Understanding ISA Rates in 2025

The best ISA rates for 2025 offer savers a chance to earn tax-free interest amid economic shifts, with top easy access options reaching 4.53% AER and fixed rates up to 4.28% AER. These rates are influenced by the Bank of England base rate, currently at 4.5%, but forecasts predict cuts to 3.75% by year-end, potentially pressuring returns downward. For those planning ahead, understanding ISAs helps maximise your £20,000 annual allowance effectively.

What is an ISA?

An Individual Savings Account (ISA) is a tax-free wrapper for your savings or investments in the UK, allowing interest or gains to grow without income tax or capital gains tax. Cash ISAs focus on secure, interest-bearing savings, while others like stocks and shares suit risk-takers. What is an ISA? It provides flexibility for various goals, from emergency funds to retirement.

Current vs. forecasted rates

As of November 2025, the best cash ISA rates UK stand at 4.53% AER for easy access, per Moneyfactscompare.co.uk. However, with base rate forecasts from experts like Martin Lewis suggesting declines, expect the best ISA rates 2025 to ease to around 3.5-4% by late year. This shift underscores the need for timely action to lock in higher yields now.

Tax year allowance

The ISA allowance for 2025/26 remains £20,000, as confirmed by HMRC via Moneysavingexpert.com. This covers all ISA types combined, resetting each April 6. Spreading it across cash and other ISAs can diversify returns while staying tax-free. For details on ISA allowance 2025, check official guidelines.

Top Cash ISA Rates for 2025

The standout best cash ISA rates 2025 hover around 4.5% AER, ideal for liquidity without penalties. These variable rates adjust with market conditions, making them suitable for short-term needs. Providers compete fiercely, but monthly fluctuations mean checking updates is key.

Best easy access options

Easy access cash ISAs top the list with 4.53% AER from select building societies, allowing withdrawals anytime. For the best easy access cash ISA rates UK 2025, look to options beating inflation without lock-ins. These suit emergency funds, offering flexibility over fixed alternatives.

Provider comparisons

Comparing providers reveals leaders like Leeds Building Society at 4.52% AER. Leeds Building Society cash ISAs provide variable and fixed choices up to that rate. Versus banks, building societies often edge out with better customer service and competitive yields.

| Provider | Rate (AER) | Type | Min Deposit |

|---|---|---|---|

| Moneyfacts Top Pick | 4.53% | Easy Access | £1 |

| Leeds Building Society | 4.52% | Variable | £100 |

| Santander | 4.20% | Fixed 1-Year | £500 |

Monthly updates (e.g., July-September)

In July 2025, the best cash ISA rates UK July 2025 hit 4.60% before slight dips in August and September, per Moneyfacts weekly updates. Track best UK ISA rates this week to catch peaks. Seasonal trends often follow base rate decisions.

Best Fixed Rate ISAs and Forecasts

Fixed rate ISAs guarantee returns, with the best fixed ISA rates 2025 at 4.28% AER for one-year terms, shielding against forecasted cuts. These lock your money for stability, appealing if you foresee lower rates ahead. Forecasts indicate a gradual decline, making now optimal for securing deals.

1-Year and multi-year deals

One-year fixed cash ISAs lead at 4.28% AER, as noted by Which.co.uk. Multi-year options from Santander offer up to 4.20% AER for two years, per their site. Choose based on your horizon—shorter for flexibility, longer to beat inflation.

Impact of base rate cuts

The Bank of England base rate at 4.5% supports current highs, but cuts to 3.75% could trim ISA yields by 0.5-1%, according to Martin Lewis on X. This forecast, from Martin Lewis base rate update, highlights urgency for fixed locks. Savers may see effective rates drop below 4% by 2026.

Building society vs. bank rates

Building societies like Leeds outperform banks on the best building society ISA rates 2025, often by 0.1-0.3% AER due to member focus. Banks provide easier access but lag in yields. For comparisons, compare ISA providers.

