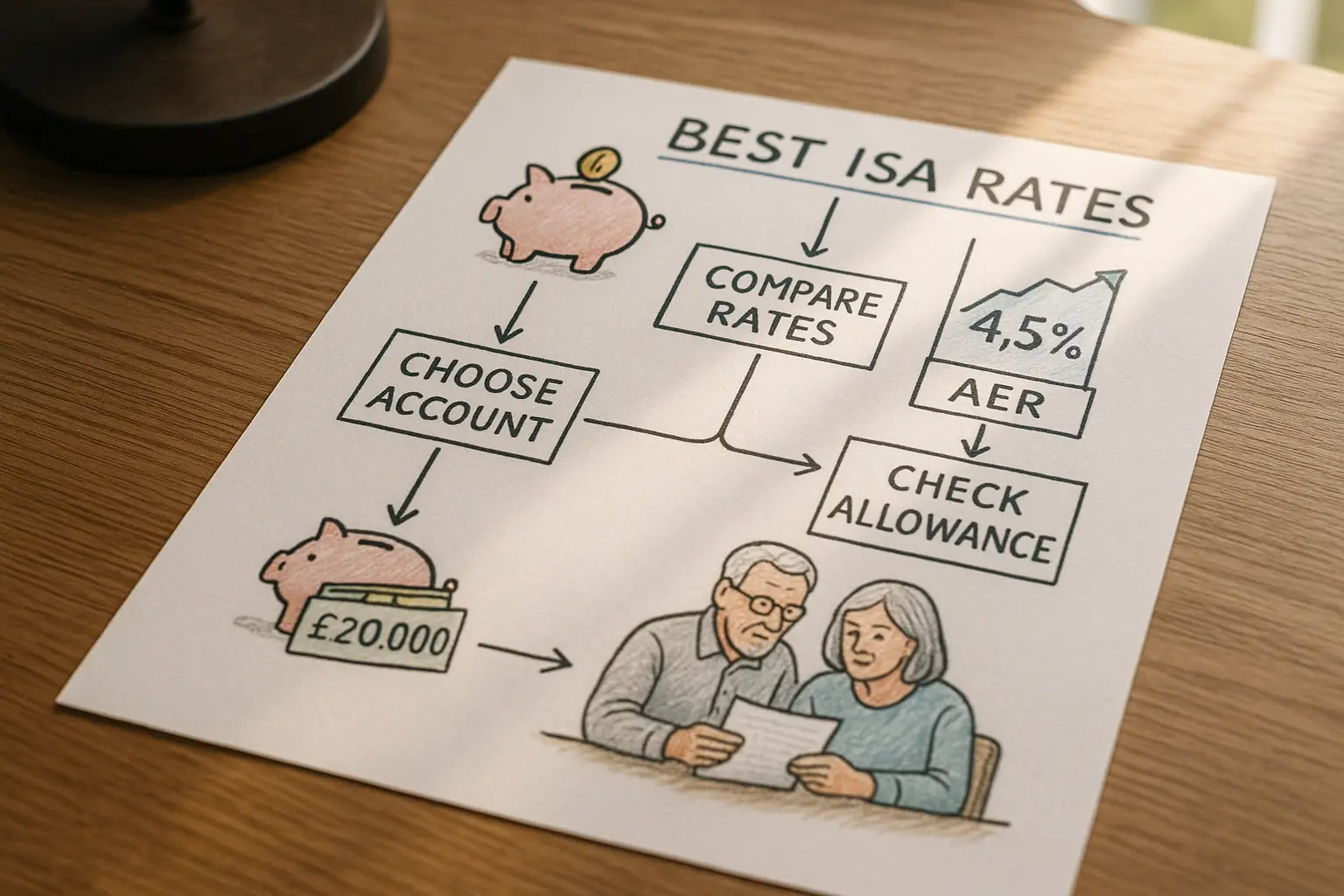

Understanding ISAs for over 60s

For over 60s seeking the best ISA rates for over 60s, Individual Savings Accounts (ISAs) offer tax-free growth on savings, ideal for supplementing pensions or retirement funds. No special eligibility rules apply based on age, but seniors often benefit from higher balances and flexible options to cover living costs. The 2025/26 tax year ISA allowance stands at £20,000, allowing tax-free interest up to that amount regardless of age.

