Understanding ISA rates and types

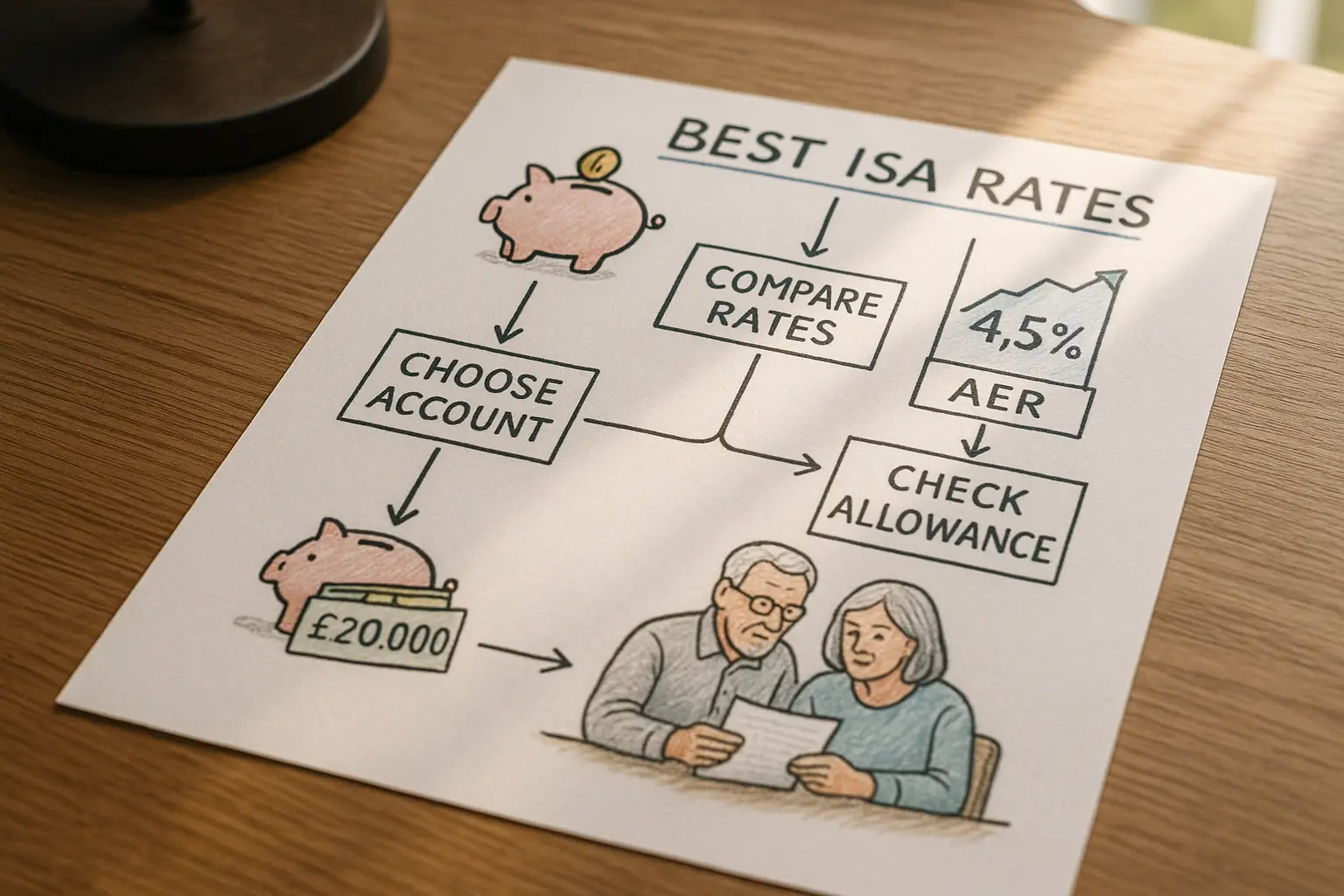

The best ISA rates in 2025 offer tax-free savings up to 4.51% AER for easy access options, helping UK savers maximize returns without paying income tax on interest. Individual Savings Accounts (ISAs) allow you to earn interest or investment growth free from UK tax, making them essential for anyone looking to grow their money efficiently. With the annual allowance set at £20,000, choosing the right type based on your needs is key to getting the top yields.

