Definition and basics of an ISA

An ISA, or Individual Savings Account, is a tax-free savings or investment account available to UK residents, allowing you to save or invest up to a certain amount each year without paying tax on the interest, dividends, or capital gains earned. Introduced in 1999 to encourage saving, an ISA acts as a tax wrapper around your money, meaning earnings grow sheltered from income tax and capital gains tax—unlike regular savings accounts where interest over £1,000 for basic-rate taxpayers is taxable. In 2023-24, UK households deposited a record £103 billion into ISAs, highlighting their popularity amid rising interest rates and economic uncertainty (source: The Guardian).

What is an ISA account in the UK?

An ISA account in the UK is essentially a flexible container for your savings or investments that shields them from tax, making it ideal for long-term wealth building. You can open an ISA account if you’re 18 or older and a UK resident, including crown employees abroad. What sets an ISA apart from a standard savings account is the tax efficiency: for example, if you earn 5% interest on £10,000 in a regular account, a basic-rate taxpayer might owe £250 in tax, but in an ISA, you keep it all.

How ISAs differ from regular savings

Regular savings accounts offer easy access but tax on interest, while ISAs provide tax relief at the cost of annual limits and sometimes lower liquidity. For beginners wondering what is an ISA uk versus a bank account, the key difference lies in tax savings—ISAs prevent HMRC from taxing your growth, potentially adding thousands over time.

Types of ISAs available

ISAs come in several types to suit different goals, from safe cash saving to higher-risk investing, with the most common being cash, stocks and shares, and lifetime variants. Each type allows tax-free growth within the overall annual allowance, but they differ in risk and access—for instance, cash ISAs mimic high-street savings while investment ISAs let you buy shares.

Cash ISAs, including instant access

A cash ISA is like a savings account where your money earns interest tax-free, perfect for emergency funds. What is an instant access ISA? It’s a cash ISA variant allowing withdrawals anytime without penalty, though rates might be lower than fixed-term options. Easy access ISAs, or instant access cash ISAs, offer flexibility for those needing liquidity, with current rates around 4-5% AER.

Stocks and shares ISAs

What is an investment ISA? A stocks and shares ISA lets you invest in funds, shares, or bonds tax-free, ideal for growth over 5+ years. This investment ISA account UK suits those comfortable with market fluctuations, where capital gains and dividends escape tax. For example, an equity ISA focuses on stock investments, while an AIM ISA targets smaller companies for potentially higher returns but more risk.

Innovative finance and other ISAs

An innovative finance ISA covers peer-to-peer loans or crowdfunding, offering yields up to 6-8% tax-free but with default risks. What is an innovative finance ISA? It’s for alternative investments beyond traditional stocks. Niche options include junior ISAs for kids under 18, saving tax-free for their future.

| Type | Risk level | Suitability | Key feature |

|---|---|---|---|

| Cash ISA (e.g., instant access) | Low | Beginners, short-term savers | Tax-free interest, easy withdrawals |

| Stocks and shares ISA | Medium to high | Long-term investors | Tax-free dividends and gains |

| Innovative finance ISA | Medium | Alternative seekers | Tax-free P2P lending returns |

| Lifetime ISA | Medium | First-time buyers or retirees (18-50) | 25% government bonus on £4,000 |