ISA basics and eligibility

ISAs come in cash, stocks and shares, or lifetime varieties, but cash ISAs suit risk-averse over 60s wanting stable returns. Eligibility requires UK residency and being 18 or older; over 60s qualify without restrictions. For the best cash ISA rates for over 60s, focus on AER (Annual Equivalent Rate), which shows the true yearly return including compounding.

Benefits for seniors

Seniors can shield interest from tax, crucial if personal savings allowance is exceeded. Over 40% of UK over-60s hold £8,000 or more in savings that could benefit from ISAs, according to a 2023 poll by Martin Lewis. This preserves more income for essentials like healthcare.

2025 allowance and rules

The £20,000 limit resets each tax year from 6 April to 5 April. Unused allowance doesn’t carry over, so maximise it annually. Details on ISA allowance 2025 confirm no age-based changes, but transfers between providers keep tax-free status. For full rules, see our isa allowance 2025 guide.

Top easy access cash ISAs for over 60s

The highest easy access cash ISA rate for over 60s reaches 4.53% AER on balances up to £20,000, providing liquidity without penalties. These suit seniors needing quick access for unexpected expenses, outperforming standard savings if rates stay competitive.

Highest rates comparison

Current top picks include providers offering 4.52% AER tailored for seniors. Easy access allows withdrawals anytime, unlike fixed options. Compare via tables below for the best easy access ISA rates for over 60s.

| Provider | Rate (AER) | Type | Min Deposit | Access |

|---|---|---|---|---|

| Moneybox | 4.53% | Cash ISA | £500 | Easy access |

| Chip | 4.52% | Cash ISA | £1 | Easy access |

| Tembo | 4.50% | Cash ISA | £10 | Easy access |

| Leeds Building Society | 4.40% | Cash ISA | £100 | Easy access |

| Nationwide | 4.35% | Cash ISA | £1 | Easy access |

Rates sourced from MoneySavingExpert’s best cash ISAs guide as of November 2025; they may vary.

Provider reviews

Providers like Chip offer app-based ease for tech-savvy seniors, while Leeds Building Society provides branch support for the best easy access cash ISA rates for over 60s. All are FSCS-protected up to £85,000.

Withdrawal flexibility

These ISAs allow unlimited withdrawals, perfect for over 60s. However, variable rates can drop; monitor quarterly.

Best fixed rate ISAs for over 60s

For guaranteed returns, the best fixed ISA rates for over 60s offer 4.35% AER on one-year terms, locking in rates against potential base rate cuts. Ideal for those not needing immediate access.

One-year options

Top one-year fixed cash ISAs hit 4.35% AER with minimum £1,000 deposits. Providers like Shawbrook Bank lead for the best 1 year fixed ISA rates for over 60s.

Two-year and longer terms

Two-year deals average 4.20% AER, suiting longer horizons. Longer terms (up to five years) yield slightly higher but tie up funds.

Pros and cons

Pros include rate security; cons are penalties for early withdrawal. Fixed suits risk-averse seniors. See Moneyfacts’ fixed rate ISAs for updates. Explore our best fixed rate isa article.

Bank-specific deals: Halifax, Nationwide, and more

High street banks offer competitive best ISA rates for over 60s Halifax at 4.10% AER for easy access, while Nationwide provides 4.00% with loyalty bonuses for existing members. These balance familiarity with decent yields.

Halifax ISA rates

Halifax’s cash ISA for seniors offers easy access at 4.10%, with online management. For martin lewis best ISA rates for over 60s Halifax, it’s a solid high street choice per expert reviews.

Nationwide senior offers

Nationwide’s Flex Instant ISA pays 4.00% AER, with no minimum for over 60s. It includes transfer options for the best ISA rates for over 60s Nationwide.

High street comparisons

Compare Santander (3.90%) and Barclays (3.80%) against building societies for the best high street ISA rates for over 60s. Visit money.co.uk’s over-60s cash ISAs.