What is a cash ISA?

A cash ISA is a tax-free savings account where your money earns interest without UK income tax deductions, ideal for low-risk savers seeking stability. Unlike regular savings accounts, all interest from a cash ISA stays with you, potentially adding hundreds of pounds yearly on larger balances. Providers like those highlighted on MoneySavingExpert offer competitive cash ISA rates, ensuring your funds are protected up to £85,000 by the Financial Services Compensation Scheme (FSCS).

Fixed vs easy access ISAs

Fixed rate ISAs lock in a guaranteed interest rate for a set period, such as 1 to 5 years, providing certainty but limiting withdrawals with penalties. Easy access ISAs, on the other hand, allow instant withdrawals with variable rates that can change, suiting those needing flexibility. In 2025, fixed options up to 4.27% AER outperform easy access for long-term holders, but compare best cash ISA rates on sites like moneyfactscompare.co.uk to match your goals.

2025 allowance and tax benefits

For 2025, the ISA allowance remains £20,000, letting you split it across cash, stocks, or other types without tax on gains. This tax shield can save basic-rate taxpayers up to £1,000 annually on £20,000 at 5% interest, per HMRC rules. Maximizing your allowance with the best ISA rates in the UK ensures more money compounds over time, as noted in GOV.UK’s annual savings statistics showing £60.1 billion in cash ISA subscriptions last year.

Top easy access cash ISA rates

The highest easy access cash ISA rates in 2025 hit 4.51% AER, beating inflation and offering liquidity for emergency funds. These accounts from online providers often outpace high street banks, with no notice required for withdrawals. For savers prioritizing access, flexible cash ISA best rates make them a top pick amid rising living costs.

Best rates up to 4.51% AER

Leading providers deliver easy access rates around 4.51% AER, as tracked by MoneySavingExpert’s latest comparisons. This yield on a £10,000 balance could earn £451 tax-free yearly, far surpassing standard savings. Always check eligibility, as some require minimum deposits starting at £1.

Options for over 50s and 60s

Seniors can access tailored best cash ISA rates UK over 60s, with some providers offering 4.2% AER or more for easy access. Accounts from building societies like Yorkshire often boost rates for older customers, combining accessibility with senior perks. These options address the best ISA rates for over 50s by providing penalty-free withdrawals for retirement needs.

Flexible ISAs

Flexible ISAs allow withdrawals and replacements within the same tax year without affecting your allowance, with best flexible cash ISA rates at 4.3% AER. Ideal for irregular savers, they match easy access benefits while preserving contribution limits. Providers like Chase Bank lead here, per money.co.uk reviews.

