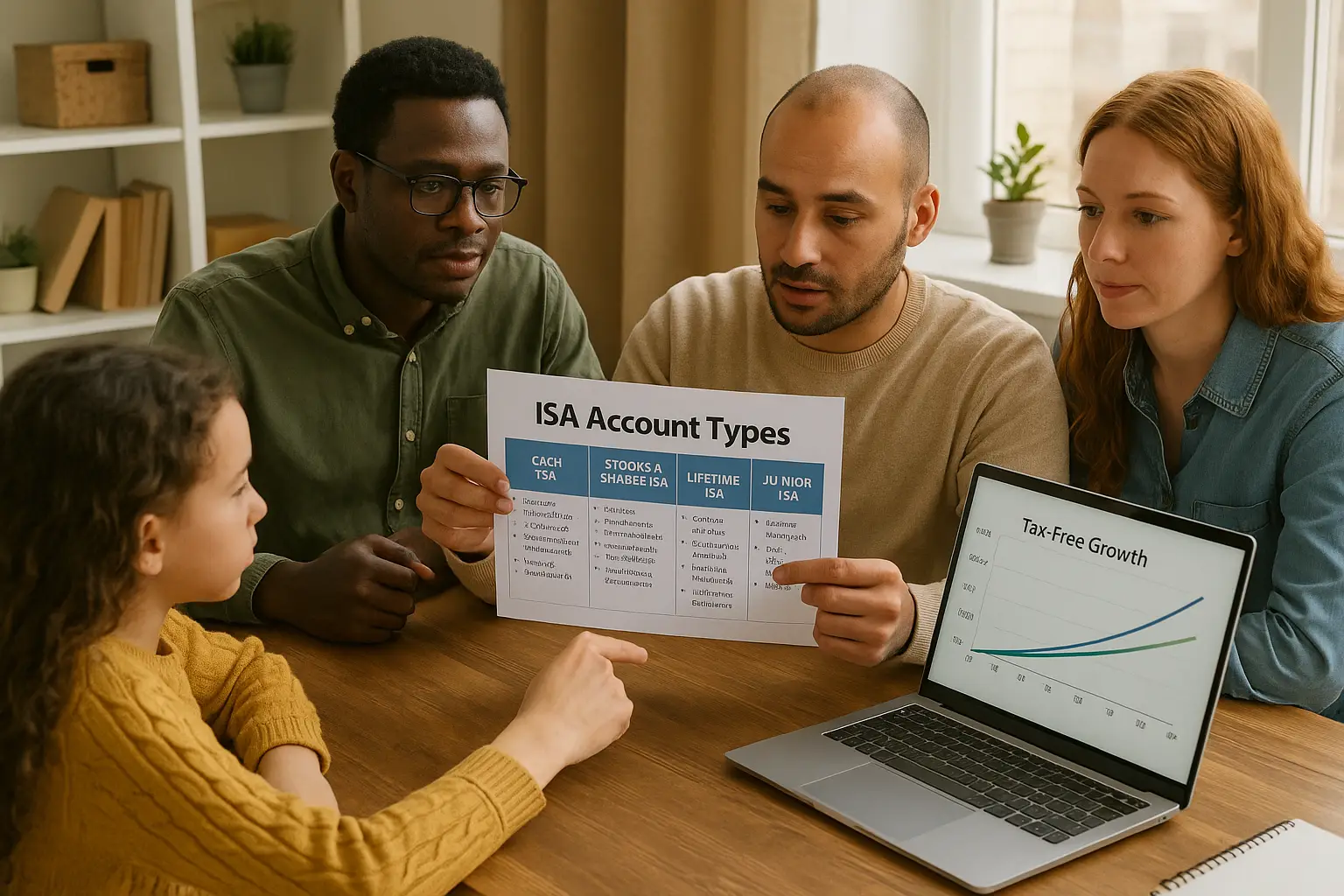

Age requirements for opening a Lifetime ISA

You must be at least 18 years old and under 40 to open a Lifetime ISA in 2025. This age window targets younger savers building long-term wealth, but once opened, you can keep contributing until age 50. For lifetime isa eligibility age uk, the rules remain unchanged from previous years, with no extensions announced in the 2025 budget.

Minimum age of 18

The minimum age for lifetime isa eligibility is 18, ensuring the account suits those entering adulthood and starting their saving journey. Under-18s cannot open one, though parents or guardians might use Junior ISAs instead for younger children. This threshold aligns with general UK financial independence markers, like voting or driving.

Maximum age of 39 to open

To meet lifetime isa eligibility age limit uk, you need to open the account before turning 40—your 39th birthday is the cutoff. If you’re 40 or older, you’re ineligible to start a new one, though existing holders can continue. This rule encourages early saving for home purchases or pensions, as per GOV.UK’s eligibility page.

Contributions allowed until age 50

After opening, lifetime isa age eligibility uk extends contributions up to your 50th birthday, giving more than a decade of tax-free growth potential. This applies even if you open at 39, maximising the government bonus over time. Post-50, you can still hold the funds until age 60 for penalty-free retirement withdrawals.

UK residency and basic criteria

UK residency is a core part of lifetime isa eligibility uk, requiring you to live in the country when opening the account. You also need a National Insurance number and must not own a property anywhere in the world if using it for a home purchase. These criteria ensure the LISA supports genuine first-time buyers and UK-based savers.