For broader options, check best isa rates on our pillar page.

Martin Lewis tips for maximising ISA savings

Martin Lewis recommends hunting the best cash ISA rates for over 60s via comparison sites, as rates beat standard savings. His advice: transfer maturing ISAs promptly to avoid losing tax-free status.

Expert recommendations

For martin lewis best ISA rates for over 60s, prioritise AER above 4% and FSCS cover. He highlights easy access for flexibility in retirement.

Transfer strategies

Transfers are free if done provider-to-provider; contact your old bank first. Steps: Open new ISA, request transfer form. Learn what is an isa basics.

Avoiding common pitfalls

Don’t exceed £20,000 or forget tax year end. Lewis warns against low-rate loyalty traps.

Senior savings tips and considerations

Prioritise FSCS protection and tax-free growth; consider inflation eroding returns. Alternatives like premium bonds suit low-risk seniors.

Tax implications

ISAs keep all interest tax-free, unlike non-ISA savings limited to £1,000 personal allowance for basic rate taxpayers.

Risks and protection

Variable rates fluctuate; fixed offer stability. All recommended are FSCS-protected. See FSCS site.

Alternatives to ISAs

For higher risk, stocks and shares ISAs; otherwise, regular savings accounts. Understand types of isa.

Disclaimer: Rates accurate as of November 2025; they change frequently. Consult a financial advisor for personal advice.

Frequently asked questions

What are the best ISA rates for over 60s in the UK?

The best ISA rates for over 60s in the UK currently top 4.53% AER for easy access cash ISAs, with fixed options at 4.35% for one year. These rates, from providers like Moneybox and Shawbrook, help seniors maximise tax-free returns on up to £20,000 annually. Factors like minimum deposits and access terms vary, so compare based on needs; check sites like MoneySavingExpert for live updates to ensure you’re getting the martin lewis best ISA rates for over 60s.

Are there special ISAs for seniors?

No dedicated special ISAs exist for seniors, but over 60s can access all standard cash ISAs with the same £20,000 allowance. Some providers offer senior-friendly features like easier online transfers or branch support for the best cash ISA rates for over 60s. This levels the playing field, allowing tax-free savings to supplement pensions without age barriers, though eligibility requires UK tax residency.

How much can I save in an ISA over 60?

Over 60s can save up to £20,000 per tax year in ISAs, same as younger adults, with all growth tax-free. This covers cash, stocks, or innovative finance ISAs combined. For those with larger pots, multiple ISAs over years build wealth; over 40% of seniors already hold £8,000+, per Martin Lewis data, making full use of the allowance key to beating inflation.

What is the ISA allowance for 2025?

The ISA allowance for 2025 remains £20,000 for the 2025/26 tax year, covering all ISA types without age limits. It resets on 6 April, and unused portions don’t roll over, so plan deposits accordingly. HMRC rules ensure tax-free status, beneficial for over 60s on fixed incomes; see Moneyfarm for detailed breakdowns.

Is a fixed rate ISA better for over 60s?

Fixed rate ISAs can be better for over 60s seeking predictable income, offering up to 4.35% AER locked in for one to five years, shielding against rate drops. However, they’re less ideal if liquidity is needed for emergencies, as penalties apply. Weigh against easy access at 4.53% AER; for conservative seniors, fixed provides stability, but diversify for best fixed ISA rates for over 60s.

How do I transfer an existing ISA as an over-60?

To transfer an ISA as an over-60, open a new account with a better-rate provider, then request a transfer form from them to your old provider. The process takes 15-30 days, keeping tax-free status intact without using your £20,000 allowance. It’s free if direct; ideal for chasing the best ISA rates for over 60s Halifax to Nationwide. Avoid withdrawals to prevent tax issues—Martin Lewis advises this for seamless switches.

What are the best fixed cash ISA rates for over 60s?

The best fixed cash ISA rates for over 60s reach 4.35% AER for short terms, from providers comparing on Moneyfacts. These lock funds for guaranteed yields, suiting retirees not needing access. Compare one-year vs two-year options; longer terms may edge higher but increase illiquidity risks for seniors.