Understanding ISA types and rates

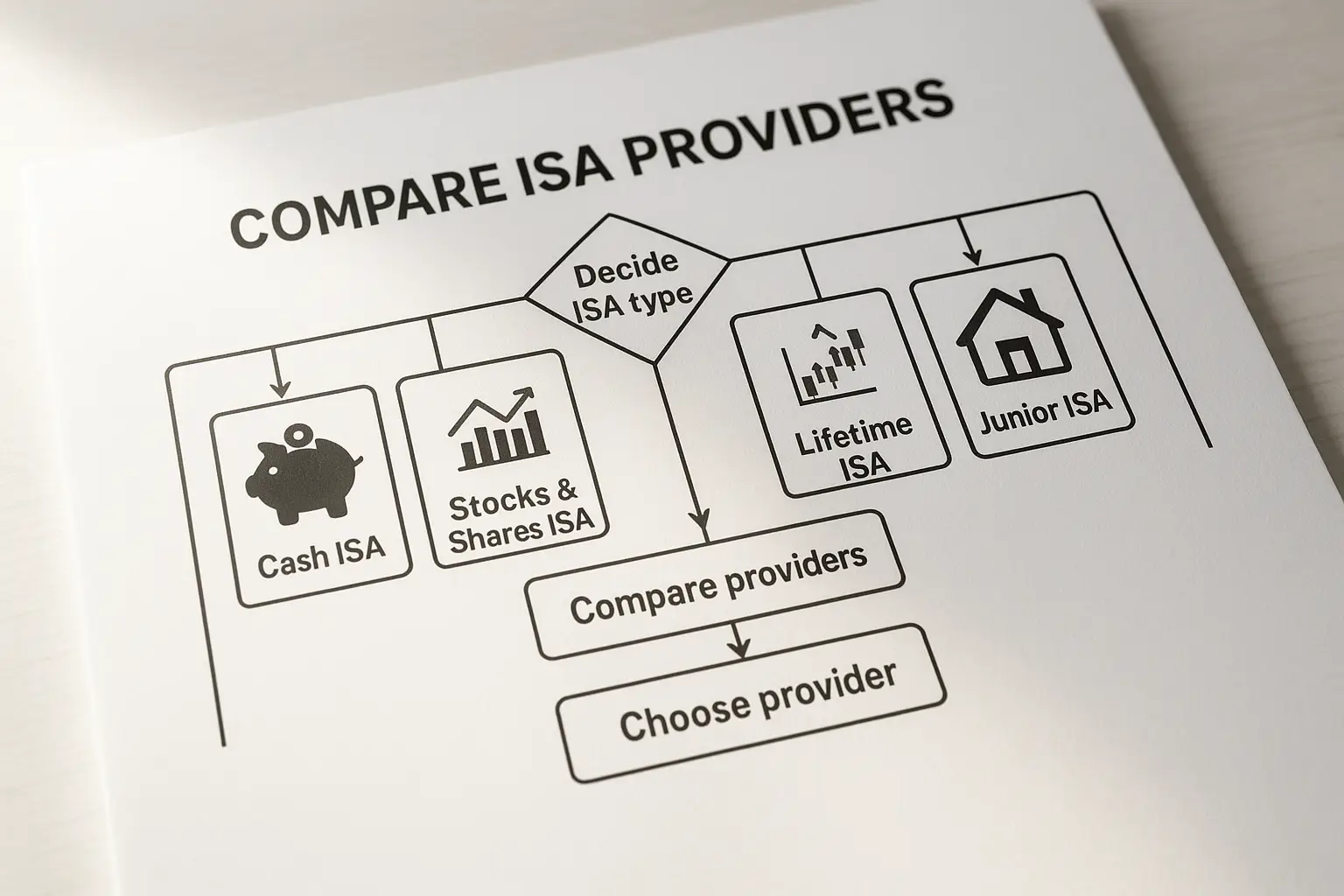

The key to an effective ISA rates comparison in 2025 lies in grasping the main types available and how their interest rates stack up against each other. Individual Savings Accounts (ISAs) are tax-free wrappers for your savings or investments in the UK, with cash ISAs offering straightforward interest earnings and fixed rate ISAs providing locked-in returns for security.

