How base rate influences savings rates

The Bank of England base rate directly shapes savings account interest rates across the UK. As of October 2025, the base rate stands at 4.25% following a recent cut, impacting variable rates on easy access and notice accounts. This adjustment means savers can still access competitive yields, but monitoring the next Bank of England interest rate decision is key for future planning.

Latest BoE decision

In October 2025, the Bank of England reduced its base rate to 4.25% to support economic stability amid moderating inflation. This BoE interest rate cut has led many providers to lower their savings account interest rates slightly, though fixed-rate options remain more insulated. For context, the UK interest rate influences everything from daily banking to long-term savings strategies, as explained in the Bank of England Monetary Policy Report.

2025 forecast

Forecasts suggest the UK interest rate could drop to 3.75% by the end of 2025, potentially pressuring savings yields downward. Interest rate predictions UK point to gradual easing if inflation stays controlled, but unexpected events like global trade shifts could alter this. Savers should prepare for variable rates around 3-4% AER (annual equivalent rate, a standard measure showing the true return including compounding) by year-end, based on analysis from Birmingham Live (accessed 2025-10-16).

Impact on yields

A lower base rate typically reduces interest on savings accounts, but current levels still offer better returns than recent years. For instance, easy access accounts have adjusted but hold above inflation. This dynamic underscores why understanding the bank of England interest rate matters for maximising earnings.

Best easy access savings accounts

Top easy access savings accounts currently offer up to 4.55% AER as of October 2025, providing flexibility without withdrawal penalties. These accounts suit those needing quick access to funds, with rates tied closely to the current UK interest rate environment.

Top rates comparison

Here’s a comparison of leading easy access options, drawing from recent data:

| Provider | Rate (AER) | Type | Min/Max Deposit |

|---|---|---|---|

| Chip | 4.55% | Easy Access | £1 / £85,000 |

| Trading 212 | 4.50% | Easy Access | £1 / No max |

| Starling Bank | 3.25% | Easy Access | £1 / £85,000 |

| Monzo | 4.10% | Easy Access | £1 / £85,000 |

Data sourced from Moneyfactscompare (accessed 2025-10-16). All are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person per institution.

Provider features

Providers like Starling and Monzo offer app-based management with instant transfers, ideal for digital-savvy users. Revolut provides competitive rates around 3.5% for eligible customers, often with perks like cashback. Nationwide’s loyalty saver interest rate hovers at 4.00%, rewarding existing members.

Pros and cons

Pros include liquidity and FSCS protection; cons involve variable rates that may fall with the BoE interest rate. For the best savings account options, compare features against your needs.

Fixed and regular saver options

Fixed-rate savings lock in yields for a set period, while regular savers encourage monthly deposits for higher returns. In 2025, these can beat easy access amid falling UK interest rates.

Highest fixed rates

Select fixed-rate savings offer over 4.5% AER for one-year terms, shielding from base rate drops. For example, options from building societies reach 4.55%, as per money.co.uk (accessed 2025-10-16). Longer terms (two to five years) yield slightly less but provide stability.

Regular saver details

Regular savings accounts yield up to 7.5% AER, but with monthly deposit limits of £200-£500 over 12 months, per MoneySavingExpert (accessed 2025-10-16). Providers like Nationwide suit disciplined savers, though early withdrawals incur penalties.

Deposit limits

Most fixed accounts cap at £85,000 for FSCS coverage; regular savers often limit total to £2,400 annually. Exceeding these risks lower protection.

For more on the savings account landscape, explore detailed comparisons.

How to choose and calculate returns

Selecting a savings account involves balancing rate, access, and risk. Use an interest rate calculator to project earnings based on deposit size and term.

