Tip: Before deciding between a cash ISA and stocks and shares ISA, assess your financial goals and risk tolerance. This guide provides a balanced comparison to help you choose wisely.

Understanding cash ISAs

A cash ISA is a tax-free savings account where your money earns interest without paying income tax on it. It functions like a regular savings account but with the added benefit of tax exemption, making it ideal for those seeking stability. In the UK, cash ISAs are regulated by HMRC and protected up to £85,000 per institution by the Financial Services Compensation Scheme (FSCS).

How cash ISAs work

You can open a cash ISA with various providers, contributing up to the annual ISA allowance. Interest is calculated daily or monthly and added to your balance, often quoted as AER (Annual Equivalent Rate), which shows the true return accounting for compounding. Withdrawals are flexible in easy-access accounts, but fixed-rate options lock your money for a set period for higher rates.

Current rates and protection

As of October 2025, top cash ISA rates stand at 4.51% AER, including bonuses for new customers, according to Moneyfactscompare. These rates beat many standard savings accounts but may fall if base rates drop. Cash ISAs offer FSCS protection, safeguarding your savings if the provider fails, unlike some other investments.

Pros of cash ISAs include low risk and predictable returns, while cons involve lower growth potential compared to investments. For the best cash isa options, compare providers carefully.

Exploring stocks and shares ISAs

A stocks and shares ISA allows you to invest in stocks, shares, funds, and bonds within a tax-free wrapper. Your returns come from capital growth or dividends, but values can fluctuate. This type suits those comfortable with market volatility for potentially higher long-term gains.

Investment basics

You can choose from individual shares, investment trusts, or ready-made portfolios via platforms. The annual allowance applies here too, and you can hold multiple asset types. Platforms charge fees, typically 0.25-1% annually, which impact net returns. For insights on platforms, see MoneySavingExpert’s guide.

Potential returns and risks

Over the past 10 years, stocks and shares ISAs averaged 7-8% annual returns net of fees, based on FTSE All-Share data from MoneySavingExpert (2024). However, past performance is not indicative of future results, and you could lose money. Risks include market downturns, currency fluctuations, and fees eroding gains.

Head-to-head comparison

When comparing cash ISA vs stocks and shares ISA, the key difference lies in risk versus reward. Cash ISAs provide guaranteed interest with capital protection, while stocks and shares ISAs offer higher potential but no guarantees. In 2024, 67% of £103 billion in ISA investments went into cash options, per ONS data, reflecting savers’ preference for safety.

Tax benefits and allowances

Both types are tax-free under HMRC rules, with a £20,000 ISA allowance for 2025/26, unchanged from prior years (HMRC). You can split this across cash and stocks and shares ISAs. No tax on interest, dividends, or gains applies, maximising your savings.

Short vs long-term suitability

For short-term needs (under 5 years), a cash ISA is better due to stability—stocks and shares ISAs suit longer horizons where volatility evens out. If rates remain around 4.51%, cash might outperform low-risk investments short-term, but stocks and shares could double money over 10+ years historically.

| Feature | Cash ISA | Stocks and Shares ISA |

|---|---|---|

| Typical Returns | 4.51% AER (2025) | 7-8% average (past 10 years) |

| Risk Level | Low (FSCS protected) | High (market dependent) |

| Fees | Minimal | 0.25-1% platform fees |

| Suitability | Short-term savings | Long-term growth |

For stocks and shares vs cash ISA, weigh these factors against your goals.

Tip: Use the how to choose a cash isa guide if prioritising safety, or explore cash isa rates for current deals.

