Top fixed rate ISAs: secure your high-yield savings for the long term

Fixed rate ISAs offer guaranteed returns over a set period, making them ideal for savers seeking stability in the current economic climate. The best fixed rate ISA locks in competitive interest rates tax-free, protecting your savings from rate fluctuations. As of November 2025, top options provide up to 4.35% AER, far surpassing variable accounts amid falling base rates.

These accounts suit those who can commit funds without needing access, with terms from one to five years. Key considerations include the interest rate, minimum deposit, early withdrawal penalties, and whether interest is paid monthly or at maturity. For the best fixed rate ISA UK, compare AER figures and FSCS protection up to £85,000 per provider.

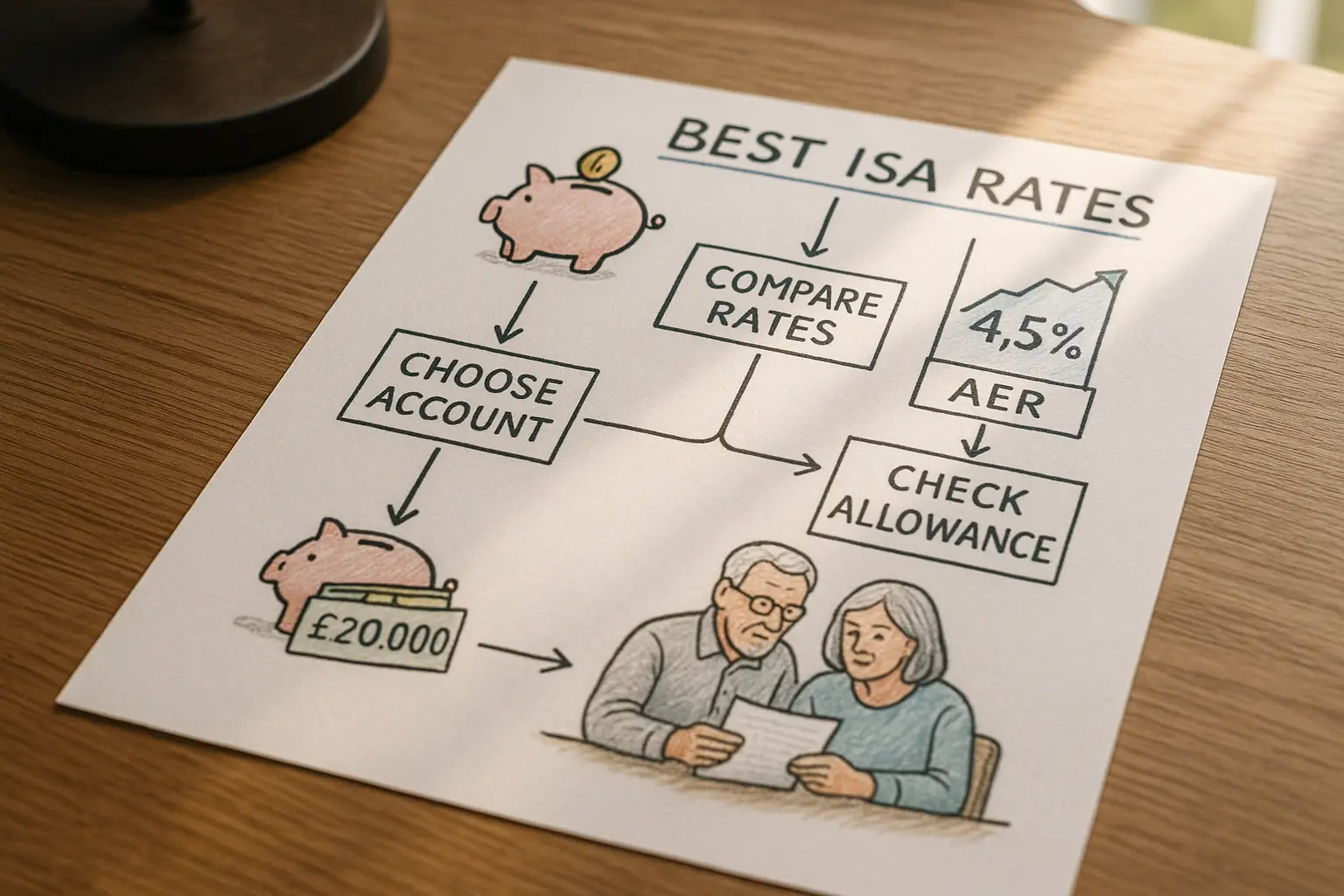

Before choosing, assess your financial goals—short-term needs might favour a one-year term, while longer horizons benefit from higher yields on extended bonds. Transfers from existing ISAs are penalty-free if to another fixed rate product, preserving your £20,000 annual allowance. To explore broader options, check our guide on best isa rates.

Overview of the best fixed rate ISAs

The best fixed rate cash ISA combines security with tax efficiency, allowing up to £20,000 invested annually without income tax on interest. Current top fixed rate ISA rates hover around 4% AER, influenced by the Bank of England’s base rate cuts. Providers like building societies and online banks dominate, offering rates that beat inflation.

Average one-year fixed ISA rates stand at 3.89% AER, down slightly from September, while longer terms average 3.84%. For the best fixed rate ISA savings, prioritise AER over gross rates, as it accounts for compounding. Always verify eligibility, such as UK residency and age 18+.

- Tax-free growth on interest up to the ISA limit.

- Fixed returns unaffected by market changes.

- Options for monthly or annual interest payouts.

- Potential early access charges up to 365 days’ interest.

For a detailed explanation, see what is an isa.

