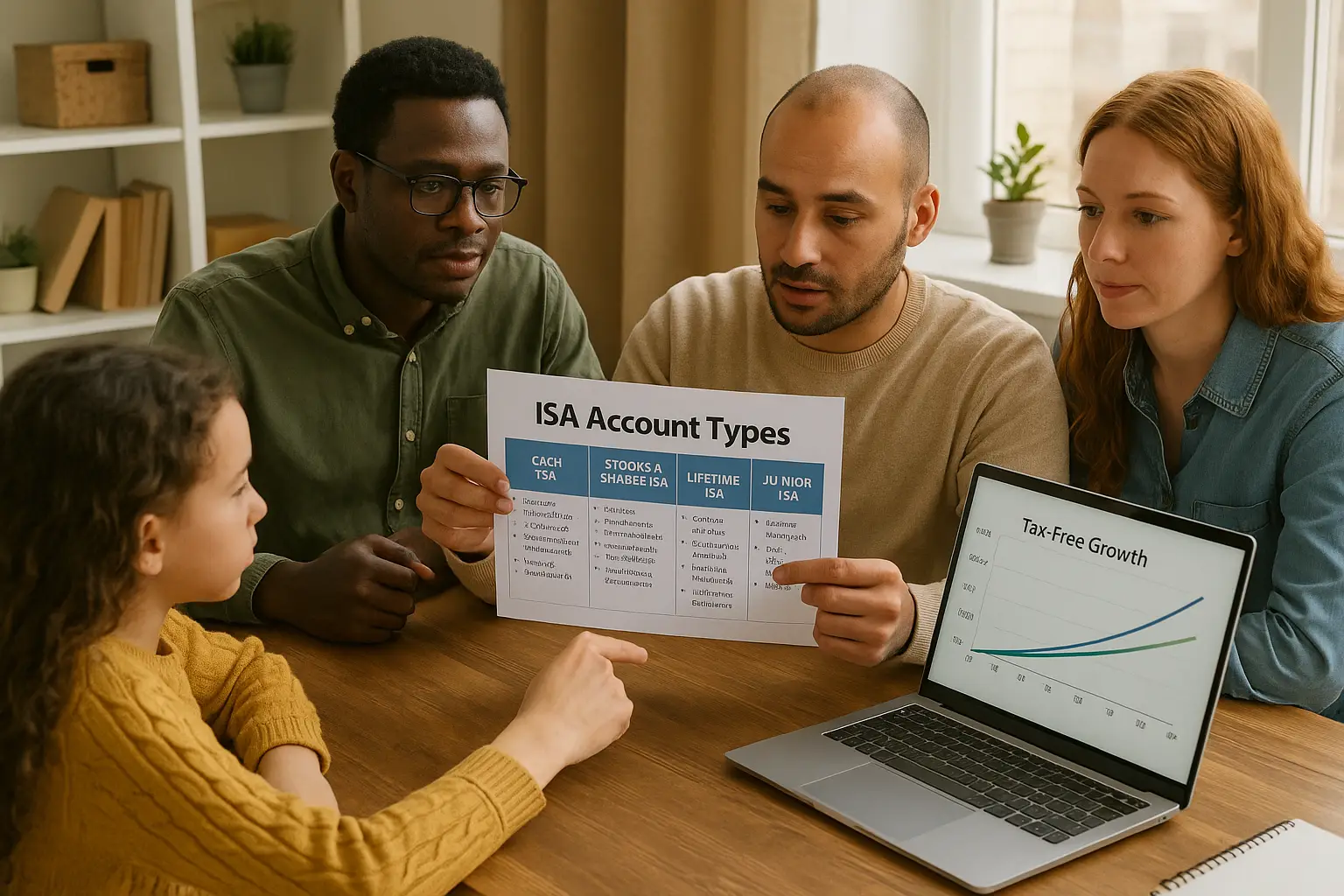

What is an ISA account?

An Individual Savings Account (ISA) is a tax-free savings or investment account available to UK residents. It allows you to save or invest money without paying income tax or capital gains tax on the returns. ISAs come in various types, each suited to different financial goals, from safe savings to long-term growth.