Specialist ISAs: Junior, Lifetime, and More

Beyond standard cash ISAs, specialist options cater to families and long-term goals, with rates mirroring general best ISA rates 2025 but with bonuses like government top-ups for Lifetime ISAs.

Junior ISA rates

The best junior ISA rates 2025 reach 4.5% AER for cash versions, tax-free until age 18. Providers like Halifax offer competitive yields for child savings. These build habits early, with £9,000 annual limit.

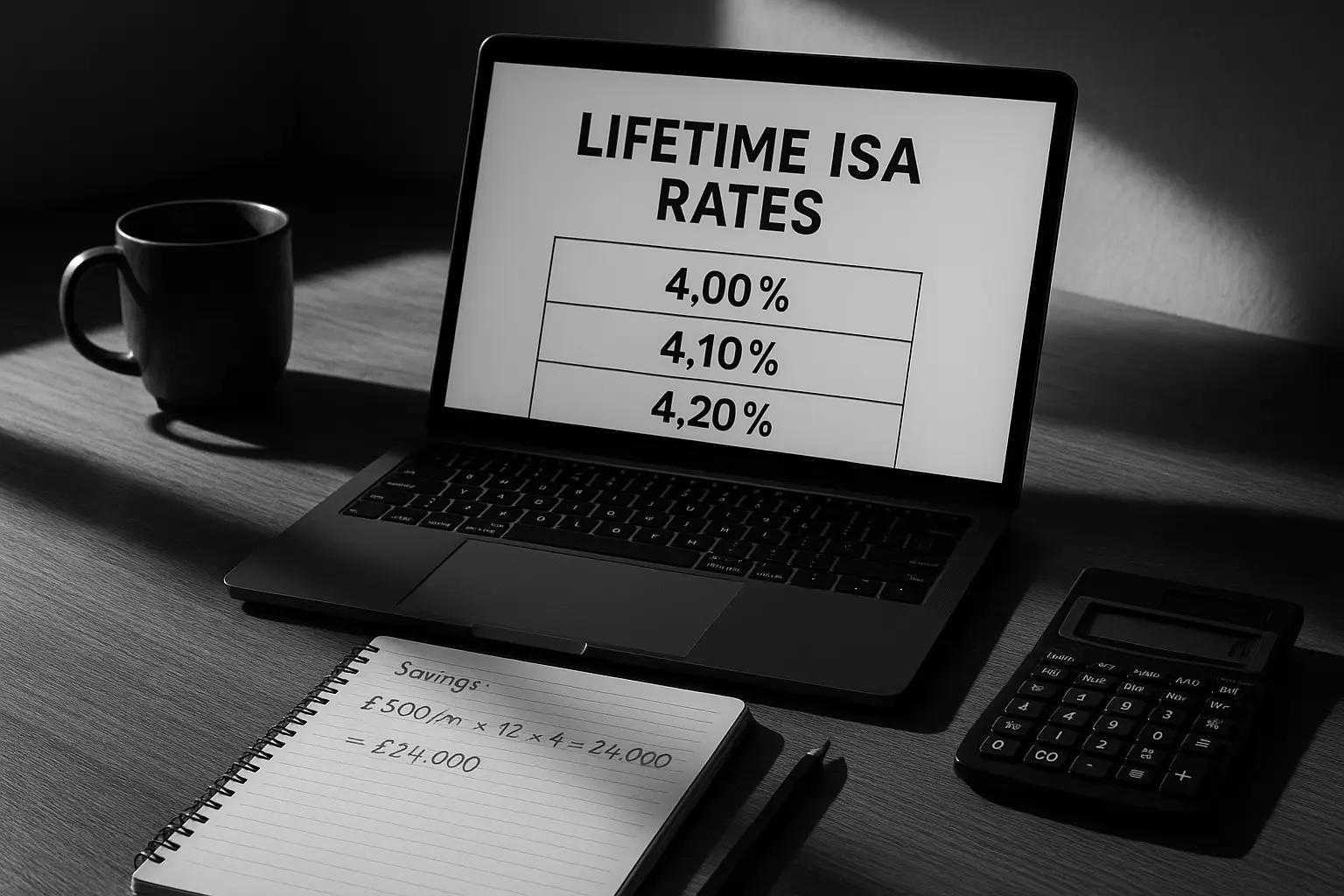

Lifetime ISA options

Lifetime ISAs (LISAs) provide 25% government bonus on up to £4,000 yearly, with cash rates up to 4.2% AER. Ideal for first homes or retirement, but withdrawals before 60 incur penalties except for property. Check top cash ISAs 2025/26 for LISA integrations.

Provider-specific deals (Santander, Halifax, NatWest)

Santander’s best Santander ISA rates 2025 include fixed at 4.20% AER, while Halifax and NatWest hover at 4.10-4.15%. Santander fixed rate ISAs suit conservative savers. Compare to independents for potentially higher returns.

How to Maximize Returns on Your ISA

To get the most from the best ISA rates for 2025, transfer existing funds to higher-yield providers and blend types for balanced growth. Regular monitoring ensures you stay ahead of rate drops.

Transfer strategies

Transfers are free and preserve your allowance, moving up to £20,000 yearly to better rates without tax loss. Start by checking eligibility—most providers handle it seamlessly. Aim for 0.5%+ gains to compound effectively.

Combining ISA types

Mix cash for safety with stocks and shares for growth, staying within £20,000. For types of ISA, allocate 50% to fixed cash at 4.28% and the rest to higher-potential investments.

Monitoring rate changes

Use tools from Which.co.uk to track shifts, acting when rates exceed 4.5%. Set alerts for base rate announcements to preempt cuts.

Frequently asked questions

What is the best ISA rate for 2025?

