What are ISA savings accounts?

ISA savings accounts UK offer a smart way to grow your money without paying tax on the interest. These accounts, known as Individual Savings Accounts, allow UK residents to save up to £20,000 each tax year tax-free, making them ideal for those seeking the best ISA savings accounts UK has to offer. Unlike regular savings, ISAs shield your earnings from income tax, which is particularly beneficial in 2025 with rates like 4.51% AER available.

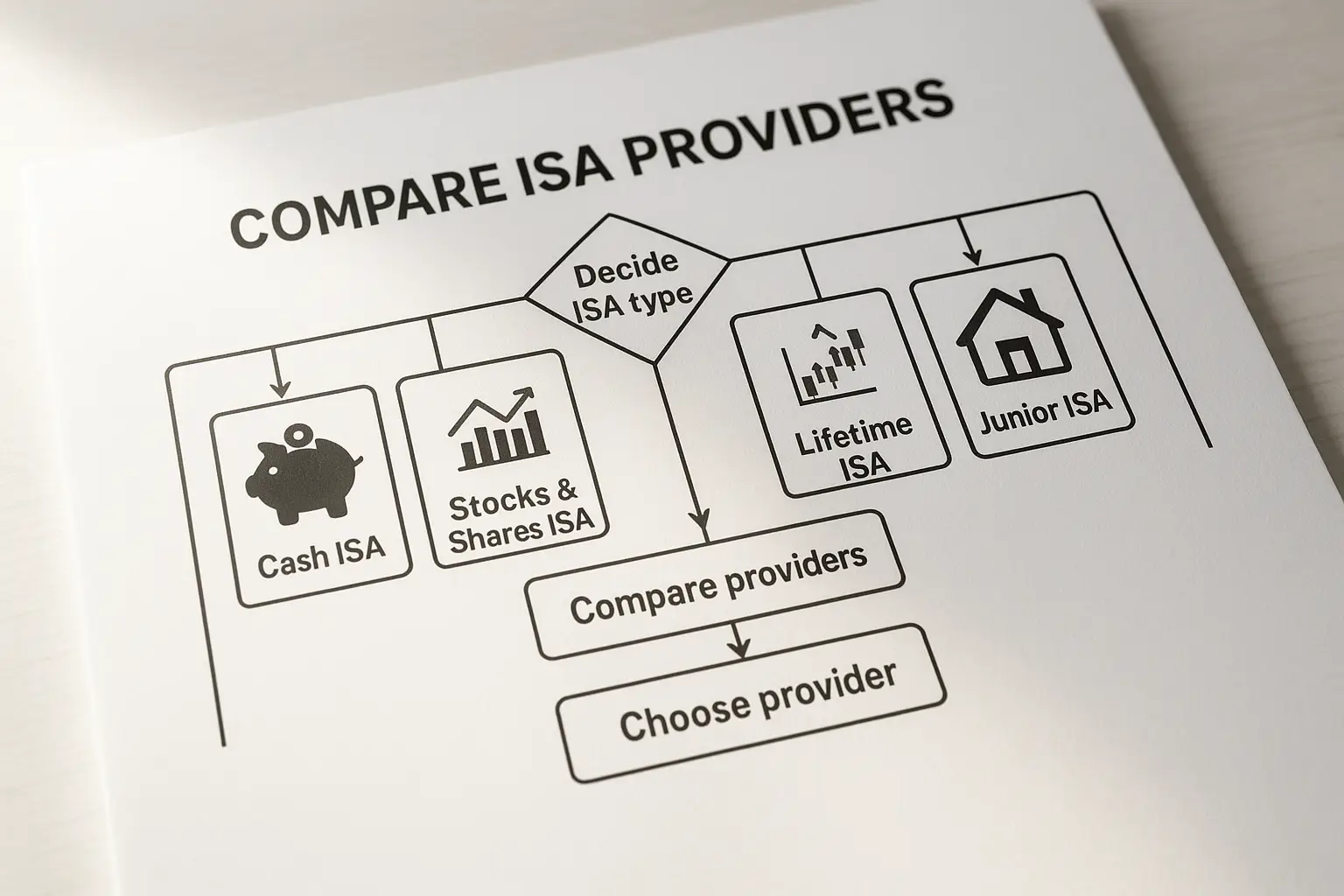

Definition and types

An ISA is a tax-efficient savings or investment wrapper provided by UK financial institutions. The main types include cash ISAs, which work like high-interest savings accounts, and stocks and shares ISAs for investing. For those focused on cash ISA savings accounts UK, options split into easy access for flexibility or fixed-rate for guaranteed returns. Other variants like Lifetime ISAs support specific goals such as buying a home.

