax compared to non-ISA investments. For example, if your £20,000 investment grows by 10% to £22,000, you’d keep the full £2,000 profit without HMRC taking a cut. This is particularly appealing in 2025 amid economic uncertainty, as it shields your returns from fiscal changes.

Growth potential for savers

With inflation lingering, cash savings often fail to keep pace, but a stocks and shares ISA can deliver compounded growth over time. Diversified funds like those from Vanguard have historically returned 9.5% annually over five years, making it ideal for long-term savers aiming for retirement or major goals. Remember, while potential is high, markets fluctuate, so consider your risk tolerance.

Comparison to cash ISAs

Cash ISAs suit conservative savers with guaranteed returns up to around 5% in 2025, but they lag behind stocks and shares ISAs for growth. For more on best isa rates across types, including cash options, explore broader ISA comparisons. Stocks and shares ISAs shine for those comfortable with volatility seeking higher yields.

Top providers and platforms for stocks and shares ISAs

The best stocks and shares ISA providers in the UK for 2025 balance low fees, wide investment choices and user-friendly tools. Hargreaves Lansdown leads with over 1.2 million ISA accounts and robust research, while Vanguard excels in low-cost index funds. Platforms like Freetrade offer commission-free trading for beginners.

Hargreaves Lansdown review

Hargreaves Lansdown is a top choice for the best stocks and shares ISA UK, charging 0.45% annual fees for managed portfolios but providing access to 3,000+ funds. It’s ideal for intermediate investors with its educational resources and no minimum investment. As per Kepler Trust Intelligence, its scale ensures reliability, though fees are higher than budget options.

Vanguard options

Vanguard stands out for the best platform for stocks and shares ISA with fees as low as 0.15%, focusing on passive index funds that track markets like the FTSE 100. Their LifeStrategy funds are popular for diversified, low-effort growth. Which? rates it highly for cost-effectiveness in 2025.

To compare top picks, here’s a table of key providers:

| Provider | Annual Fee | Minimum Investment | Fund Range | 2025 Rating (Which?) |

|---|---|---|---|---|

| Hargreaves Lansdown | 0.45% | £100 | 3,000+ | 4/5 |

| Vanguard | 0.15% | £500 | 80+ | 5/5 |

| Freetrade | 0% | £1 | 4,000+ | 4/5 |

| Barclays Smart Investor | 0.25% | £50 | 2,000+ | 3/5 |

Data sourced from Which? and MoneySavingExpert (2025 updates).

Best performing funds and portfolios

The best performing stocks and shares ISA over the last five years have delivered 8-12% average annual returns, driven by global equity funds, per Money To The Masses analysis up to 2024. For 2025, focus on diversified portfolios to balance growth and risk, with Vanguard’s offerings leading in low-cost performance. Always note that past results don’t guarantee future gains—markets can dip.

Five-year performance data

Top funds like Vanguard LifeStrategy 80% Equity averaged 9.5%, while funds tracking tech sectors hit 12% in strong years. Ethical options from Royal London also performed well at 8-10%. Diversification across assets reduces volatility; aim for a mix of UK, US and emerging markets.

Risk considerations

Higher returns mean higher risk—expect 20-30% swings in a bad year. For growth savers, a moderate-risk portfolio suits most, but consult your financial situation.

- Select funds with proven track records, like those beating the FTSE All-Share index.

- Rebalance annually to maintain allocation.

- Monitor fees, as they erode returns over time.

Best junior and children’s stocks and shares ISAs

For families, the best junior stocks and shares ISA allows tax-free growth until age 18, with a £9,000 annual limit in 2025/26 per Forbes Advisor UK. Providers like Hargreaves Lansdown and Nutmeg offer low-fee options tailored for long-term child savings, historically growing at 7-10%. It’s a smart way to build education funds without tax drag.

Provider comparisons

Hargreaves Lansdown provides junior ISAs with 0.45% fees and vast fund choices, while Vanguard keeps it simple at 0.15%. Both support easy parental management. Compare via compare isa providers for family fits.