The top best ISA rates 2025 currently peak at 4.53% AER for easy access cash ISAs, according to Moneyfacts. This outperforms many regular savings amid tax-free benefits. For forecasts, expect slight declines, so locking in fixed options around 4.28% could prove wise for stable returns.

Will ISA rates fall in 2025?

Yes, ISA rates are likely to fall following Bank of England base rate cuts to 3.75% by year-end, as predicted by financial experts. This could reduce easy access yields to 3.5-4%, impacting the best cash ISA rates 2025. Savers should consider fixed terms now to secure higher returns before the drop.

How much can I put in an ISA in 2025/26?

The ISA allowance for 2025/26 is £20,000 total across all types, unchanged from prior years per HMRC. This tax-free limit applies per person, allowing diversification. Exceeding it means taxable overflow, so plan contributions early in the tax year starting April 6.

What is the best fixed rate ISA?

The best fixed ISA rates 2025 offer 4.28% AER for one-year terms, ideal for risk-averse savers seeking guarantees. Providers like those highlighted by Which.co.uk lead this category. Longer terms may yield slightly less but protect against further rate falls.

Are cash ISAs still worth it?

Cash ISAs remain worthwhile for tax-free security, especially with rates above the 2.05% personal savings allowance for basic-rate taxpayers. They beat inflation better than standard accounts currently. However, for higher returns, pair with investments if your risk tolerance allows.

How do I switch to a better ISA rate?

Switching involves transferring to a new provider offering superior rates, often done online without fees. Verify the new ISA is open and contact them to initiate— they’ll handle the move. This preserves tax-free status and can boost earnings by 0.5% or more annually.

What are the best easy access ISA rates UK 2025?

Top easy access rates hit 4.53% AER, providing liquidity for immediate needs. These variable options from building societies outperform banks slightly. Monitor monthly for adjustments, as seen in July-September 2025 trends.

For the best ISA rates, explore our pillar guide on best ISA rates. Ready to act? How to open an ISA with top yields today.