Understanding Cash ISAs in the UK

A Cash ISA allows UK residents to save up to £20,000 each tax year in a tax-free wrapper, shielding interest from income tax. This makes it ideal for savers seeking to grow their money without HMRC taking a cut. For 2025/26, the allowance remains at this level, as confirmed by official rules on the HMRC website.

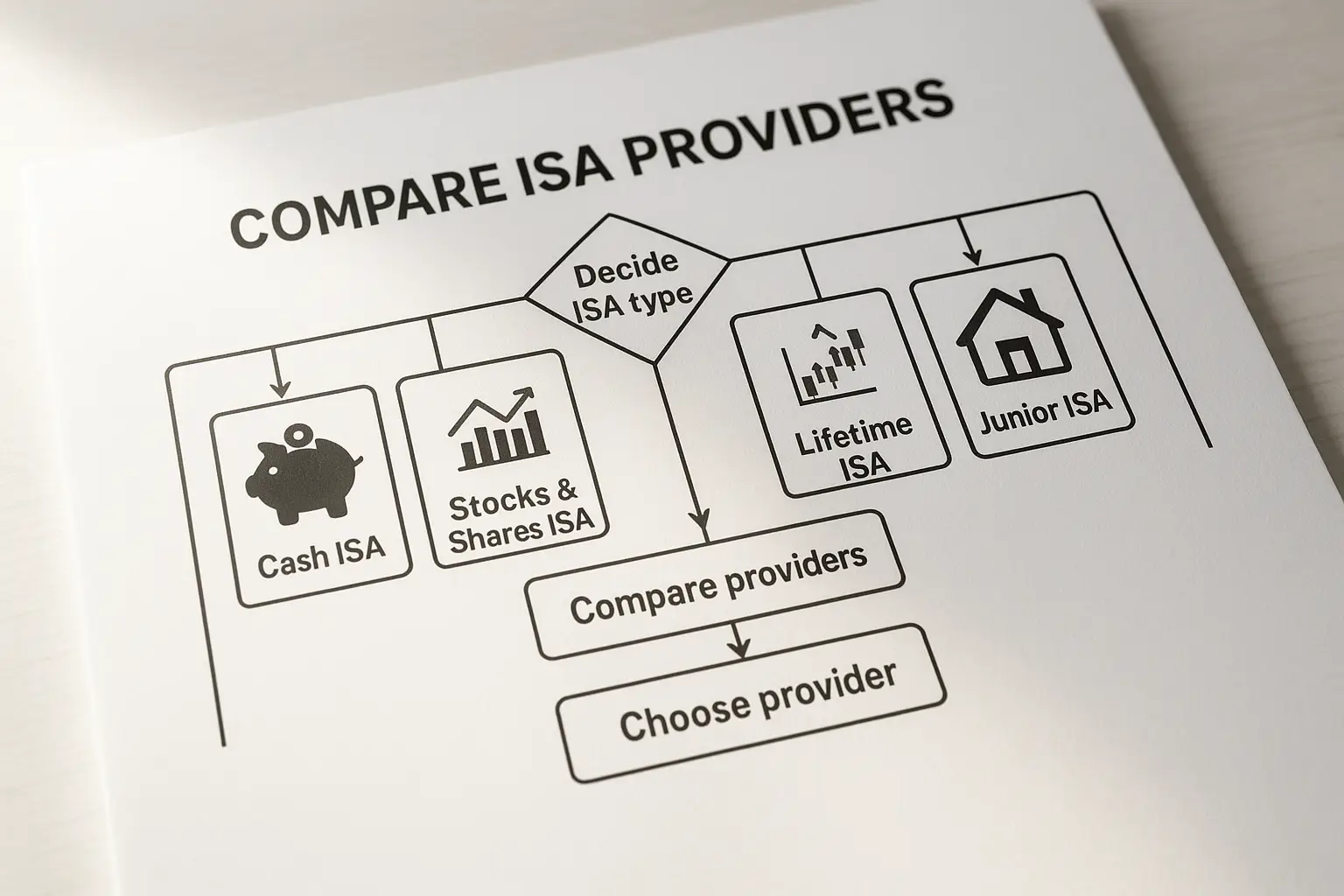

What is a Cash ISA?

A Cash ISA is a savings account where your interest earns tax-free, unlike standard savings where higher-rate taxpayers lose 40% of gains. Providers offer various options, from high-street banks to online-only firms. Top cash ISA providers in the UK typically guarantee FSCS protection up to £85,000 per institution, ensuring your funds are safe if the provider fails – FSCS stands for Financial Services Compensation Scheme.

Benefits and tax rules

The core benefit is tax efficiency: no capital gains or income tax on earnings. You can only contribute £20,000 annually across all ISAs, and withdrawals don’t affect the allowance. Interest rates, quoted as AER (Annual Equivalent Rate, which shows the true yearly return including compounding), currently peak at 4.51% according to recent data from Moneyfactscompare. Always check for updates, as rates fluctuate.

Types: easy access vs fixed

Easy access Cash ISAs let you withdraw anytime without penalty, suiting flexible needs, with rates up to 4.3%. Fixed-rate versions lock funds for a set period, like one year, offering higher yields up to 4.5% but penalise early access. Choose based on your timeline – for short-term parking, easy access wins; for committed saving, fixed is better.

