What is an ISA and why choose one in 2025

The best ISA rates in the UK for 2025 offer savers a way to earn tax-free interest, making them essential for maximising returns amid economic uncertainty. With top easy access cash ISA rates reaching 4.53% AER as of late 2025 (Moneyfactscompare, accessed 2025-11-07), ISAs protect your savings from income tax on interest, unlike regular accounts. Over 11 million UK adults already hold cash ISAs with average balances around £15,000, highlighting their popularity (Moneyfactscompare, accessed 2025-11-07).

ISA basics and tax benefits

An Individual Savings Account (ISA) is a tax-free wrapper for your savings or investments, allowing interest or gains to grow without HMRC taking a cut. For basic-rate taxpayers, this means no 20% tax on interest over £1,000 annually, while higher-rate savers avoid 40% on amounts above £500. In 2025, with inflation lingering, locking into the types of ISA with competitive rates preserves your purchasing power.

Annual allowance and eligibility

The annual ISA allowance for 2025/26 is £20,000 tax-free, unchanged from previous years and applicable to all adults aged 18+ resident in the UK (MoneySavingExpert, accessed 2025-11-07). You can split this across multiple ISAs, but the total cannot exceed the limit. For more on this, see our guide to ISA allowance 2025.

ISA vs regular savings accounts

ISAs outperform regular savings due to tax-free status, especially as rates rise; for example, a 4.5% AER ISA yields more net interest than a taxed equivalent. Regular accounts may offer higher headline rates but erode benefits for larger sums via the Personal Savings Allowance. To compare non-ISA options, check our savings accounts UK page.

Types of ISAs: Cash, fixed, and more

ISAs come in various forms to suit different needs, from flexible cash options to long-term plans like Lifetime ISAs with a 25% government bonus up to £1,000 for under-40s (Forbes Advisor UK, accessed 2025-11-07). Choosing the right type depends on your access requirements and risk tolerance.

Easy access cash ISAs

These allow withdrawals anytime with variable rates, ideal for emergency funds. Top providers like Virgin Money offer around 4.5% AER, beating inflation. They suit those seeking the best cash ISA rates without penalties.

Fixed rate ISAs

Fixed rate ISAs lock your money for a set term, guaranteeing rates like 4.28% AER for one year (Which?, accessed 2025-11-07). Best for predictable returns if you can commit funds.

Junior and Lifetime ISAs

Junior ISAs help parents save tax-free for children under 18, with rates up to 4.5% on cash versions. Lifetime ISAs combine savings and investment for first homes or retirement, boosted by the government incentive.

Best cash ISA rates for 2025

The best cash ISA rates uk focus on easy access and fixed options, with top picks exceeding 4.5% AER for flexible savers. As rates fluctuate with Bank of England policy, prioritising providers with FSCS protection up to £85,000 is key.

Top easy access options

Leading easy access cash ISAs include Trading 212 at 4.53% AER and Plum at 4.45%, both with low minimum deposits. These outperform high-street banks, offering better returns for everyday savers.

Provider comparisons

| Provider | Rate (AER) | Type | Minimum Deposit | Access Terms |

|---|---|---|---|---|

| Trading 212 | 4.53% | Easy Access | £1 | Unlimited withdrawals |

| Plum | 4.45% | Easy Access | £100 | Flexible |

| Chip | 4.40% | Easy Access | £1 | App-based |

| Moneybox | 4.35% | Easy Access | £500 | Monthly interest |

| Nationwide | 4.20% | Easy Access | £1 | Branch/online |

Data sourced from Moneyfactscompare ISA comparison (accessed 2025-11-07). Always verify latest rates.

Rates for over 60s

Seniors enjoy tailored best ISA rates for over 60s, like Halifax’s 4.5% AER easy access with no age penalties. Martin Lewis recommends these for retirees, often with higher allowances via joint accounts. Check MoneySavingExpert’s best cash ISA guide for over-60s picks.

Tip: Maximise senior benefits

If you’re over 60, look for ISAs with bonus rates or no withdrawal limits to complement your state pension. Providers like Nationwide offer competitive deals; compare via compare ISA providers tools.