Key factors

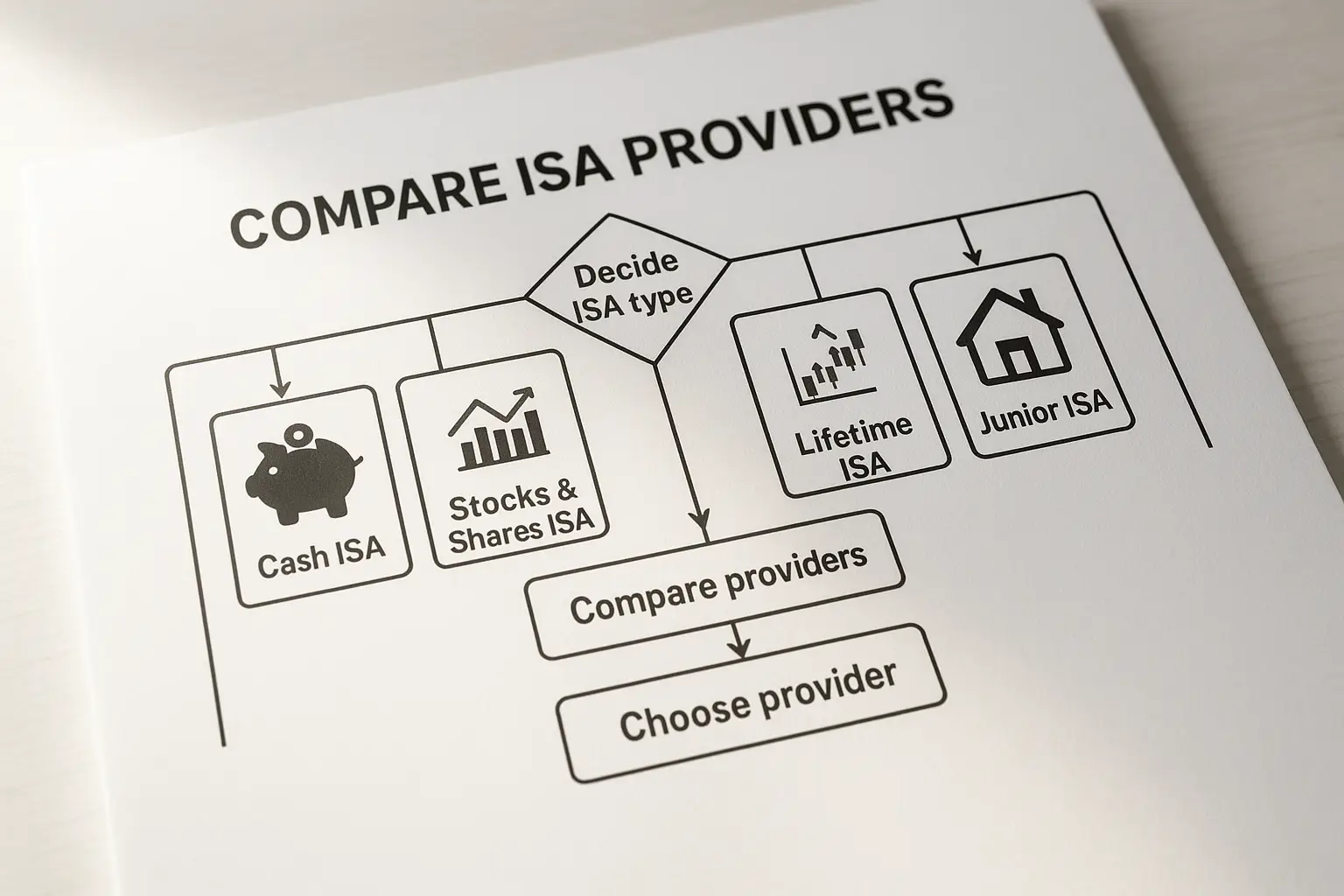

Prioritise AER, withdrawal flexibility, and FSCS eligibility. Consider tax-free ISAs if allowances apply. High street vs digital banks like Monzo offer varying perks.

Using calculators

An interest rate calculator UK tool estimates growth; for £10,000 at 4.5% AER over one year, expect around £450 interest (simple compound). Online tools from MoneySavingExpert simplify this.

Tax considerations

Interest counts as taxable income; basic-rate taxpayers have a £1,000 personal savings allowance. Exceed it, and pay income tax—factor this into net returns.

Tips for maximising savings in 2025

With interest rate predictions 2025 forecasting declines, act now to secure higher yields. Diversify across account types and monitor BoE updates.

Switching strategies

Review rates quarterly; switching takes 1-2 weeks with full transfers. Steps: Compare via comparison sites, close old account post-transfer, and confirm FSCS coverage.

Inflation beating

Aim for rates above 2% inflation target. Current top picks do this, but track via ONS data.

Monitoring changes

Follow BoE announcements and use alerts from providers. For 2025 rate predictions, consult expert forecasts.

Disclaimer: Rates fluctuate; this is general information, not personalised advice. Consult a financial advisor for your situation. Data accessed October 2025.

Frequently asked questions

What is the best savings account interest rate in the UK?

The highest savings account interest rate currently reaches 4.55% AER on easy access accounts from providers like Chip, ideal for flexible saving. This outperforms many standard options but requires checking eligibility and app-based access. For regular savers, up to 7.5% is available with deposit limits, making it suitable for building habits while earning more. Always compare against your goals, as the best interest rate savings account balances yield with accessibility.

When is the next Bank of England interest rate decision?

The next BoE interest rate decision is scheduled for November 2025, typically announced on a Thursday afternoon. These meetings assess economic data like inflation and growth, influencing the UK interest rate directly. Savers should watch for changes, as a cut could lower variable savings rates quickly. Historical patterns show eight meetings yearly, with minutes released two weeks later for deeper insights.

How do interest rates affect savings accounts?

Interest rates determine the growth on your savings, with higher rates like the current 4.25% base rate boosting AER on accounts. When the Bank of England raises rates, providers often follow, increasing yields; cuts have the opposite effect. This impacts easy access more than fixed, where rates are locked. Understanding this helps savers time deposits for optimal returns, especially in a variable economy.

What are the predicted interest rates for 2025?

Interest rate predictions 2025 forecast the UK base rate falling to around 3.75% by year-end, driven by controlled inflation. This could push average savings account interest rates to 3-4% AER, per market analysts. However, if growth stalls, further cuts might occur; conversely, persistent inflation could stabilise rates. Savers should diversify to hedge against these shifts, focusing on fixed terms for security.

Which banks offer the highest savings rates?

Challenger banks like Trading 212 and Monzo lead with up to 4.50% on easy access, outpacing high street giants. Starling interest rate sits at 3.25%, while Nationwide loyalty saver interest rate offers 4.00% for loyal customers. Revolut interest rate varies by plan, often competitive for fintech users. These providers excel due to lower overheads, but verify FSCS protection before depositing.

How can I use an interest rate calculator for my savings?

An interest rate calculator helps forecast earnings by inputting deposit amount, rate, and term—e.g., £5,000 at 4% AER over six months yields about £100. UK-specific versions account for compounding and tax allowances, aiding comparisons. For advanced use, factor in inflation to assess real returns, revealing if a highest interest rate savings account truly beats rising costs. Tools from trusted sites ensure accuracy for informed planning.