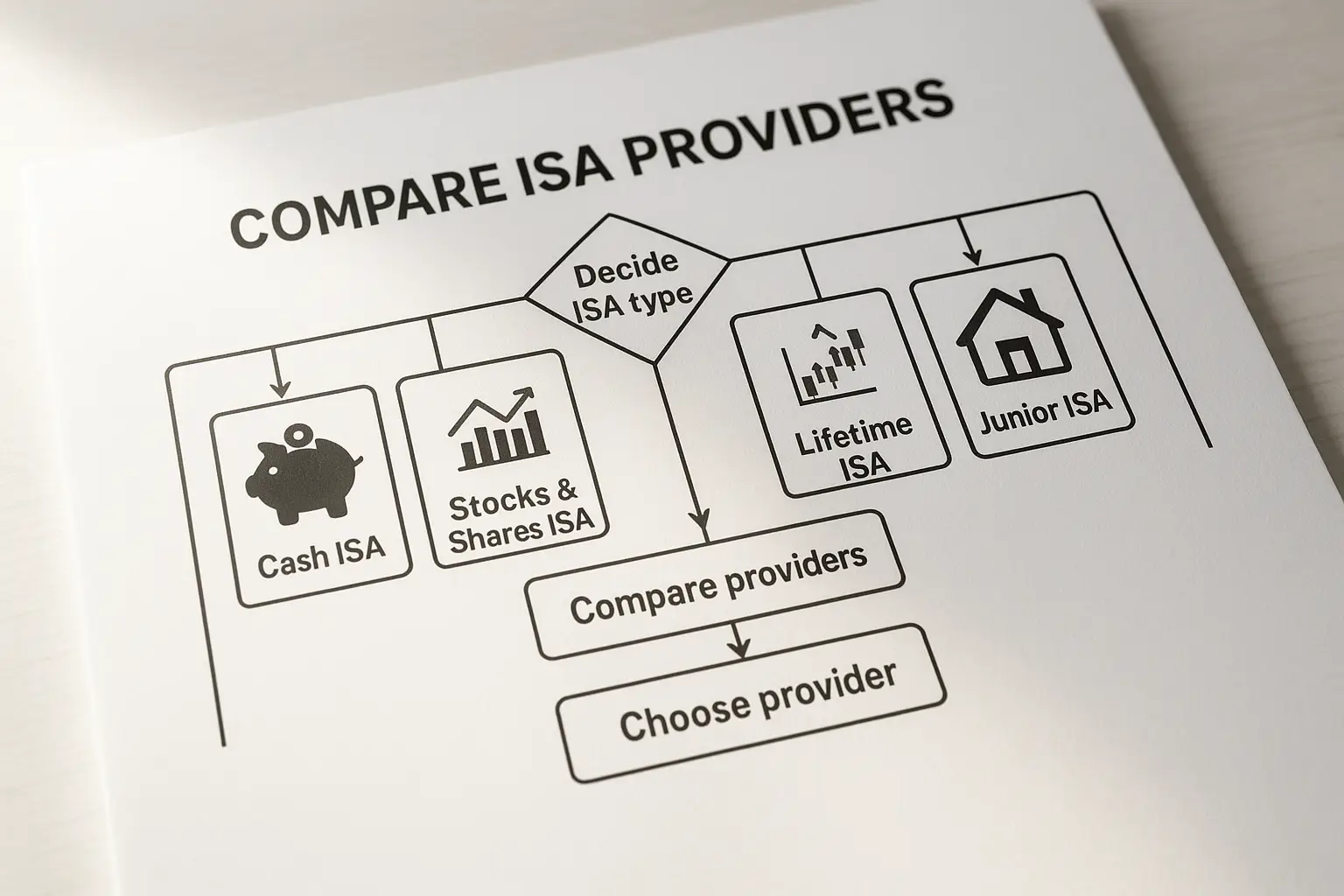

Lifetime and junior ISA options

Lifetime ISAs (LISAs) and Junior ISAs extend the cash vs stocks and shares debate to specific life stages. Both offer tax-free growth but with unique rules.

Cash vs stocks in lifetime ISAs

A Lifetime ISA allows up to £4,000 annual contributions from age 18-50, with a 25% government bonus up to £1,000 (HMRC, 2025). Cash Lifetime ISAs provide stability for first-time buyers, while stocks and shares versions aim for higher growth towards retirement or home purchase. Withdrawals before age 60 incur a 25% penalty unless for eligible uses, making cash lifetime ISA vs stocks and shares lifetime ISA a choice between security and potential.