Best fixed rate ISA picks

For stability, the best fixed ISA rates lock in returns like 4.28% for one year, shielding against rate drops expected in 2025.

1-year fixed rates

Top 1-year ISA rates include Santander at 4.25% AER and Shawbrook Bank at 4.28%, both requiring £1,000 minimum. Ideal for short-term goals.

Longer-term options

Two-year fixed ISAs from Santander yield 4.10% AER (Santander 2-year fixed rate ISA), while five-year deals hit 3.8%. Weigh liquidity against guaranteed yields.

Transfer tips

You can transfer existing ISAs tax-free to chase better rates; contact your provider to initiate without losing allowance. HMRC rules ensure seamless moves, but avoid cashing out to prevent penalties.

Top providers and expert recommendations

Martin Lewis’ best ISA rates emphasise value from building societies over banks, with picks like Coventry at 4.5% AER.

Martin Lewis picks

Via MoneySavingExpert, Lewis highlights easy access leaders for 2025, urging switches to beat inflation. His advice targets the best ISA rates money saving expert style, focusing on low-fee options.

High-street vs building societies

High-street like NatWest (NatWest ISA overview) offer convenience at 4.0% AER, but societies like Leeds Building Society provide superior 4.6% rates with FSCS cover.

How to switch for better rates

Switching is simple: use online tools to compare, then transfer. Aim for the best ISA transfer rates to gain 0.5%+ boosts annually.