Long-term growth strategies and allowance limits

Invest early for compound effects—a £9,000 yearly contribution could grow substantially by 18. Limit access until maturity encourages discipline.

| Aspect | Junior ISA | Adult ISA |

|---|---|---|

| Allowance | £9,000 | £20,000 |

| Access Age | 18 | Immediate |

| Growth Potential | 7-10% historical | 8-12% historical |

Source: HMRC (2025).

Specialized ISAs: Managed, ethical, and for beginners

Specialized stocks and shares ISAs cater to niches, with the best managed stocks and shares ISA like Nutmeg handling investments for you at 0.75% fees. For ethical focus, Royal London’s sustainable funds align with ESG goals, returning competitively. Beginners should start with low-minimum platforms like Freetrade.

Tip for beginners

Begin with a ready-made portfolio to avoid picking individual stocks. Learn basics via what is an isa guides. Diversification—spreading investments across assets—lowers risk; aim for 60% equities if new to this.

Managed vs self-managed

Managed ISAs suit hands-off investors, outperforming self-select for novices per Which?. Self-managed saves fees but requires knowledge.

Ethical fund picks and beginner tips

Best ethical stocks and shares ISA options include funds avoiding fossil fuels, with 8% five-year returns. For beginners, the best stocks and shares ISA for beginners is one with educational tools.

For more on limits, see isa allowance 2025.

External reading: Detailed fee breakdowns on MoneySavingExpert’s stocks and shares ISAs guide and Which?’s 2025 review.