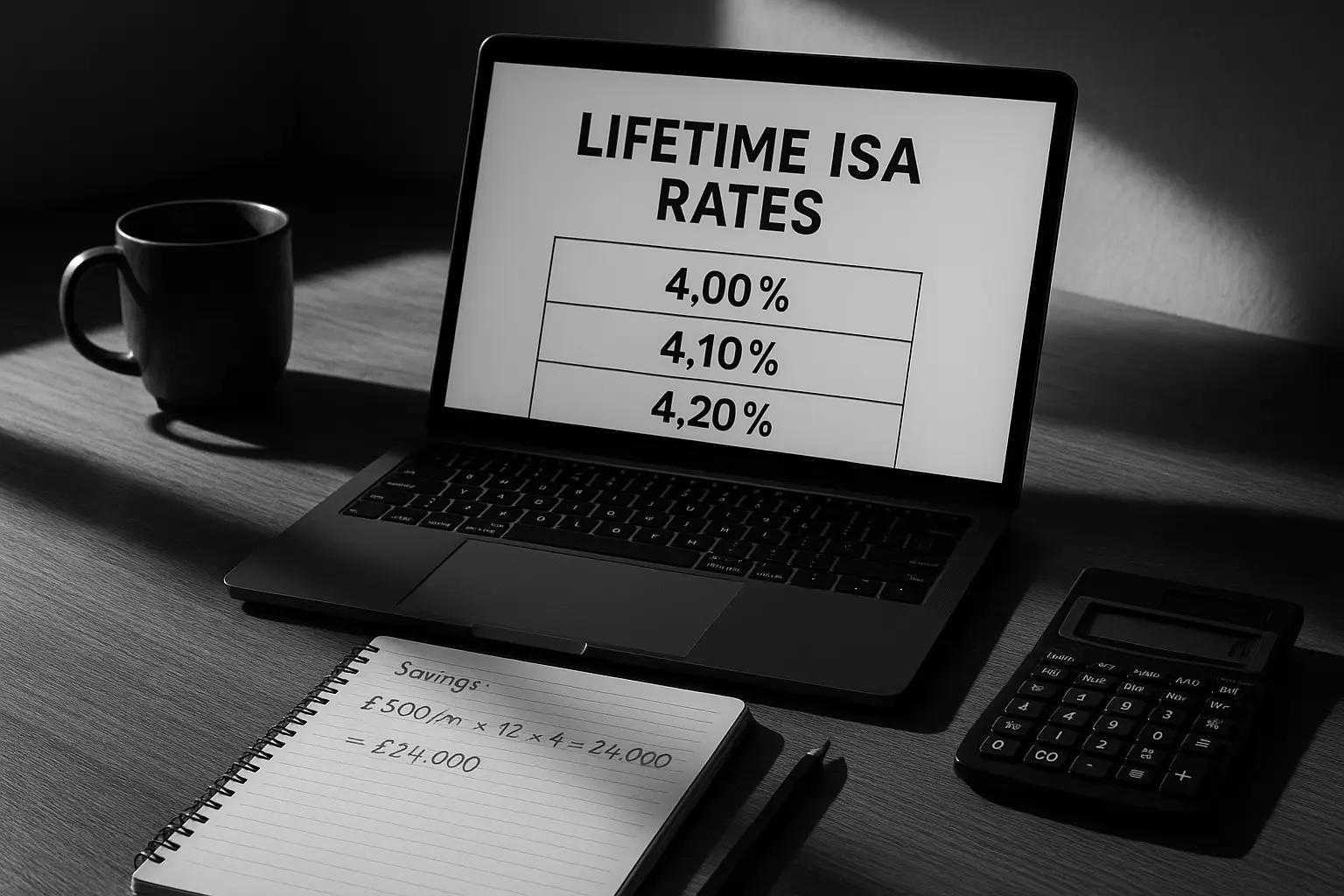

Best fixed rate ISAs by term

Fixed rate ISAs in 2025 provide locked-in returns up to 4.27% for one year, shielding against rate drops. Committing funds for 1-5 years yields higher than variable options, but early withdrawal fees apply. Select based on your timeline to secure the best fixed rates cash ISA.

| Provider | Term | Rate (AER) | Min Deposit | Penalty for Withdrawal |

|---|---|---|---|---|

| Shawbrook Bank | 1 year | 4.27% | £1,000 | 150 days’ interest |

| West Brom BS | 2 years | 4.10% | £500 | 180 days’ interest |

| Skipton BS | 3 years | 3.95% | £1 | Full term loss |

| Close Brothers | 5 years | 3.75% | £10,000 | 365 days’ interest |

1-year fixed rates

The best 1 year fixed ISA interest rates reach 4.27% AER, perfect for short-term certainty amid economic shifts. Providers like Shawbrook offer this with low minimums, earning £427 on £10,000 tax-free. Compare best fixed cash ISA rates for 1 year on Which? for unbiased ratings.

2-3 year options

For medium terms, 2 year ISA best rates hover at 4.10%, while best 3 year fixed ISA rates offer 3.95%. These balance yield and commitment, suiting savers planning ahead. Building societies dominate here, providing FSCS protection up to £85,000.

5-year long-term deals

Best ISA 5 year fixed rates at 3.75% lock in stability for major goals like home deposits. Though lower than shorter terms, they beat easy access over time due to compounding. Check best fixed ISA rates for 5 years for options with no early access fees in emergencies.

ISA transfers: Maximizing your returns

Transferring ISAs can boost earnings by 0.5% or more via best cash ISA rates for transfers, without using your allowance. The process is free and preserves tax-free status, ideal for chasing higher yields. In 2025, top transfer rates hit 4.16% AER for fixed terms.