Tax-free benefits

The core advantage of ISA savings accounts UK is tax-free growth, meaning no income tax on interest or dividends. This is crucial as standard savings interest counts towards your Personal Savings Allowance—£1,000 for basic-rate taxpayers—which can be exceeded with larger balances. As per Which? (2025), ISA interest remains tax-free even for those with over £20,000 in savings at 4%+ rates, enhancing net returns significantly.

Eligibility and allowance

To open ISA savings accounts UK, you must be a UK resident aged 18 or over. The annual allowance stands at £20,000 for the 2025/2026 tax year, from 6 April 2025 to 5 April 2026, covering all ISA types combined (Moneybox, 2025). You can hold multiple ISAs but cannot exceed the total allowance, and non-UK residents may face restrictions.

Top cash ISA rates for 2025

In 2025, the best cash ISA savings accounts UK deliver competitive rates, with top easy access options at 4.51% AER and fixed rates up to 4.27% AER, helping savers maximise tax-free growth (MoneySavingExpert, 2025).

Easy access options

Easy access cash ISAs allow withdrawals anytime without penalty, suiting those needing liquidity. Providers like Plum and Trading 212 lead with 4.51% AER on balances from £100, ideal for the best ISA savings accounts UK for flexibility. These accounts often require online management but offer variable rates that can change with market conditions.

Fixed-rate comparisons

Fixed-rate ISAs lock your money for a set period in exchange for stable returns. For one-year terms, rates hit 4.27% AER on £20,000+ deposits, as seen with providers like Close Brothers. Compare these against easy access to balance security and yield—longer terms may offer slightly higher AER but reduce access.

| Provider | AER (%) | Term | Min Deposit |

|---|---|---|---|

| Plum | 4.51 | Easy Access | £100 |

| Trading 212 | 4.51 | Easy Access | £1 |

| Close Brothers | 4.27 | 1 Year Fixed | £10,000 |

| Skipton Building Society | 4.25 | 1 Year Fixed | £1 |

| Nationwide | 4.20 | Easy Access | £1 |

Provider spotlights

Standout providers for top ISA savings accounts UK include Moneybox for app-based ease and high interest ISA savings accounts UK features, and Virgin Money for competitive fixed options. Check Moneyfactscompare’s ISA guide for daily updates. For over-60s, specialist rates may apply, as noted in Martin Lewis’ guides.

How tax-free growth works in ISAs

Tax-free growth in ISAs means your interest compounds without HMRC deductions, potentially adding thousands over time compared to taxable accounts.

Interest calculation examples

AER (Annual Equivalent Rate) shows the true yearly return, accounting for compounding. On £10,000 at 4.5% AER in a cash ISA, you’d earn £450 tax-free in year one, growing to £10,450. In a non-ISA, a basic-rate taxpayer might lose 20% tax on that interest, netting only £360.

Comparison to non-ISA accounts

While non-ISA savings offer similar rates, interest is taxable beyond your allowance. For compare ISA savings accounts UK, ISAs excel for larger sums; a 40% higher-rate taxpayer saves £180 tax yearly on £10,000 at 4.5%. Explore best savings account uk options for broader views.

Long-term projections

Over five years, £10,000 at 4.5% AER in an ISA grows to about £12,556 tax-free. In a taxable account for a basic-rate payer, it might reach only £12,200 after tax. Projections assume steady rates; actual growth varies, but ISAs consistently outperform for tax efficiency.

Comparing ISA vs non-ISA savings

ISAs provide tax relief but limit flexibility, while non-ISAs offer unlimited deposits without tax wrappers—choose based on your tax band and access needs.