Definition and purpose

The purpose of an ISA is to encourage saving and investing by shielding earnings from tax. Introduced in 1999, they help people build wealth efficiently. For instance, interest from savings or profits from investments grow tax-free, making ISAs a cornerstone of UK personal finance.

Tax benefits overview

ISAs shield your money from income tax on interest and dividends, as well as capital gains tax on profits from selling investments. This is particularly useful if you exceed the personal savings allowance, where basic-rate taxpayers pay no tax on the first £1,000 of interest outside an ISA. Higher-rate taxpayers benefit even more, avoiding 40% tax on savings income.

Annual allowance for 2025/26

For the 2025/26 tax year, the total ISA allowance is £20,000, which you can split across different types of ISA accounts. This limit resets each tax year on 6 April. According to MoneySavingExpert, you can use the full amount for one type or divide it, but contributions must stay within the overall cap.

Tip: Track your contributions throughout the tax year to avoid exceeding the £20,000 limit, as overpayments cannot be reclaimed.

Cash ISA

A Cash ISA is like a regular savings account but with tax-free interest, ideal for those seeking low-risk preservation of capital. It functions similarly to a bank deposit, earning steady interest without the volatility of investments.

How it works

You deposit money into a Cash ISA, and it earns interest based on the provider’s rate. All interest is tax-free, regardless of your income tax band. Withdrawals depend on the account type, but the funds remain protected up to £85,000 by the Financial Services Compensation Scheme (FSCS) if held with an authorised bank.

Interest rates and access types

Cash ISAs come in easy access, fixed-rate, or notice varieties. As of October 2025, top easy access Cash ISA rates reach 4.51% AER (Annual Equivalent Rate), according to Moneyfactscompare. Fixed-rate options lock in higher returns, like 4.5% for one year, but limit withdrawals.

Eligibility and limits

UK residents aged 18+ can open a Cash ISA, contributing up to the full £20,000 allowance. You can only subscribe to one Cash ISA per tax year but hold multiple overall. For more on ISA rates comparison, see our guide.

Stocks and Shares ISA

A Stocks and Shares ISA lets you invest in stocks, shares, funds, or bonds tax-free, offering potential for higher returns than cash savings. It’s suited for those comfortable with market fluctuations aiming for growth.

Investment options

Options include individual shares, exchange-traded funds (ETFs), investment trusts, and bonds. Platforms allow diversified portfolios, from UK stocks to global funds. Unlike Cash ISAs, returns come from capital growth and dividends, both tax-free.

Risks and returns

Investments can fall in value, so capital is at risk—there’s no FSCS protection beyond the provider’s stability. Historical returns average 7% annually for diversified funds, but past performance isn’t a guarantee. Martin Lewis often highlights Stocks and Shares ISAs for long-term horizons over 5 years.

Comparison to Cash ISA

While Cash ISAs provide guaranteed interest with low risk, Stocks and Shares ISAs offer higher potential but with volatility. Cash suits short-term savers; stocks for growth seekers. Neither pays tax on gains, but the investment ISA exposes you to market risks absent in cash.

Lifetime ISA

A Lifetime ISA (LISA) combines saving for retirement or a first home with a 25% government bonus, making it a boosted option for young adults.

Government bonus details

The government adds 25% on contributions up to £4,000 per year, equating to a £1,000 bonus. This is part of your £20,000 ISA allowance. As per GOV.UK, the bonus applies after the provider claims it from HMRC.

Who qualifies

Available to UK residents aged 18-39 opening their first LISA, with no upper age limit for holding. It’s ideal for first-time buyers under 60 or retirement planning. Contributions stop at 50, but growth continues tax-free.

Withdrawal rules

Penalty-free withdrawals are for buying a first home up to £450,000 or after age 60. Otherwise, a 25% charge applies, recouping the bonus plus 6.25% on your savings. Learn more in our how to open an ISA article.

Junior ISA

A Junior ISA (JISA) is a tax-free savings account for children under 18, helping parents or guardians build a nest egg.

For children under 18

Parents or guardians open a JISA for a child resident in the UK. It can be cash or stocks and shares, mirroring adult versions but with child-focused protections.

Subscription limits

The 2025/26 limit is £9,000, all tax-free. Only one JISA per child, but switches between providers are allowed without affecting the allowance, per MoneySavingExpert.