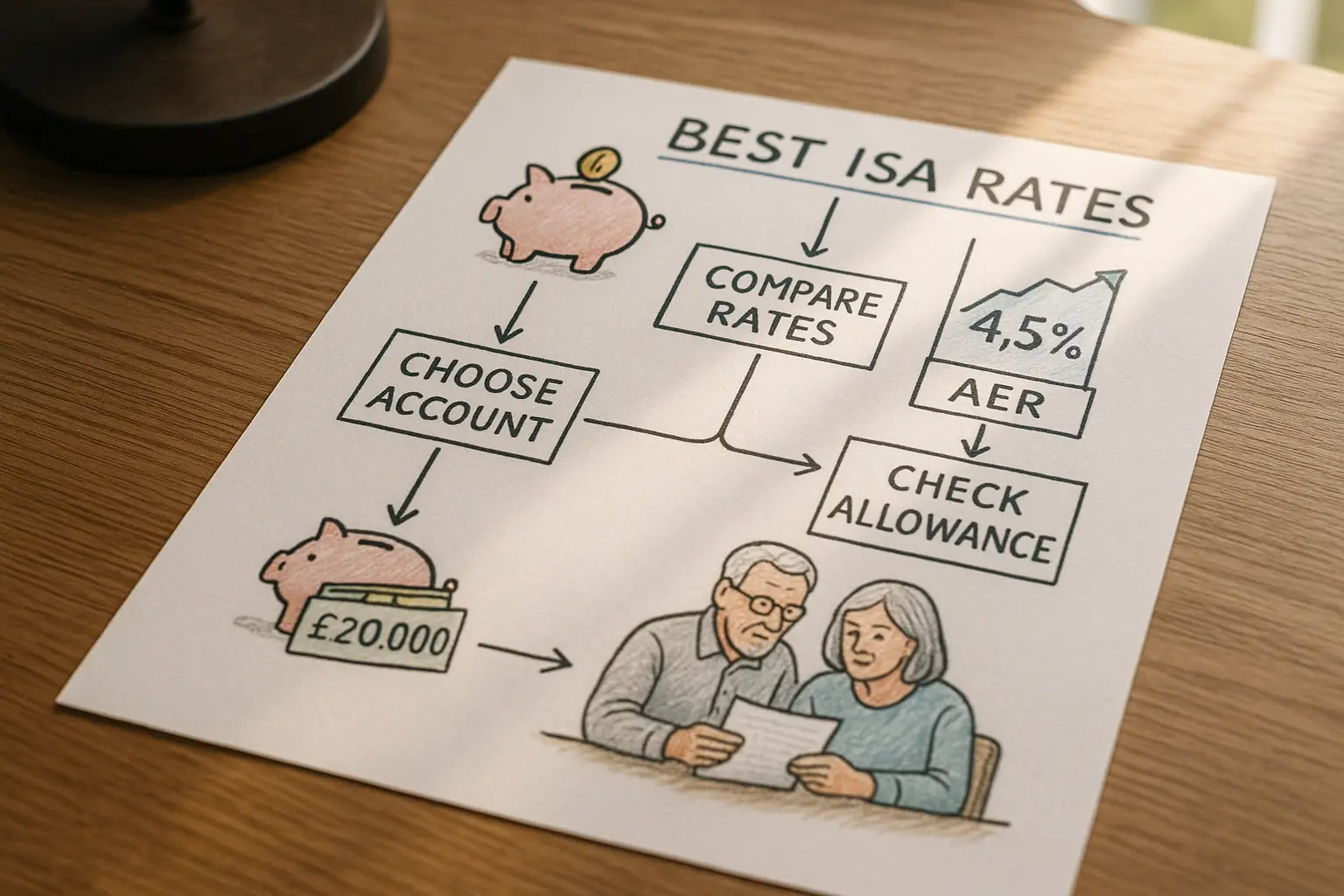

How to choose and open the best ISA

Select based on access needs, rates, and protection; for 2025, prioritise AER above 4% with FSCS backing.

Factors to consider

Evaluate AER (Annual Equivalent Rate, showing true yearly return), minimum deposits, and withdrawal penalties. For families, consider what is an ISA options like juniors.

Step-by-step guide

1. Assess your goals and allowance.

2. Compare rates on sites like Moneyfacts.

3. Open online or in-branch with ID.

4. Fund via transfer or deposit. See our how to open an ISA guide for details.

Common mistakes to avoid

Don’t exceed £20,000 or ignore fees; always transfer, don’t withdraw. Overlook stocks and shares ISAs if risk-tolerant for potentially higher returns.

Frequently asked questions

What is the best cash ISA rate right now?

As of November 2025, the top easy access cash ISA rate is 4.53% AER from providers like Trading 212, offering flexibility for immediate needs (Moneyfactscompare, accessed 2025-11-07). This beats most high-street options and includes FSCS protection. For over-60s, Halifax matches closely at 4.5%, ideal for retirees seeking stability without lock-ins.

How much can I put in an ISA in 2025?

The ISA allowance for 2025/26 is £20,000 tax-free, covering all types combined for UK residents aged 18+ (MoneySavingExpert, accessed 2025-11-07). Unused allowance doesn’t roll over, so maximise it annually. Juniors have a separate £9,000 limit, while Lifetime ISAs cap at £4,000 with bonus.

What’s the difference between a cash ISA and a stocks and shares ISA?

Cash ISAs provide guaranteed, low-risk interest like a savings account, with top rates around 4.5% AER, suitable for conservative savers. Stocks and shares ISAs invest in markets for potential higher returns but with volatility and no guarantees. Both offer tax-free growth, but cash suits short-term, while shares fit long-term goals like retirement.

Are ISA rates better than regular savings accounts?

Yes, ISAs often match or exceed regular savings rates while being tax-free, e.g., 4.53% AER vs taxed equivalents where basic-rate tax reduces net yields. For sums over £1,000 interest, ISAs save 20%+ in tax. However, some non-ISA accounts may edge headline rates; always calculate after-tax returns.

Can I transfer my ISA to get a better rate?

Absolutely, transfers are tax-free and preserve your allowance, allowing moves to higher-rate providers without penalty if done correctly. Contact your new provider to handle it, avoiding direct withdrawals. This strategy can boost returns by 0.5-1%, especially for fixed terms; check HMRC rules to ensure compliance.

What are the best ISA rates for over 60s?

For over-60s, top rates include 4.5% AER easy access from Halifax and Nationwide, often with senior perks like no fees (Martin Lewis recommendations via MoneySavingExpert). These leverage the full £20,000 allowance without age restrictions. Retirees benefit most from flexible access to supplement pensions, but compare via tools for personalised fits.

Are there best junior ISA rates for 2025?

Yes, leading junior cash ISA rates hit 4.6% AER from building societies like Coventry, tax-free until age 18. Parents can contribute up to £9,000 yearly, growing substantially over time. For long-term, consider Lifetime ISAs post-18 for home-buying bonuses.