How to transfer ISAs

Contact your new provider to initiate a transfer; they handle moving funds from the old one, typically in 30 days. You won’t lose interest if done correctly, and it works for cash or stocks ISAs. Follow FCA guidelines at fca.org.uk for smooth switches to the best ISA rates transfer.

Top transfer rates

Best cash ISA transfer rates include 4.16% for one-year fixed from Virgin Money, requiring a current account. These inbound deals often beat new subscriptions, per Tembo blog analysis. Prioritize providers offering bonuses for transfers in to optimize savings.

Junior and inheritance ISAs

Children’s ISA best rates for juniors reach 4.0% easy access, with £9,000 annual limit until age 18. Inheritance ISAs allow adding up to £20,000 from a deceased spouse’s account at competitive rates. These secure the best junior ISA interest rates for future planning.

High street vs online providers

High street banks like Barclays offer reliable but lower best bank ISA rates around 3.0%, while online challengers push 4.5%+ for better yields. Building societies provide a middle ground with community focus and solid rates. Weigh convenience against returns when seeking best ISA rates on the high street.

Nationwide, Barclays, and Halifax rates

Nationwide’s best cash ISA rates nationwide include 3.75% fixed, with easy access at 3.2%. Barclays provides 3.0% easy access, emphasizing app-based management. Halifax’s 3.45% one-year fixed requires a current account, as detailed on their sites and tembomoney.com.

Building society options

Best building society cash ISA rates from Yorkshire BS hit 4.20% for fixed terms, often exceeding banks. These mutuals prioritize member benefits with low minimums. Compare via goodmoneyguide.com for the best high street ISA interest rates.

Comparison tips

Use tools on moneysavingexpert.com to sort by AER, minimum deposit, and access type for the best current ISA rates. Factor in FSCS coverage and provider stability. Regularly review to switch to the best ISA rates today.

Frequently asked questions

What is the best easy access cash ISA rate in 2025?

The top easy access cash ISA rate in 2025 is 4.51% AER from providers like Chip or Plum, offering instant withdrawals and tax-free interest. These outperform inflation, helping savers preserve purchasing power on balances up to £20,000. For the latest, consult MoneySavingExpert’s dynamic tables, as rates can vary by eligibility and deposit size.

How do I transfer my ISA to get a better rate?

To transfer your ISA, select a new provider with higher rates and instruct them to handle the move from your current one, avoiding direct withdrawals to preserve tax benefits. The process takes about 15-30 days and incurs no fees if done properly, potentially gaining 0.5-1% more AER. Always confirm the new account matches your old type, like cash to cash, per FCA rules to maximize best cash ISA transfer rates.

Are there special ISA rates for seniors?

Yes, seniors over 50 or 60 often qualify for boosted rates, such as 4.2% AER easy access from select building societies targeting the best ISA rates for over 50s. These accounts may include perks like no withdrawal limits, suiting retirement income needs. Check providers like Halifax for tailored options, ensuring FSCS protection for peace of mind.

What are the top fixed rate ISAs for 1 year?

Top one-year fixed ISAs in 2025 offer up to 4.27% AER from Shawbrook or RCI Bank, locking in yields for short commitments. They suit savers expecting rate cuts, with minimum deposits as low as £500. Compare on money.co.uk to avoid penalties and secure the best 1 year ISA rates without overcommitting funds.

What’s the difference between cash ISA and stocks ISA?

A cash ISA provides low-risk, guaranteed interest like a savings account, with top rates at 4.51% AER, while a stocks and shares ISA invests in markets for potential higher returns but with volatility and no guarantees. Cash suits conservative savers; stocks appeal to those comfortable with risk for long-term growth. Both are tax-free up to £20,000, but diversify to balance stability and upside.

Can I get the best ISA saver fixed rates for transfers?

Yes, transfers qualify for competitive fixed rates like 4.16% AER on one-year terms from Virgin Money, often matching or exceeding new customer deals. This allows switching without using your allowance, preserving tax efficiency. Review tembomoney.com for provider-specific transfer bonuses to achieve the best fixed cash ISA rates for 1 year via inbound moves.