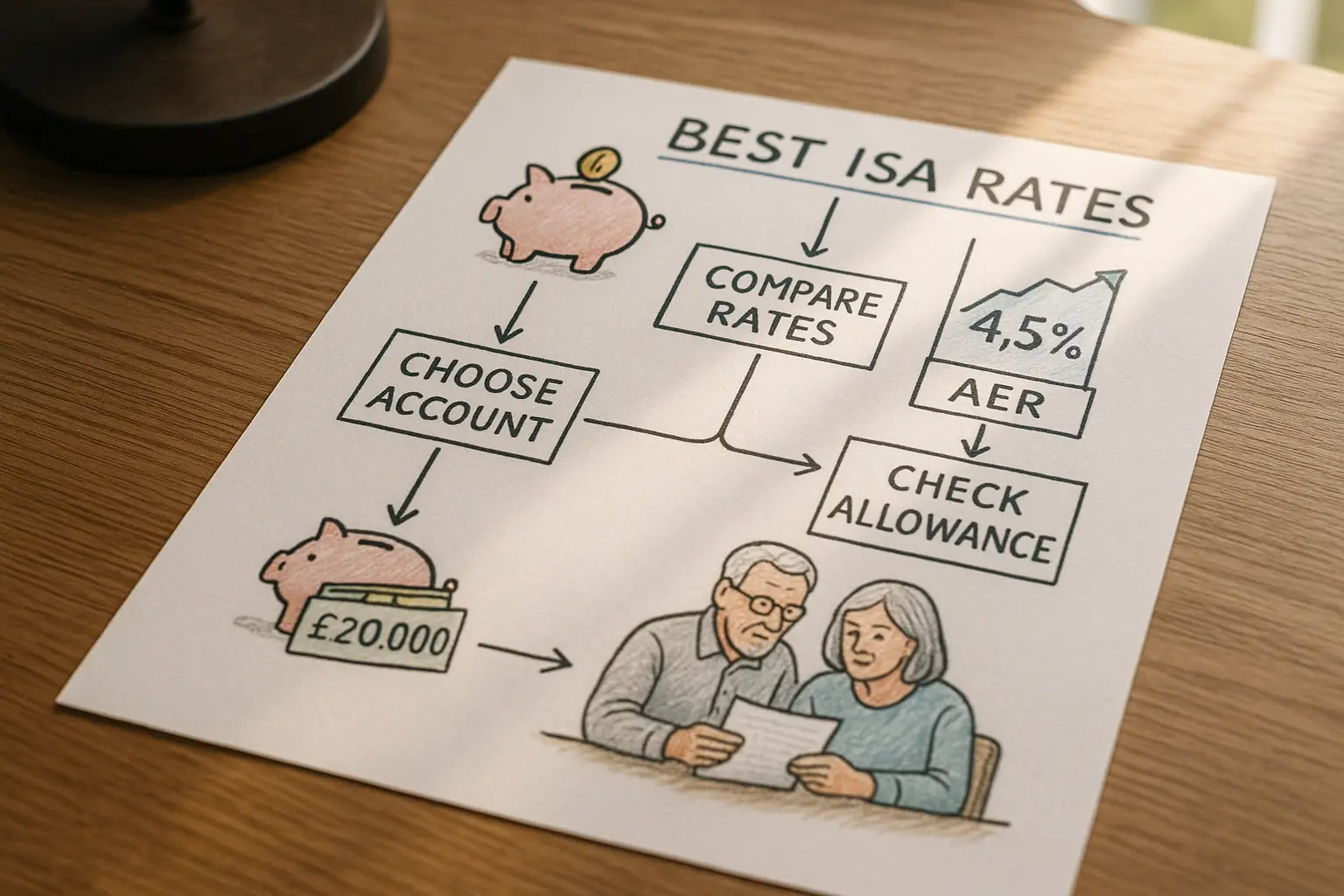

How to open and maximize your 2025 ISA

Opening a stocks and shares ISA takes minutes online: choose a provider, verify ID, and transfer funds. Maximize by investing the full £20,000 early for compound growth and diversifying across funds. Avoid high fees by picking low-cost platforms like Vanguard.

Step-by-step guide

1. Research providers via comparisons. 2. Open account online. 3. Fund it within the tax year (April 6 to April 5). Follow steps in how to open an isa.

Fee avoidance and diversification advice

Opt for 0.15-0.25% fees to preserve returns. Diversify: 50% global stocks, 30% bonds, 20% alternatives.

For allowance details, visit HMRC’s ISA rules and Money To The Masses performance analysis.

Remember, investments can fall as well as rise; this isn’t personal advice. Past performance isn’t a guide to future results.

Frequently asked questions

What is a stocks and shares ISA?

A stocks and shares ISA is a UK tax wrapper for investing in shares, funds and bonds, shielding gains from income and capital gains tax. It differs from savings accounts by offering market-linked growth, ideal for the best stocks and shares ISA seekers in 2025. With £20,000 allowance, it’s accessible for most, but involves risk unlike fixed-rate cash options.

How do I choose the best stocks and shares ISA?

Assess fees, investment choices and your risk level—low-fee platforms like Vanguard suit cost-conscious growth savers. Compare providers for the best stocks and shares ISA UK using tools from Which? or MoneySavingExpert. Factor in 2025 updates like fee caps; beginners should prioritize ease-of-use over complexity.

What are the best stocks and shares ISA providers?

Top providers include Hargreaves Lansdown for research depth and Vanguard for low costs, both rated highly by Which? in 2025. For the best stocks and shares ISA platform, Freetrade offers zero commissions for active traders. Choose based on your needs: managed for hands-off, self-select for control.

Are stocks and shares ISAs worth it?

Yes, for growth-oriented savers, as they beat inflation with 8-12% historical returns versus cash ISAs’ 4-5%. Tax savings amplify long-term wealth— a £10,000 investment growing at 7% could save £1,500 in taxes over a decade. However, they’re not for short-term needs due to volatility; weigh against your goals.

What is the best stocks and shares ISA for beginners?

The best stocks and shares ISA for beginners is Freetrade or Vanguard, with low minimums (£1-£500) and simple apps. They provide ready-made portfolios to ease entry, avoiding the overwhelm of picking stocks. Start small, learn via built-in education, and diversify to manage risks effectively.

Which stocks and shares ISA has the best performing returns last five years?

Platforms hosting Vanguard funds topped with 9.5-12% averages, per Money To The Masses data to 2024. For the best performing stocks and shares ISA UK, focus on equity-heavy portfolios, but diversify to mitigate downturns. Returns vary; 2025 projections depend on markets, so review annually.

How much can I invest in a stocks and shares ISA in 2025?

The 2025/26 allowance is £20,000 total across all ISAs, per HMRC—no change from prior years. You can allocate it all to stocks and shares for maximum growth potential. Unused allowance doesn’t carry over, so invest by April 5, 2026; couples can double up to £40,000 combined.