Access at maturity

Funds are locked until the child turns 18, then convert to an adult ISA. Early access is rare, only for the child’s benefit in exceptional cases.

Innovative Finance ISA

An Innovative Finance ISA (IFISA) wraps alternative investments like peer-to-peer lending in a tax-free structure, targeting higher yields.

P2P and alternative investments

It covers peer-to-peer loans, crowdfunding, and debt-based investments, earning tax-free interest or returns.

Risks without FSCS

No FSCS protection means higher risk—if the lender fails, you could lose money. Returns can exceed 5%, but defaults occur.

Integration with allowance

Part of the £20,000 allowance, you can only contribute to one IFISA per year. It’s for experienced investors, as noted by Forbes Advisor UK.

ISA rules and how many can you have

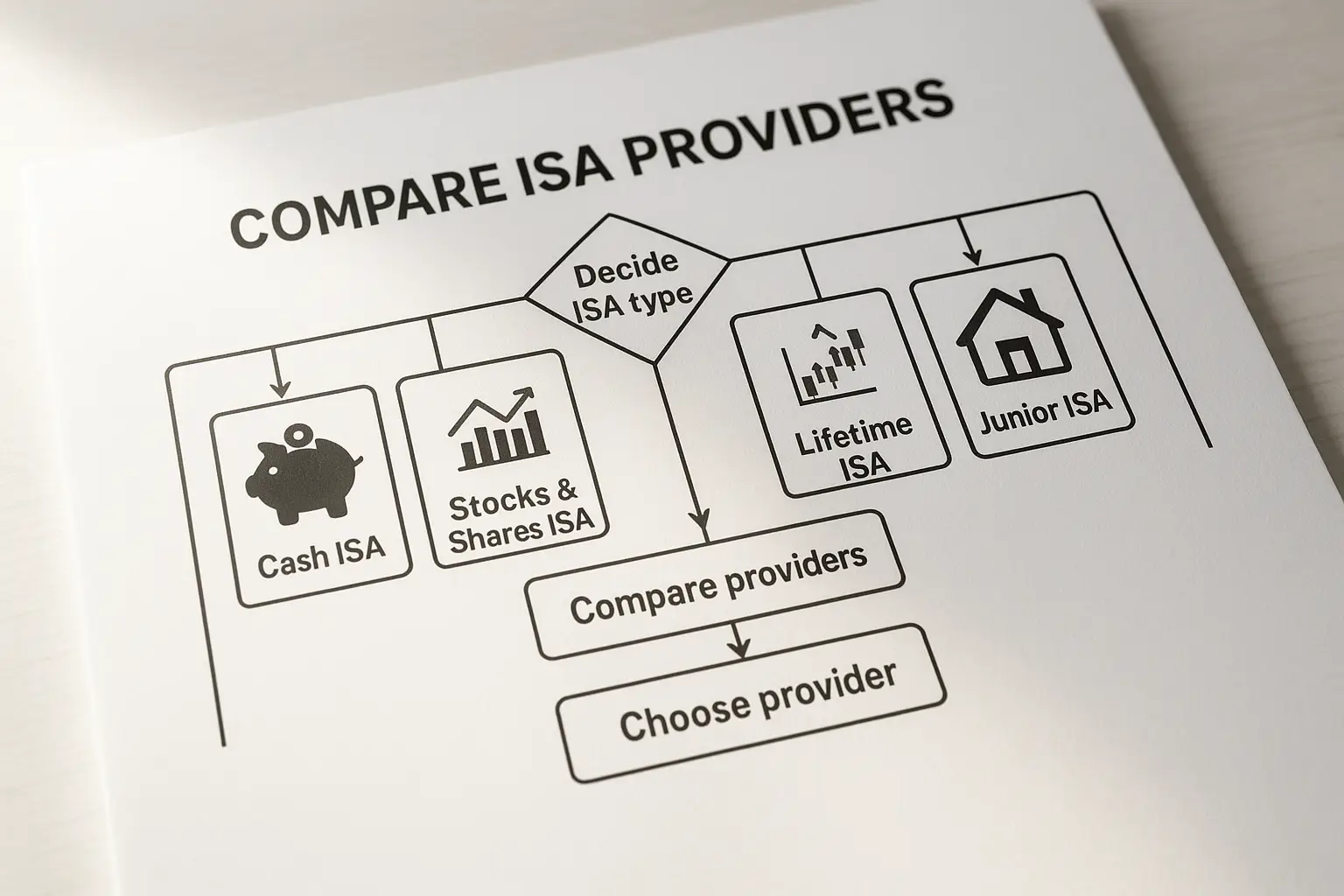

Multiple ISAs per person

You can hold multiple ISAs but subscribe to only one of each type per tax year. For example, one Cash ISA and one Stocks and Shares ISA.

Transfers and contributions

Transfers between same-type ISAs don’t count towards your allowance. Contributions must be new money or matured investments.

Tax year deadlines

The tax year runs 6 April to 5 April; use your allowance fully before it ends. For official rules, visit GOV.UK.

| Type | Allowance share | Risk level | Key benefit | Eligibility |

|---|---|---|---|---|

| Cash ISA | Up to £20,000 | Low | Tax-free interest, FSCS protected | 18+ UK residents |

| Stocks and Shares ISA | Up to £20,000 | Medium/High | Potential growth, diversified investments | 18+ UK residents |

| Lifetime ISA | Up to £4,000 | Low/Medium | 25% government bonus | 18-39 UK residents |

| Junior ISA | Up to £9,000 | Low/Medium | Long-term tax-free for children | Under 18, via guardian |

| Innovative Finance ISA | Up to £20,000 | High | Tax-free alternative yields | 18+ UK residents |

Frequently asked questions

What are the different types of ISAs?

The main types of ISA accounts include Cash ISAs for savings, Stocks and Shares ISAs for investments, Lifetime ISAs for home or retirement with a bonus, Junior ISAs for children, and Innovative Finance ISAs for peer-to-peer lending. Each offers tax-free growth but differs in risk and purpose. Cash is safest, while stocks provide growth potential; choose based on your goals like short-term saving or long-term wealth building.