Saving for children

Junior ISAs (JISAs) enable tax-free savings for kids under 18, with a £9,000 allowance. Junior cash ISAs offer low-risk growth, ideal for near-term needs, whereas junior stocks and shares ISAs can build wealth over time but with volatility. Parents control until age 18; for child stocks and shares ISA vs child cash ISA, consider the child’s future timeline.

For more on junior options, check Forbes Advisor.

Choosing the right ISA for you

The best choice in cash ISA vs stocks and shares ISA depends on your circumstances. If preserving capital is key, opt for cash; for growth, choose stocks and shares.

Factors to consider in 2025

Evaluate your time horizon—short-term favours cash at 4.51% AER, long-term stocks for 7-8% potential. Risk tolerance is crucial: cash is safe, stocks volatile. Market conditions in 2025, like interest rates, influence decisions. Consult Aviva’s knowledge centre for balanced views. Remember, this is not financial advice; seek professional guidance.

Frequently asked questions

What’s the difference between a cash ISA and stocks and shares ISA?

The main difference in cash ISA vs stocks and shares ISA is how your money grows: cash ISAs earn fixed interest like a savings account, protected and low-risk, while stocks and shares ISAs invest in markets for potentially higher but variable returns. Both are tax-free up to £20,000 annually per HMRC rules, but cash suits conservative savers, and stocks appeal to those seeking growth over time. Understanding this helps align with your financial goals, such as emergency funds versus retirement planning.

Which ISA is better for short-term savings?

For short-term savings (under 5 years), a cash ISA is generally superior due to its guaranteed returns and capital protection, currently at up to 4.51% AER as per Moneyfactscompare (2025). Stocks and shares ISAs carry market risk, where short-term dips could lead to losses, making them unsuitable for funds you need soon. Always factor in your liquidity needs and inflation to ensure real growth.

Can I have both a cash ISA and stocks and shares ISA?

Yes, you can hold both a cash ISA and stocks and shares ISA simultaneously, as long as total contributions stay within the £20,000 annual allowance for 2025/26 (HMRC). This diversification balances safety and growth, allowing part in low-risk cash for emergencies and part in investments for long-term wealth. Track your subscriptions carefully to avoid exceeding limits.

How much can I put in an ISA in 2025?

The ISA allowance for 2025 is £20,000, applicable across all ISA types including cash and stocks and shares, as confirmed by HMRC. This tax year runs from 6 April 2025 to 5 April 2026, and unused allowance doesn’t carry over. For stocks and shares ISA vs cash ISA planning, split wisely based on your risk profile.

Are stocks and shares ISAs worth the risk?

Stocks and shares ISAs can be worth the risk for long-term goals, with historical 7-8% returns outperforming cash’s 4.51% AER, but only if you tolerate volatility and invest for 5+ years (MoneySavingExpert, 2024). They’re not for everyone—short-term needs or low risk tolerance favour cash. Diversify and review regularly to manage risks effectively.

Cash lifetime ISA vs stocks and shares lifetime ISA: which for first-time buyers?

For first-time buyers, a cash Lifetime ISA offers stability with the 25% government bonus, ideal if buying soon and rates like 4.51% AER beat inflation (HMRC, 2025). Stocks and shares versions provide growth potential for longer timelines but with penalty risks on early withdrawals. Choose based on your purchase horizon—cash for 1-2 years, stocks for 5+.

Junior cash ISA vs junior stocks and shares ISA for children’s savings?

A junior cash ISA prioritises safety for children’s funds, earning tax-free interest without market exposure, suitable for modest goals. Junior stocks and shares ISAs aim for higher growth over 18 years but involve risks like value drops. Parents should match to the child’s future needs, such as education, while considering FSCS protection for cash.

This guide empowers you to decide on cash ISA vs stocks and shares ISA. For top cash isa providers, research further or consult an advisor.