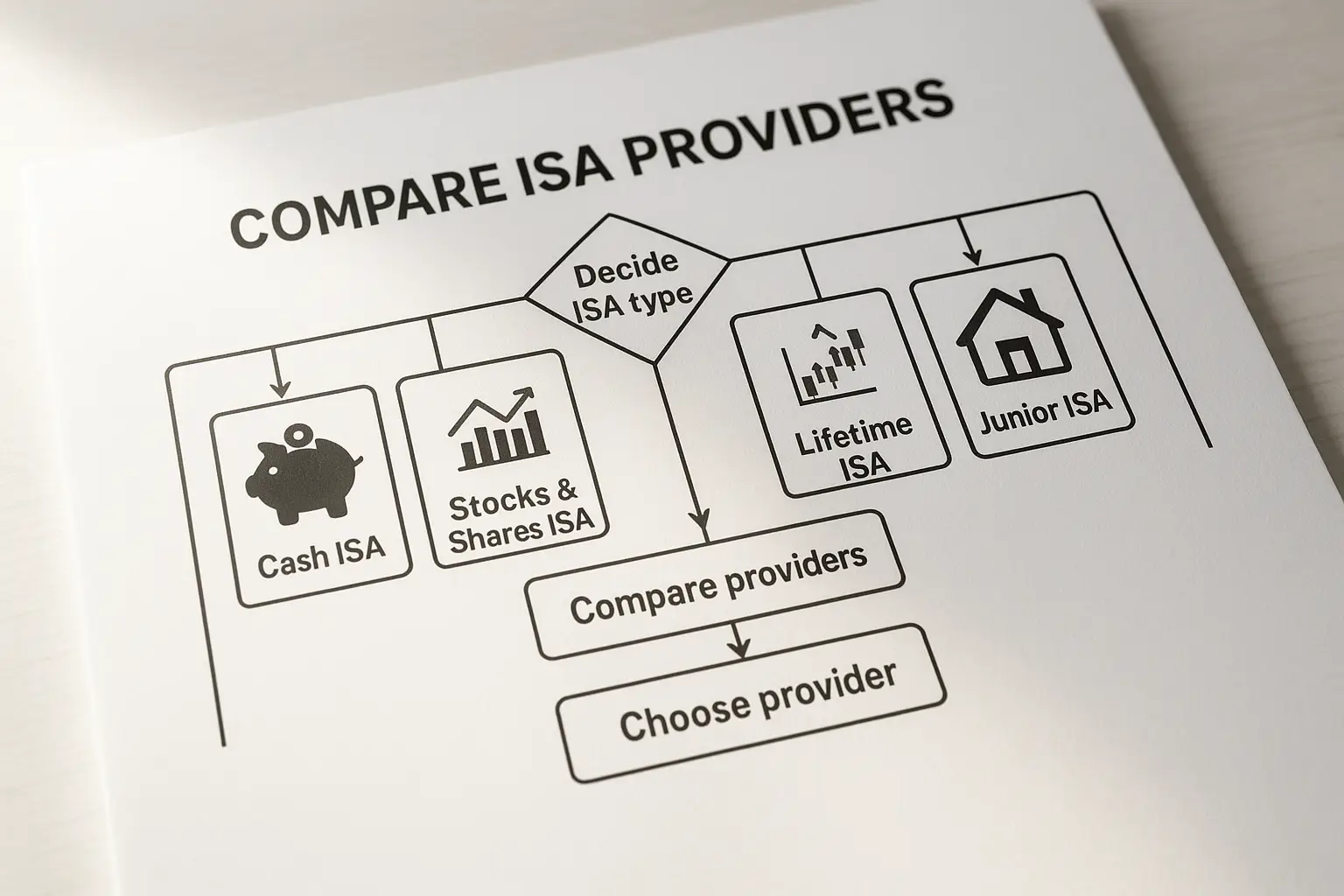

Understanding ISA types and eligibility

Individual Savings Accounts (ISAs) allow UK residents to save or invest up to £20,000 tax-free each tax year, ending on 5 April 2026, according to official HMRC data from GOV.UK. To compare ISA providers effectively, start by identifying which type suits your goals, as each offers different benefits and risks. Cash ISAs provide guaranteed interest like a savings account, ideal for low-risk savers seeking stability.

Cash ISAs

Cash ISAs earn interest tax-free, with top rates reaching up to 4.51% AER as of October 2025, per Moneyfactscompare.co.uk. They come in easy access, fixed-rate, or notice varieties, allowing quick withdrawals or locking funds for higher returns. Eligibility requires UK residency and being 18 or over; compare cash ISA providers by checking AER (Annual Equivalent Rate), minimum deposits, and withdrawal penalties to maximise earnings.

Stocks and shares ISAs

These investment ISAs let you buy shares, funds, or bonds tax-free, potentially offering higher long-term growth but with market volatility. Providers like AJ Bell charge fees from 0.25%, providing wide fund choices, as noted by Kepler Trust Intelligence for 2025. Suitable for those comfortable with risk, compare stocks and shares ISA providers on platform fees, investment options, and customer service ratings.

Lifetime ISAs

Lifetime ISAs (LISAs) target first-time buyers or retirement savers under 40, offering a 25% government bonus up to £1,000 annually on contributions up to £4,000, detailed by Money to the Masses. Withdrawals for homes or after 60 are penalty-free, but others incur a 25% charge. Compare lifetime ISA providers focusing on bonus eligibility, cash or stocks options, and low fees.