Best 1-year fixed rate ISAs

The best 1 year fixed rate ISA delivers quick, reliable returns for short-term savers, with top rates at 4.35% AER from providers like Vida Savings. Martin Lewis highlights these as strong choices for those eyeing rate drops in 2025. Ideal for sums up to £20,000, they often require lump-sum deposits.

| Provider | AER (%) | Min Deposit | Early Withdrawal Penalty |

|---|---|---|---|

| Vida Savings | 4.35 | £500 | 180 days’ interest |

| NatWest | 4.20 | £1 | Up to 150 days’ interest |

| RBS | 4.20 | £500 | Up to 90 days’ interest |

These rates are current as of November 2025; the best 1 year fixed rate cash ISA from NatWest suits branch users, while online options like Vida offer higher yields. For over-60s, check senior-specific boosts, though general rates apply broadly. Compare via Moneyfacts’ 1-year fixed rate ISAs page.

Best 2-year fixed rate ISAs

For medium-term security, the best 2 year fixed rate ISA yields up to 4.16% AER from UBL UK, balancing commitment with reward. Martin Lewis recommends these for savers confident in their liquidity needs. Interest typically pays annually, compounding your tax-free gains.

Expect minimum deposits from £1,000, with penalties for early exit often equating to 180 days’ interest. Santander’s 2-year fixed ISA at 4.00% AER appeals to existing customers, featuring daily interest calculation.

Tip: Ladder your savings across 1-year and 2-year terms to access funds annually while securing higher overall rates. Review your isa allowance 2025 before investing.

See Santander’s details at Santander’s 2-year fixed rate ISA and MoneySavingExpert’s picks via their best cash ISA guide.

Best longer-term fixed rate ISAs

Longer commitments unlock superior rates; the best 5 year fixed rate ISA reaches around 4.00% AER, suitable for retirement planning. For three years, options hover at 4.10%, providing stability against volatility.

These best fixed rate ISA accounts for 2025 demand higher minimums, often £5,000, but reward patience with compounded tax-free interest. Over-60s may find tailored rates slightly higher.

- 3-year: Up to 4.10% AER (e.g., selected building societies).

- 5-year: Around 4.00% AER, with maturity rollovers available.

Longer terms mitigate reinvestment risk if rates fall further. Explore via Moneyfacts’ fixed rate ISAs comparison.

Key considerations before buying a fixed rate ISA

Evaluate your access needs first—fixed rate ISAs penalise withdrawals, potentially losing all interest earned. Compare the best fixed rate ISA rates UK across providers for the highest AER, factoring in fees or bonuses.

Transfers maintain tax-free status without using your allowance; opt for the best fixed rate ISA transfer to upgrade rates seamlessly. Ensure FSCS coverage and read terms on interest frequency.

Are fixed rate ISAs worth it? Yes, if you avoid easy-access accounts’ lower yields (around 4.53% top but variable). For 2025 forecasts, consult Money.co.uk’s fixed rate cash ISAs guide.

Frequently asked questions

What is the best 1 year fixed rate ISA?

The best 1 year fixed rate ISA currently offers 4.35% AER from Vida Savings, ideal for short-term locking with minimal commitment. This edges out high-street options like NatWest at 4.20% AER, providing better returns for online-savvy users. Consider your deposit size, as minimums vary, and always check for updates since rates shift with market conditions.

How do fixed rate ISAs work?

Fixed rate ISAs lock your money for a set term, guaranteeing a fixed interest rate tax-free within the £20,000 allowance. Interest accrues daily but pays out monthly, annually, or at maturity, depending on the provider. They differ from variable ISAs by shielding against rate cuts, though early withdrawals incur penalties equivalent to lost interest.

Providers calculate AER to reflect compounding, ensuring fair comparisons. For beginners, start with shorter terms to test the waters before longer commitments.

What is the ISA allowance for 2025/26?

The ISA allowance for 2025/26 remains £20,000, covering all ISA types from 6 April 2025 to 5 April 2026. You can split this across cash, stocks, or lifetime ISAs, but unused portions don’t roll over. Transfers between ISAs don’t count towards this limit, allowing rate upgrades without penalty.

High earners benefit most from tax-free growth, especially with personal savings allowances at £1,000 for basic-rate taxpayers.

Are fixed rate ISAs worth it?

Fixed rate ISAs are worth it for risk-averse savers, securing yields like 4.35% AER against falling rates. They outperform easy-access accounts long-term if you won’t need funds soon, maximising tax-free returns. However, if liquidity is key, variable options might suit better despite lower guarantees.

Expert strategy: Use them to beat inflation (currently around 2%), building a diversified savings ladder.

What happens if I withdraw early from a fixed ISA?

Early withdrawal from a fixed ISA typically forfeits all interest earned and may charge up to 365 days’ equivalent, depending on the term. Providers like Santander apply tiered penalties, reducing to zero after a notice period. You retain your principal, but tax-free status holds only if not exceeding allowance elsewhere.

Advanced users mitigate this by choosing flexible fixed options or planning maturities carefully.

What are the best fixed rate ISA rates for over 60s?

Best fixed rate ISA rates for over 60s mirror general tops at 4.35% AER for one-year terms, with some providers like building societies adding senior bonuses up to 0.10%. Focus on easy-access hybrids if health concerns arise, though pure fixed yields more. Compare demographic perks alongside standard AER for optimal tax-free growth.

Risks include penalty impacts on pensions; pair with types of isa for comprehensive planning.

Is the best fixed rate cash ISA 2025 different from previous years?

The best fixed rate cash ISA 2025 features rates around 4.20-4.35% AER, lower than 2024 peaks due to base rate cuts but still competitive. Expect more online providers dominating, with emphasis on digital transfers. For long-term savers, five-year options hold steady, hedging against further declines.

Monitor Martin Lewis updates for timely shifts, ensuring alignment with your 2025/26 allowance.