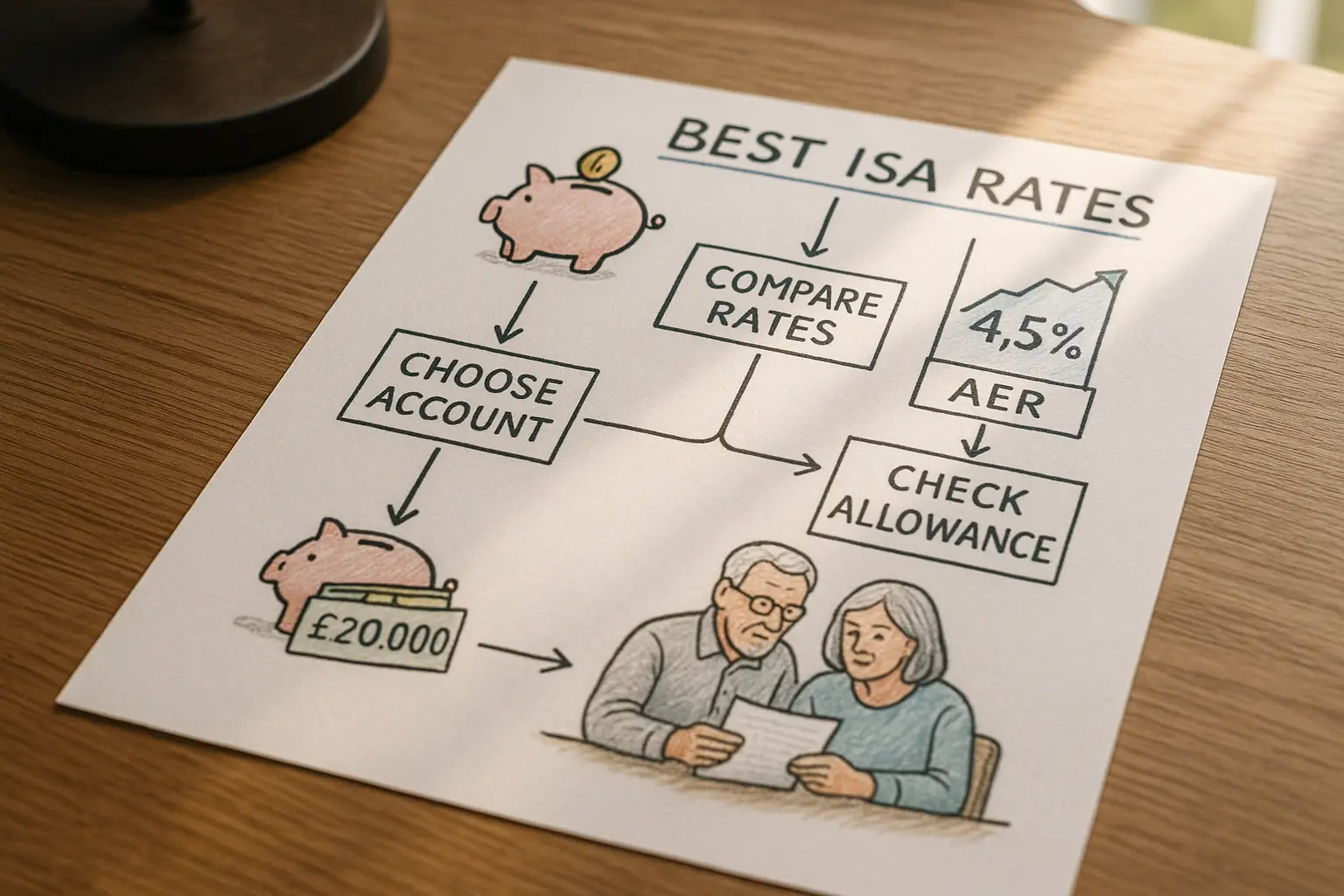

ISA allowance and rules

The ISA allowance for 2025/26 is £20,000, meaning you can contribute up to this amount across all your ISAs without tax on growth (source: Hargreaves Lansdown). This limit resets each tax year from 6 April to 5 April, and unused allowance doesn’t carry over—what is the limit for an ISA? It’s strictly £20,000 annually.

Tax year deadlines and contributions

Contributions must be new money or transfers from existing ISAs; you can’t withdraw and re-contribute in the same year without rules applying. What is the maximum you can save in an ISA? Up to £20,000, split across types like £10,000 in cash and £10,000 in stocks. Around 15 million adult ISAs were active in 2023-24, with cash making up 66% (source: GOV.UK).

Withdrawal and transfer rules

Withdrawals are tax-free but don’t replenish your allowance unless it’s a flexible ISA. Transfers between providers keep tax benefits intact, and ISA splits allow dividing contributions. What is an ISA split? It’s a rule letting you spread allowance across multiple providers in one tax year.

Benefits and tax advantages

The main benefit of an ISA is tax-free growth on interest, dividends, and capital gains, potentially saving basic-rate taxpayers up to £2,000 yearly on £20,000 at 5% return. What is the benefit of an ISA? It compounds savings faster without HMRC deductions, outperforming taxable accounts.

Comparisons to other options

Unlike bonds, which might offer fixed returns but tax implications, an ISA wrapper shields everything tax-free—what is the difference between an ISA and a bond? ISAs are more versatile for various assets. Compared to regular savings, ISAs avoid the £1,000 personal savings allowance tax trap.

Risks and considerations

Investment ISAs carry market risk, where value can fall, unlike guaranteed cash ISAs. Fees vary—what is an ISA fee? Typically 0.25-1% for platforms, plus fund charges. Always assess your risk tolerance.

How to open and manage an ISA

To open an ISA, choose a provider like a bank or investment platform, verify eligibility, and fund it online or in-branch—start small to test. For management, monitor via apps and consider transfers for better rates.

Choosing a provider and transfers

Compare options at best isa rates to find top yields. Transfers are free if done correctly, preserving your allowance.

Frequently asked questions

What is the ISA allowance for 2025/26?

The ISA allowance for 2025/26 remains £20,000, unchanged from previous years, allowing UK residents to save or invest this amount tax-free across all ISA types. This cap applies per tax year, from 6 April to 5 April, and includes contributions to cash, stocks and shares, or lifetime ISAs. Exceeding it means the excess is taxed as regular income, so track your contributions carefully via HMRC records for optimal tax efficiency.

How does an ISA work?

An ISA works by wrapping your savings or investments in a tax shelter, where earnings like interest or gains aren’t subject to UK taxes. You contribute eligible funds, and the provider handles the tax-free status automatically upon withdrawal. For those asking what is an ISA and how does it work, it’s designed for long-term growth, with rules ensuring only one of each type per year, promoting disciplined saving amid economic pressures like inflation.

What are the different types of ISAs?

ISAs include cash for low-risk interest, stocks and shares for potential higher returns, innovative finance for P2P lending, and lifetime for home buying or retirement with a bonus. What are the types of ISAs? Each fits specific needs—cash for safety, investments for growth— all sharing the £20,000 allowance. Beginners might start with a cash ISA, while experts diversify to mitigate risks and maximize tax benefits over time.

Who can open an ISA?

Anyone 18 or over who is a UK resident, including those living abroad for work like diplomats, can open an ISA. Non-residents or under-18s generally can’t, except via junior ISAs gifted by parents. Eligibility ensures broad access, but verify status with providers to avoid compliance issues, especially for expats planning returns to the UK.

What are the benefits of an ISA?

The primary benefits include tax-free growth on all earnings, helping savers keep more of their money compared to taxable accounts. What is the benefit of an ISA? It encourages saving, with recent trends showing £103 billion inflows as people shield funds from potential allowance cuts. For advanced users, combining ISAs with pensions offers robust retirement strategies, though liquidity varies by type.

Can I transfer an ISA and what is an ISA split?

Yes, you can transfer ISAs between providers without losing tax benefits or allowance, often to chase better rates—process it as a full or partial move. What is an ISA split? It allows dividing your £20,000 allowance across multiple new providers in one year, useful for testing platforms. Experts use splits for diversification, but watch fees to maintain net gains over time.