What is a Lifetime ISA?

A Lifetime ISA is a tax-free savings account designed to help UK residents save for their first home or retirement, offering a government bonus of 25% on contributions up to £4,000 per year. Introduced in 2017, it combines the flexibility of a Cash ISA or Stocks and Shares ISA with this unique incentive, making it particularly appealing for first-time buyers under 40. Unlike standard ISAs, the Lifetime ISA has specific withdrawal rules tied to home purchases or age 60, but it forms part of the overall £20,000 annual ISA allowance. For more on what is an isa, see our guide.

Lifetime ISA eligibility rules

To qualify for a Lifetime ISA, you must be a UK resident aged 18 to 39 when opening the account, though you can continue contributing until age 50. UK residency is required, meaning you need a National Insurance number and a UK address, but non-residents can hold existing accounts. The house price limit for penalty-free withdrawals is £450,000 in England, Wales, and Northern Ireland, while Scotland has no such cap under its own schemes. Note regional variations like in Lifetime ISA Scotland options.

Age and residency requirements

Eligibility starts at 18 and ends at 39 for new accounts, but contributions are allowed up to 50 if opened earlier. You must live in the UK, with exceptions for Crown servants abroad.

Contribution limits and deadlines

The Lifetime ISA allowance is £4,000 annually, within the £20,000 total ISA limit for 2025-26. Contributions must be made by the tax year end on 5 April to claim the bonus for that year. For details on the isa allowance 2025, check our overview.

How the government bonus works

The Lifetime ISA government bonus adds 25% to your contributions, up to £1,000 yearly on a £4,000 maximum input. This incentive effectively boosts your savings instantly, paid by the provider within 30 days of contribution. Over a lifetime, you could receive up to £32,000 in bonuses if maxing out from age 18 to 50. As Martin Lewis highlights in his Lifetime ISA advice, this makes it a powerful tool for long-term goals.

Bonus calculation

For every £80 you save, the government adds £20; full £4,000 gets £1,000 free. Only new contributions qualify, not transfers.

When bonus is paid and maximum lifetime bonus

Providers pay the bonus promptly, but delays can occur. The cap is £32,000 total, assuming consistent max contributions.

Tip: Use a Lifetime ISA calculator to project growth; for example, £200 monthly contributions could yield over £100,000 by retirement with bonus and average returns.

Best Lifetime ISA providers in 2025

Top Lifetime ISA providers in 2025 include Moneybox for easy cash options and Nutmeg for stocks and shares, selected for competitive rates, low fees, and user-friendly apps. Moneybox’s Lifetime ISA stands out with 4.2% AER and no transfer fees, ideal for beginners. For investors, Hargreaves Lansdown offers diverse funds with the bonus intact. Compare these against others like Nationwide and NatWest for the compare isa providers landscape.

Top cash Lifetime ISAs

Moneybox and Santander lead with variable rates around 4%, FSCS protected.

Top stocks and shares Lifetime ISAs

Nutmeg and AJ Bell provide low-cost index trackers, averaging 5-7% historical returns.

| Provider | Type | Rate/AER | Fees | Bonus Eligible |

|---|---|---|---|---|

| Moneybox | Cash | 4.2% | 0.45% +£1/month | Yes |

| Nationwide | Cash | 3.5% | None | Yes |

| Nutmeg | S&S | Variable (5% avg) | 0.75% | Yes |

| Hargreaves Lansdown | S&S | Variable | 0.45% | Yes |

Source: Which? best Lifetime ISAs 2025.