How much can I put in an ISA each year?

For 2025/26, the ISA allowance is £20,000 total across all types for adults. This covers contributions to Cash, Stocks and Shares, or other ISAs but resets annually on 6 April. Exceeding it means the excess is taxed as normal savings; plan splits wisely, such as £10,000 in cash and £10,000 in stocks, to maximise tax efficiency.

Can I have more than one ISA?

Yes, you can hold multiple ISAs, but only subscribe to one of each type per tax year—for instance, one Cash ISA and one Lifetime ISA. You might have several Cash ISAs from past years but can only add to one new or existing Cash ISA yearly. Transfers between providers don’t use your allowance, allowing flexibility without penalties.

What is the difference between a Cash ISA and a Stocks and Shares ISA?

A Cash ISA earns fixed interest like a savings account with low risk and FSCS protection, ideal for capital preservation. In contrast, a Stocks and Shares ISA invests in markets for potentially higher returns but with value fluctuations and no FSCS guarantee. Both are tax-free, but cash suits cautious savers, while stocks appeal to those with a 5+ year horizon tolerant of volatility.

What is a Lifetime ISA and who is it for?

A Lifetime ISA is for 18-39 year-olds saving for a first home or retirement, offering a 25% bonus on up to £4,000 yearly. It’s part of the £20,000 allowance and grows tax-free. Withdrawals before 60 incur penalties unless for an eligible home purchase; it’s best for young adults planning major life goals with government support.

How many ISAs can I have UK?

UK rules allow unlimited ISA holdings but limit subscriptions to one per type annually. For example, you could contribute to a Cash ISA, a Stocks and Shares ISA, and a Lifetime ISA in one year, totalling £20,000. This setup supports diversified saving; always check with HMRC for personal circumstances to avoid rule breaches.

What is an ISA allowance 2025?

The 2025/26 ISA allowance remains £20,000 for adults, unchanged from prior years per HMRC. It applies to all types combined, including the £4,000 LISA cap. Use it strategically for tax-free growth; for children, Junior ISAs have a separate £9,000 limit, enabling family-wide planning.

For the best ISA options tailored to your needs, consider your risk tolerance and goals before deciding.