Cash ISAs vs fixed rate ISAs

Cash ISAs allow flexible access to your money while earning competitive interest, making them ideal for short-term needs, whereas fixed rate ISAs lock your funds for a set period in exchange for higher, guaranteed rates. For a cash ISA rates comparison, top easy-access options currently yield up to 4.51% AER (annual equivalent rate, which shows the true return including compounding), as per Moneyfactscompare.co.uk accessed on 2025-10-22. In contrast, fixed ISA rates comparison shows 1-year terms at up to 4.27% AER, but withdrawals may incur penalties, so choose based on your liquidity requirements.

Lifetime and junior ISAs overview

Lifetime ISAs target first-time buyers aged 18-39, combining savings with a 25% government bonus, while junior ISAs build tax-free pots for children under 18. A lifetime ISA rates comparison reveals cash components around 4.00% AER plus the bonus, outperforming standard cash ISAs for eligible savers. Junior ISAs offer similar rates to adult versions but with parental control until the child turns 18, emphasising long-term growth over immediate access.

Key factors affecting rates

Interest rates on ISAs are influenced by the Bank of England base rate, currently at 4.75%, provider competition, and economic forecasts for 2025. Inflation and market volatility can cause fluctuations, so always verify live rates. Building societies often lead in ISA fixed rates comparison due to member-focused models.

Top cash ISA rates comparison

As of October 2025, the highest cash ISA rates reach 4.51% AER for easy-access accounts, providing tax-free growth without commitment, according to Moneyfactscompare.co.uk.

Easy access options

Easy-access cash ISAs let you withdraw anytime, suiting emergency funds, with rates like 4.20% AER for weekly top picks from Moneyfactscompare.co.uk’s roundup accessed 2025-10-22. These outperform standard savings by shielding interest from tax, especially useful if you’re a basic-rate taxpayer.

Best providers and AERs

Leading providers include online banks and building societies offering up to 4.45% AER, as highlighted by Money.co.uk. For a detailed cash ISA interest rates comparison, focus on FSCS protection (Financial Services Compensation Scheme, covering up to £85,000 per institution) and minimum deposits starting at £1.

| Provider | AER (%) | Min Deposit | Access Type |

|---|---|---|---|

| Plum | 4.51 | £100 | Easy Access |

| Moneybox | 4.45 | £500 | Easy Access |

| Chip | 4.20 | £1 | Easy Access |

Rates are illustrative and subject to change; check providers directly.

Tax-free benefits

All ISA interest is tax-free, potentially saving £200+ annually on a £20,000 deposit at 4% AER for higher-rate taxpayers. This makes cash ISA comparison rates essential for maximising returns without HMRC deductions.

Tip: Use online calculators on sites like Moneysavingexpert.com to project your earnings and compare against non-ISA savings.

Fixed rate ISA comparisons

Fixed rate ISAs guarantee returns for terms from 6 months to 5 years, with top 1-year options at 4.27% AER as of October 2025, per Moneyfactscompare.co.uk, ideal for those expecting rate drops.

1-year vs longer terms

A fixed ISA rates comparison shows 1-year deals at 4.10% AER weekly average, dropping to 3.80% for 5-year terms due to longer commitments. Shorter terms offer quicker access post-maturity, balancing yield and flexibility.

Rate tables by provider

Providers like Santander and NatWest feature in fixed rate ISA rates comparison, with AERs varying by deposit size.

| Provider | Term | AER (%) | Min Deposit |

|---|---|---|---|

| Santander | 1 Year | 4.27 | £500 |

| NatWest | 2 Years | 4.00 | £1,000 |

| Yorkshire BS | 1 Year | 4.10 | £100 |

Data from Moneyfactscompare.co.uk, accessed 2025-10-22.

Lock-in considerations

Fixed ISAs penalise early withdrawals, often losing 90-180 days’ interest, so assess your plans before committing in a cash ISA fixed rates comparison.

Specialised ISAs: Lifetime and help to buy

Specialised ISAs like Lifetime offer bonuses alongside rates around 4.00% AER, enhancing value for homebuyers, while Help to Buy ISAs remain relevant for legacy holders despite closure in 2019.

Bonus structures

Lifetime ISAs provide a 25% bonus on up to £4,000 annually, equating to £1,000 free, boosting effective rates beyond standard comparisons.