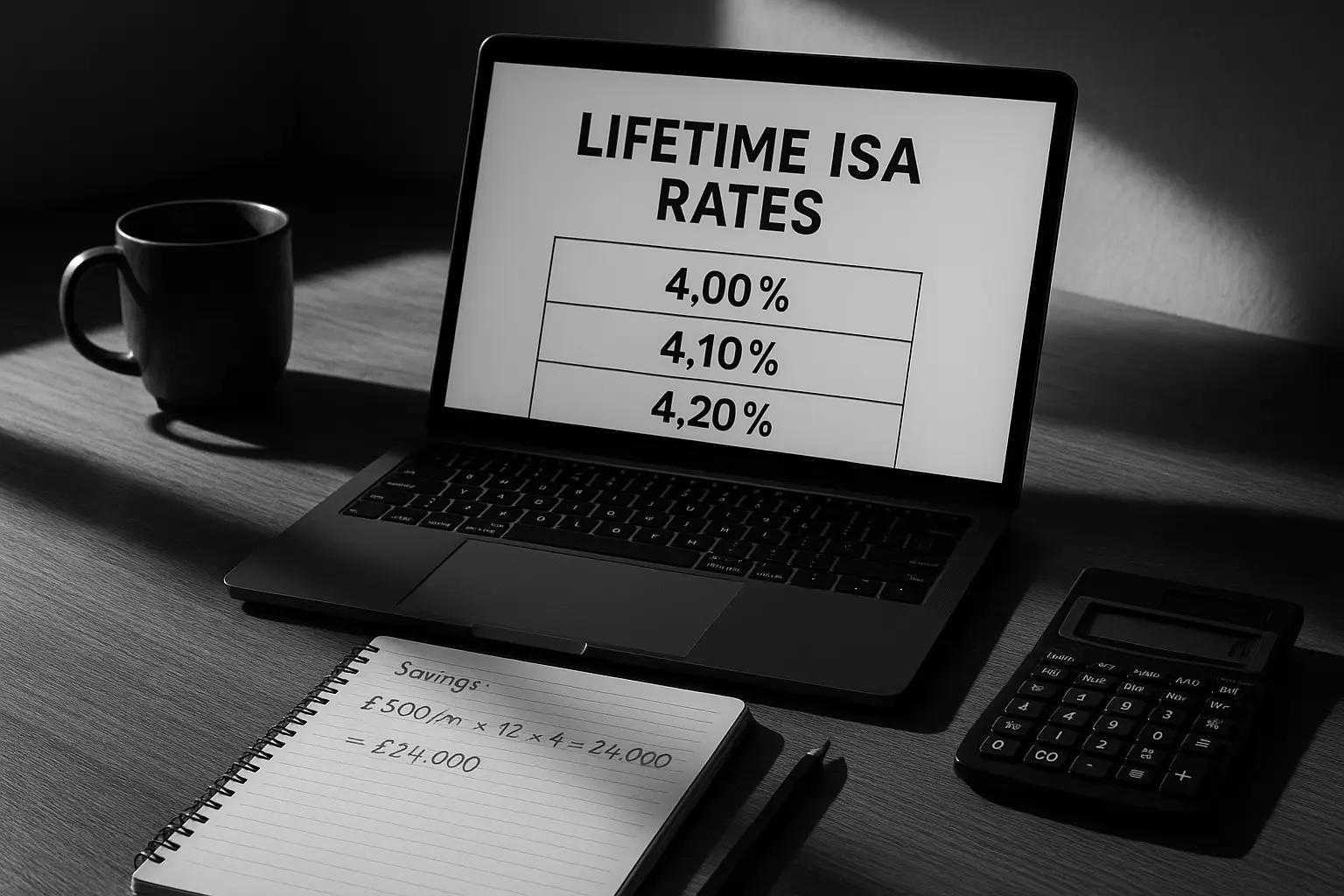

Lifetime ISA rates and comparison

Cash Lifetime ISA rates in 2025 range from 3.5% to 4.5% AER, with variable options from providers like Moneybox outperforming fixed ones amid base rate cuts. Stocks and shares variants offer higher potential through investments but with market risk. Compare Lifetime ISA rates to ensure bonus alignment and low fees for optimal growth. For broader options, explore the best isa rates.

Current interest rates

Top cash rates hit 4.5%, but expect fluctuations.

Rate types and performance

Variable rates suit short-term savers; stocks and shares average 7% long-term per historical data.