Pros and cons

Pros of ISA savings accounts UK: tax-free up to £20,000 allowance, FSCS protection up to £85,000 (UK News Blog, 2025). Cons: annual cap, potential penalties for early withdrawal. Non-ISAs pros: no limits, often higher headline rates; cons: taxable interest, especially for higher earners.

When to choose each

Opt for cash ISA savings accounts UK if you’re a taxpayer with £1,000+ interest potential. Non-ISAs suit low earners under the allowance or those saving beyond £20,000. For best non ISA savings accounts UK, consider if tax impact is minimal—see savings account interest rates uk for details.

Switching tips

Transfer existing ISAs within 30 days to avoid losing tax-free status. Use provider tools or MoneySavingExpert’s guide. Avoid partial transfers exceeding allowances.

How to choose and open an ISA

Select based on rate, access, and provider reliability; opening takes minutes online for most.

Key factors to consider

Prioritise AER for returns, FSCS cover, and minimum deposits. For best fixed rate ISA savings accounts 2023 UK updates into 2025, weigh lock-ins against yields. Learn how to choose a savings account uk for more.

- Interest rate and type (variable vs fixed)

- Withdrawal flexibility

- Provider ratings and FSCS protection

Step-by-step guide

1. Check eligibility via HMRC guidelines.

2. Compare rates on sites like Moneyfactscompare.

3. Choose a provider and apply online with ID.

4. Transfer funds or deposit new money.

5. Monitor via app or statements (GOV.UK process).

Common pitfalls

Exceeding the £20,000 allowance voids tax benefits. Ignoring rate drops in variable accounts can erode gains. Always confirm non-UK resident rules to avoid ineligibility.

FAQs on UK ISA savings

What is the best ISA rate in the UK 2025?

As of October 2025, the top easy access cash ISA rates reach 4.51% AER from providers like Plum and Trading 212, ideal for the best ISA savings accounts UK (Moneyfactscompare, 2025). These variable rates suit flexible savers but may adjust with economic changes. For fixed options, 4.27% AER on one-year terms provides stability, though access is limited—compare via trusted aggregators for your balance size.

How much can I put in an ISA each year?

The ISA allowance is £20,000 for the 2025/2026 tax year, applicable across all ISA types including cash ISAs (Moneybox, 2025). This resets on 6 April annually, allowing fresh contributions. Exceeding it means taxable overflow; plan deposits to maximise tax-free growth in ISA savings accounts UK.

What’s the difference between a cash ISA and a stocks and shares ISA?

A cash ISA functions like a savings account with guaranteed interest, focusing on low-risk tax-free growth for cash ISA savings accounts UK seekers. Stocks and shares ISAs invest in markets for potential higher returns but with volatility and no capital guarantees. Choose cash for preservation, shares for growth—both count towards the £20,000 allowance.

Are ISA savings protected?

Yes, ISA savings are protected up to £85,000 per person per institution under the FSCS (Financial Services Compensation Scheme), covering bank failures (UK News Blog, 2025). This applies equally to cash ISAs as standard savings. For larger sums, spread across providers; always verify FSCS eligibility on provider sites.

Can I have more than one ISA?

You can hold multiple ISAs of different types, like one cash and one stocks and shares, but the total contribution cannot exceed £20,000 yearly. Opening several cash ISAs from one provider is often unnecessary due to combined limits. This flexibility helps tailor to needs, but track allowances via HMRC to stay compliant.

How do I compare ISA savings accounts UK effectively?

To compare ISA savings accounts UK, focus on AER, access terms, and minimum deposits using tables from sites like Which?’s cash ISA guide. Consider your tax band and withdrawal needs—easy access for liquidity, fixed for yields. Tools like Moneyfacts provide real-time data; avoid overlooking fees or rate guarantees.

What are high interest ISA savings accounts UK best for?

High interest ISA savings accounts UK excel for taxpayers maximising returns on up to £20,000, especially with rates over 4% AER outpacing inflation. They’re suitable for medium-term goals like emergencies or home deposits, offering tax-free compounding. However, variable rates risk drops; pair with diversification strategies for optimal use.