Rate benchmarks

Lifetime ISA interest rates comparison shows cash yields of 4.00% AER from providers like Moneybox, per Money.co.uk estimates for 2025.

| Provider | Cash Rate (AER %) | Bonus Eligibility |

|---|---|---|

| Moneybox | 4.00 | Up to £1,000 |

| Ajax | 3.80 | Up to £1,000 |

| Plum | 3.90 | Up to £1,000 |

Eligibility rules

Available to UK residents aged 18-39 for Lifetime ISAs, with 25% penalties on non-qualifying withdrawals; Help to Buy requires prior contributions before closure.

For more on the best isa options, explore our pillar guide. If you’re new, learn how to open an isa efficiently.

How to choose and switch ISAs

To choose the best ISA, prioritise your access needs and risk tolerance, using tools for a thorough ISA comparison rates analysis before switching seamlessly via providers.

Comparison tools

Sites like Moneyfactscompare.co.uk offer filters for cash ISA rates UK comparison, including AER and terms, updated daily.

Transfer process

Switching ISAs maintains tax-free status; instruct your new provider to handle the transfer, typically taking 5-15 days without losing interest, as advised by GOV.UK.

2025 rate forecasts

With potential base rate cuts, fixed rates may rise short-term, per Moneysavingexpert.com analysis; monitor for isa saving rates comparison opportunities.

ISA allowance and regulations 2025/26

The £20,000 annual ISA allowance applies across all types for the 2025/26 tax year (6 April 2025 to 5 April 2026), allowing flexible splits without carryover, per HMRC via Moneysavingexpert.com.

Annual limits

You can invest up to £20,000 total, with no sub-limits per type, enabling a balanced portfolio.

Multiple ISAs allowed

Yes, one of each type per tax year, maximising diversification in an ISA rates comparison table.

FSCS coverage

Protection up to £85,000 per person per institution ensures safety; verify for multi-ISA holdings.

Frequently asked questions

What is the best cash ISA rate in 2025?

The highest cash ISA rate in 2025 stands at 4.51% AER for easy-access accounts from providers like Plum, based on Moneyfactscompare.co.uk data as of October 2025. This rate beats many standard savings by being tax-free, allowing full compound growth. However, rates vary by provider, so compare using tools that factor in your deposit size and access needs for the best fit.

How do fixed rate ISAs compare to easy access?

Fixed rate ISAs offer higher yields like 4.27% AER for 1-year terms but lock funds, unlike easy-access at 4.20% AER with flexibility. In a fixed vs easy access comparison, choose fixed if you foresee rate drops in 2025; otherwise, easy access suits liquidity. Consider penalties and your financial goals to avoid opportunity costs.

What is the ISA allowance for 2025/26?

The ISA allowance for 2025/26 remains £20,000, covering all types from cash to stocks, as confirmed by HMRC guidelines. This limit resets each tax year on 6 April, with no rollover for unused amounts. It enables tax-efficient saving; exceeding it means taxable interest on excess funds.

Are Lifetime ISAs worth it for interest rates?

Lifetime ISAs provide around 4.00% AER plus a 25% government bonus, making them worthwhile for eligible 18-39-year-olds saving for homes or retirement. Compared to standard ISAs, the bonus effectively boosts returns to 5.00% equivalent on contributions. However, 25% penalties apply to non-qualifying withdrawals, so assess long-term commitment before investing.

How to switch ISA providers without losing interest?

To switch without losing interest, your new provider manages the transfer, crediting accrued earnings seamlessly within 15 working days under FCA rules. Use this for better rates in a cash ISA transfer rates comparison, ensuring the old ISA closes properly. Always confirm FSCS coverage transfers to maintain protection up to £85,000.

What factors influence ISA rates comparison in the UK for 2025?

Key factors include Bank of England base rate changes, provider competition, and inflation trends, with current highs at 4.51% AER influenced by the 4.75% base. For an ISA interest rates comparison UK 2025, also weigh access types and bonuses. Experts like Martin Lewis recommend monitoring weekly updates on sites like Moneysavingexpert.com for timely decisions.

Rates are current as of 2025-10-22 and may change; verify with providers and consult a financial advisor for personal advice. For the latest, visit Moneysavingexpert.com’s top cash ISAs guide.