Withdrawal rules and penalties

You can withdraw from a Lifetime ISA penalty-free for a first home under £450,000 or after age 60, but other withdrawals incur a 25% charge that claws back the bonus plus extra. In 2023/24, penalties cost savers £1.8 million, prompting calls for Lifetime ISA withdrawal charge reform. Emergency access is possible but costly, so plan carefully.

Allowed withdrawals

Home buys or retirement only; small amounts under £450,000 qualify.

Penalty details and reforms

The 25% hit applies to the whole withdrawal; reforms may ease for near-miss homebuyers.

Lifetime ISA vs Help to Buy ISA

The Lifetime ISA offers a higher 25% bonus on £4,000 versus Help to Buy’s 25% on £2,400 max, but Help to Buy closes to new savers post-2020 while Lifetime ISA continues for retirement too. Lifetime ISA suits younger savers needing flexibility; Help to Buy legacy holders might transfer for better rates. Overall, Lifetime ISA edges for ongoing contributions unless you have an existing Help to Buy.

Key differences

Lifetime ISA: Dual purpose, higher limit; Help to Buy: Home-only, lower cap.

Which is better and migration

Lifetime ISA for most first-timers; transfers allowed without penalty.

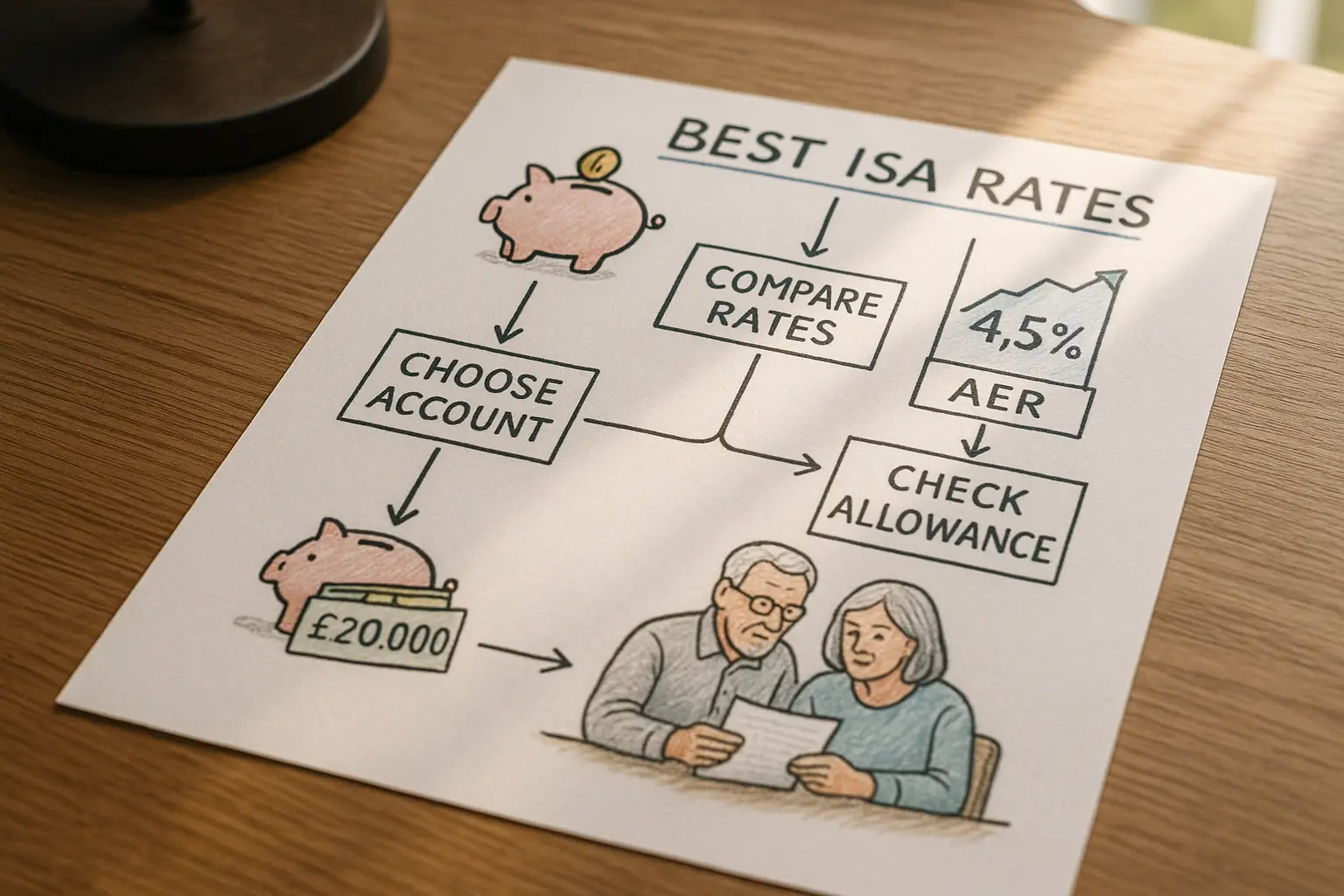

How to open a Lifetime ISA

Opening a Lifetime ISA is straightforward online via providers like Moneybox, requiring ID verification and a bank link—complete in minutes for immediate contributions. You’ll need proof of eligibility like a passport and address. Transfers from other ISAs preserve bonuses. Follow our how to open an isa steps for seamless setup. Deadline: 5 April for tax year bonus.

Step-by-step guide

1. Choose provider. 2. Apply online. 3. Fund account. 4. Claim bonus.

Required documents and transfers

ID, address proof; transfers free within 180 days.

Frequently asked questions

Who is eligible for a Lifetime ISA?

Eligibility for a Lifetime ISA requires UK residency and being aged 18-39 to open, with contributions possible until 50. This targets young adults saving for homes or retirement, excluding those over 39 or non-residents. Recent rules confirm no changes for 2025, making it accessible for most first-time savers. Always verify via GOV.UK for personal circumstances.