Junior ISAs

Junior ISAs (JISAs) help parents save for children under 18, with tax-free growth until age 18. They split into cash and stocks versions, with a £9,000 annual limit. Compare junior ISA providers on growth potential, accessibility, and transfer ease to build long-term family wealth.

Top cash ISA providers comparison

The best cash ISA rates stand at 4.92% for easy access options in October 2025, according to Tembo, beating standard savings amid falling base rates. Focus on providers offering high AER, flexible access, and strong customer service when comparing cash ISA providers. Fixed-rate deals lock in returns but limit withdrawals, suiting those not needing immediate funds.

Rate and accessibility

Easy access cash ISAs allow anytime withdrawals without penalty, crucial for emergency funds. Providers like Nationwide and Santander lead with competitive rates, but always verify current offers as they fluctuate weekly.

Fees and withdrawal options

Most cash ISAs have no ongoing fees, but check for early withdrawal charges on fixed terms. Top picks balance high rates with minimal restrictions.

| Provider | AER (%) | Min Deposit | Withdrawal Terms |

|---|---|---|---|

| Nationwide | 4.92 | £1 | Easy access |

| Santander | 4.51 | £500 | Easy access |

| Post Office | 4.40 | £20 | Notice (90 days) |

Ratings from MoneySavingExpert highlight providers excelling in app usability and support.

Tip: Maximise your cash ISA

Transfer existing ISAs to higher-rate providers without losing tax benefits, but confirm no exit fees apply. Use tools from Moneyfactscompare.co.uk for weekly updates.

Best stocks and shares ISA providers

For growth-oriented savers, stocks and shares ISAs outperform cash in the long run, though past performance isn’t indicative. Compare investment ISA providers on low fees and diverse options like ETFs from Vanguard.

Platform fees and investment choices

AJ Bell and Hargreaves Lansdown offer broad selections, with AJ Bell’s 0.25% fee suiting larger portfolios. Interactive Investor provides flat fees for frequent traders.

Risk and returns

Expect volatility; diversify to mitigate risks. Returns average 5-7% annually historically, per industry benchmarks.

Lifetime and junior ISA options

Lifetime ISAs boost home buying with bonuses, while junior ISAs secure children’s futures. Compare these providers for family planning.

Government bonuses and long-term features

LISA bonuses require holding until qualifying events. Junior options grow tax-free over 18 years.

Provider comparisons

Moneybox and Plum lead for LISAs with low fees; for JISAs, Dodl offers simple stocks access.

How to choose the right ISA provider

Prioritise high rates or low fees based on your risk tolerance and timeline when comparing ISA providers. For more on basics, see what is an isa. The £20,000 isa allowance 2025 applies across all types.

Key factors: Rates, fees, service

Evaluate AER for cash, platform charges for investments, and app reviews for service. Link to best isa rates for updates.

Switching ISAs and tax implications

Transfers keep tax-free status; use a platform to avoid gaps. No capital gains tax applies within ISAs.

Frequently asked questions

What is the best ISA for me?

The best ISA depends on your goals and risk appetite; cash ISAs suit conservative savers wanting guaranteed returns, while stocks and shares ISAs fit those seeking growth. Consider eligibility, like age for Lifetime ISAs, and your timeline—short-term needs favour easy access cash, long-term benefit from investments. Consult GOV.UK eligibility rules to ensure you qualify, and compare providers to match features like fees and bonuses.

How do I compare ISA rates?

To compare ISA rates, focus on AER for cash options and historical performance for stocks, using sites like Moneyfactscompare.co.uk for daily updates. Factor in fees, minimum deposits, and withdrawal flexibility to calculate net returns. Always check as of the latest date, like October 2025 figures, since rates change with Bank of England decisions.

What are the top ISA providers in the UK?

Top providers include Nationwide for cash ISAs with 4.92% easy access rates, AJ Bell for stocks with 0.25% fees, and Moneybox for Lifetime ISAs offering quick bonuses. They excel in customer service and app features, per MoneySavingExpert reviews. For juniors, providers like Hargreaves Lansdown provide robust investment choices for long-term growth.

What are the differences between cash and stocks ISAs?

Cash ISAs offer fixed or variable interest like a savings account, with low risk but capped returns around 4-5% AER. Stocks and shares ISAs invest in markets for potential higher gains, say 5-7% average, but face value fluctuations and no guarantees. Choose cash for capital protection, stocks for growth, always diversifying to manage risks.

Lifetime ISA vs regular ISA?

Lifetime ISAs add a 25% government bonus for buys under 40, limited to £4,000 yearly, unlike regular ISAs’ full £20,000 allowance without bonuses. Regular ISAs have no withdrawal penalties, while LISAs charge 25% on non-qualifying uses before 60. LISAs suit first-time buyers or pension planners; regulars offer more flexibility for general saving.

Can I transfer between ISA providers?

Yes, transfer ISAs to new providers without tax loss, either fully or partially, via a simple process taking days to weeks. It preserves your allowance and can access better rates or features, like switching to a higher AER cash ISA. Contact your current provider first to initiate, and use comparison tools to avoid fees or gaps in protection.