Requirement to live in the UK

For eligibility for lifetime isa, you must be a UK resident, meaning your main home is in England, Scotland, Wales, or Northern Ireland. Non-residents cannot open one, though expats with existing LISAs may contribute under certain conditions, as detailed on GOV.UK’s Lifetime ISA overview. Proof might include utility bills or council tax records when applying with providers.

No previous property ownership for home use

Lifetime isa eligibility criteria exclude those who already own or have owned a residential property, for the home-buying purpose. This applies globally—if you’ve inherited or bought abroad, you can’t use LISA funds penalty-free for another UK home. However, the account still works for retirement savings regardless of property status.

National Insurance number needed

A valid National Insurance number is essential for lifetime isa uk eligibility, verifying your identity with HMRC. Without it, providers won’t process your application. It’s a straightforward requirement, similar to opening any bank account, and ties into the tax-free ISA framework.

Tip: Before applying, double-check your residency status with recent documents to avoid delays. If unsure about property history, review land registry records for clarity on lifetime isa rules.

| Criterion | Eligible? | Details |

|---|---|---|

| Age 18-39 | Yes | Must open before 40th birthday (GOV.UK, 2025) |

| UK resident | Yes | Main home in UK; non-residents ineligible |

| No prior property ownership (for home use) | Yes if first-time buyer | Global check required |

| National Insurance number | Yes | Mandatory for HMRC verification |

| Over 50 for contributions | No | Can hold until 60 for retirement |

Eligibility for government bonus and usage

The government adds a 25% bonus to your contributions, up to £1,000 annually on £4,000 saved, but only if you meet lifetime isa government bonus eligibility by following withdrawal rules. Funds can be used tax-free for a first home under £450,000 or after age 60 for retirement. The overall ISA allowance for 2025/26 remains £20,000, including LISA contributions, per Hargreaves Lansdown.

25% bonus on contributions up to £1,000/year

To qualify for the bonus, your contributions must fit within lifetime isa eligibility criteria, added automatically by providers after HMRC approval. It’s calculated at 25% of up to £4,000 yearly, boosting your savings instantly. This incentive applies from the tax year you open the account.

Home purchase restrictions

For home use, the property must cost £450,000 or less, and you must be a first-time buyer under lifetime isa rules. Withdrawals outside this (before 60) incur a 25% penalty, potentially losing your bonus. See MoneyHelper’s guide for full details.

Retirement access at age 60

From age 60, you can withdraw everything tax-free for retirement, regardless of home-buying status. This makes the LISA versatile for long-term planning. Early access for other reasons triggers penalties, so plan accordingly.

Common ineligibility scenarios

Many miss out on lifetime isa eligibility due to age, residency, or property ownership—common pitfalls to avoid. Over-40s, non-UK residents, and existing homeowners top the list, but edge cases like dual residency require careful review.

Over 40 years old

If you’re 40 or older, you cannot open a new LISA, ending your chance for the bonus structure. Existing accounts continue, but new savers must explore alternatives like standard ISAs. This strict cutoff pushes urgency for those nearing 39.

Non-UK residents

Expats or those living abroad fail lifetime isa eligibility uk residency tests and cannot open one. If you move post-opening, you might still contribute, but verify with HMRC. For more on LISA rules, consult MoneySavingExpert.

Existing homeowners

Current property owners are ineligible for home-buying withdrawals without penalty, limiting LISA use to retirement. Inherited properties count too, so assess your status early. For basics, check our guide on what is a lifetime isa.

Frequently asked questions

Who can open a Lifetime ISA?

Anyone meeting lifetime isa eligibility—aged 18-39, UK resident with a National Insurance number, and not a homeowner for home use—can open one. It’s aimed at first-time buyers or retirement savers, offering tax-free growth and bonuses. Providers like banks or investment firms handle applications, but always confirm your status first to avoid issues.

What is the age limit for Lifetime ISA?

The age limit for lifetime isa eligibility age is 18 minimum and under 40 to open, with contributions until 50. This targets younger adults, but turning 40 closes the door on new accounts. If nearing the limit, act quickly to secure the benefits for 2025/26.

Can I open a Lifetime ISA if I already own a property?

No, if you own a property worldwide, you can’t use LISA funds penalty-free for another home purchase under eligibility for lifetime isa. However, it’s still viable for retirement savings until age 60. Consider standard ISAs if home-buying isn’t your goal to avoid the 25% withdrawal penalty.

Do I need to be a UK resident to open a Lifetime ISA?

Yes, UK residency is required for lifetime isa uk eligibility, meaning your primary address must be in the UK. Non-residents or those planning to move abroad soon should explore alternatives. Existing holders might continue contributing, but new openings are restricted—check GOV.UK for proofs like addresses.

What happens if I exceed the Lifetime ISA age limit?

Exceeding the age limit by turning 40 means you can’t open a new LISA, missing the bonus for first homes or boosted retirement. You can manage existing funds or switch to other ISAs within the £20,000 allowance. For those just over, compare options in our best lifetime isa roundup.

Can I open a Lifetime ISA if I’m 40?

At 40, you’re ineligible under lifetime isa eligibility age limit uk rules—no new openings allowed. If you opened before 40, continue contributing until 50. This cutoff motivates early action; otherwise, opt for Cash or Stocks and Shares ISAs for similar tax perks.