What is the Lifetime ISA bonus?

The Lifetime ISA bonus is a 25% government top-up on contributions up to £1,000 annually. It incentivises saving by adding free money, paid automatically by providers. For instance, £4,000 saved yields £5,000 total instantly. This feature, praised by experts like Martin Lewis, boosts long-term growth significantly.

Can I withdraw from a Lifetime ISA without penalty?

Penalty-free withdrawals from a Lifetime ISA are allowed only for buying a first home up to £450,000 or after age 60. Other cases trigger a 25% charge to recover the bonus and deter misuse. With £1.8 million in fines last year, reforms may adjust this for flexibility. Plan ahead to avoid losses.

What’s the difference between Lifetime ISA and Help to Buy ISA?

Lifetime ISA provides a 25% bonus on £4,000 with dual home/retirement use, while Help to Buy offered it on £2,400 solely for homes under £250,000 (now closed). Lifetime ISA has broader appeal and higher limits for 2025. Transfers from Help to Buy to Lifetime ISA are possible for better bonuses. Choose based on your timeline.

How much can I put into a Lifetime ISA?

You can contribute up to £4,000 yearly to a Lifetime ISA, within the £20,000 total ISA allowance. This limit hasn’t changed for 2025-26, allowing max bonus claims. Splitting across ISAs maximises tax-free savings. Exceeding triggers tax issues, so track via providers.

Is a Lifetime ISA worth it in 2025?

A Lifetime ISA is worth it for eligible under-40s due to the 25% bonus and tax-free growth, potentially adding £32,000 lifetime free. However, withdrawal penalties pose risks if plans change, as seen in recent fine data. For homebuyers or retirees, returns outweigh costs; compare with standard ISAs for certainty.

What are the best Lifetime ISA rates in 2025?

Best Lifetime ISA rates in 2025 feature cash AERs up to 4.5% from Moneybox, while stocks and shares average 5-7% via Nutmeg. Variable cash options suit low-risk savers; investment types offer higher potential amid inflation. Rates fluctuate, so check providers quarterly for updates.