Top 10 cash ISA providers comparison

Among the top cash ISA providers UK-wide, rates and features vary by type. For 2025, standout options include digital challengers and established societies. This section compares the top 10 based on AER, minimum deposits, and access, drawing from expert analyses like those on MoneySavingExpert.

| Provider | AER (%) | Min Deposit | Type | Pros | Cons |

|---|---|---|---|---|---|

| Plum | 4.5 | £100 | Easy Access | App-based, flexible | Newer provider |

| Chip | 4.4 | £1 | Easy Access | Low entry, user-friendly | Variable rate |

| Close Brothers | 4.5 | £10,000 | Fixed 1 Year | Competitive fixed rate | High minimum |

| Tembo | 4.2 | £1 | Easy Access | No fees, quick setup | Slightly lower rate |

| Shawbrook Bank | 4.3 | £1,000 | Fixed 2 Years | Strong FSCS cover | Lock-in period |

| Leeds Building Society | 4.4 | £100 | Easy Access | Branch support | Rate may drop |

| Virginia Savings Bank | 4.1 | £500 | Fixed 1 Year | Reliable society | Online only |

| Cynergy Bank | 4.3 | £1 | Easy Access | High liquidity | App required |

| Skipton Building Society | 4.2 | £10 | Fixed 18 Months | Established trust | Penalty on withdrawal |

| Oxbury Bank | 4.0 | £500 | Easy Access | Rural focus, solid | Limited branches |

These top 10 cash ISA providers are selected for their competitive 2025 rates, as highlighted in comparisons from Ecommerce Accountants. Plum leads for digital ease, while Close Brothers suits larger savers.

How to choose the best cash ISA provider

Prioritise AER, access needs, and provider stability when selecting from top cash ISA providers. Match your savings goal: flexible for emergencies, fixed for predictability. For 2025 trends, expect rates to hover around 4-4.5% amid base rate stability, per insights from Which?.

Key factors: rates, fees, accessibility

Look beyond headline rates – consider AER for fair comparison and any fees that erode gains. Accessibility matters: easy access for liquidity, fixed for higher yields. Minimum deposits range from £1 to £10,000, so assess your pot size.

- Compare AER across providers using tools like those on money.co.uk.

- Verify FSCS coverage for safety.

- Read customer reviews for service quality.

For deeper guidance, learn how to choose a cash isa that fits your lifestyle.

Eligibility and £20k allowance

UK residents aged 18+ qualify, with the £20,000 limit shared across ISAs. Transfers from non-ISA accounts count towards it. Non-residents or those with offshore income may have restrictions – consult HMRC.

2025 trends and predictions

With inflation cooling, top cash ISA providers UK 2025 are likely to maintain rates near 4.5%, though Bank of England cuts could trim them. Digital providers like Chip may innovate with bonuses. Track weekly updates via Moneyfactscompare for the best deals.

Explore current cash isa rates or our pillar on best cash isa options.

Lifetime ISA providers overview

Lifetime ISAs (LISAs) blend Cash ISA perks with a 25% government bonus for home buying or retirement, up to £1,000 yearly on £4,000 contributions. They’re for under-40s, with withdrawal penalties outside allowed uses. Top 10 cash lifetime ISA providers overlap with standard ones but add bonus mechanics.

Key differences from standard Cash ISA

Unlike regular Cash ISAs, LISAs cap at £4,000 annually and offer the state top-up, but penalise non-qualifying withdrawals at 25%. Rates mirror Cash ISAs at around 4.2-4.5%. Ideal for first-time buyers saving for deposits.

Top options for first-time buyers

Providers like Plum and Tembo offer competitive LISA rates with easy apps. For example, Moneybox provides 4.3% AER plus bonus. Compare via Wise to avoid fees.

Note: This is not financial advice; rates as of October 2025 may change. Consult a professional.

Frequently asked questions

What is the best cash ISA rate right now?

As of late 2025, the highest cash ISA rates reach 4.51% AER for fixed terms, primarily from specialist providers like Close Brothers, according to Moneyfactscompare daily updates. Easy access options lag slightly at 4.3%, offering flexibility for uncertain savers. These rates beat standard savings by shielding tax, potentially adding hundreds to your pot yearly on larger balances – always verify current figures as they shift with market conditions.

How do I choose a cash ISA provider?

Selecting from top cash ISA providers involves balancing AER, access type, and minimums against your goals, such as liquidity needs or fixed returns. Review FSCS protection and customer service ratings from sources like Which? to ensure reliability. For beginners, start with low-entry digital banks; experts might optimise by laddering fixed terms to capture peak rates without locking all funds.

Are cash ISAs worth it in 2025?

Yes, with rates up to 4.5% tax-free, Cash ISAs outpace inflation and taxable alternatives for basic-rate taxpayers, maximising the £20,000 allowance. However, if your savings exceed £85,000 per provider, diversify for FSCS limits. In 2025, amid stable base rates, they’re particularly valuable for medium-term goals like emergencies or home funds, though stocks and shares ISAs suit risk-tolerant investors seeking higher long-term growth.

What are the top fixed-rate cash ISAs?

Top fixed-rate cash ISAs for 2025 include 4.5% one-year deals from Close Brothers and Shawbrook, locking rates against potential cuts. These outperform variable easy access by 0.2-0.5%, ideal for predictable savers. Penalties apply for early withdrawal, so assess your timeline; comparisons on MoneySavingExpert highlight the best for different terms, from six months to five years.

What are the differences between easy access and fixed cash ISAs?

Easy access Cash ISAs allow penalty-free withdrawals, with rates around 4.3% but prone to drops, suiting emergency funds. Fixed versions guarantee higher AER like 4.5% for a set period but restrict access, perfect for committed saving. Choose easy if flexibility trumps yield; fixed if you can commit, as per expert breakdowns on money.co.uk – hybrid strategies often combine both for balance.

Who are the top 10 cash lifetime ISA providers?

Leading top 10 cash lifetime ISA providers for 2025 feature providers like Plum at 4.5% AER plus 25% bonus, and Chip for low-minimum entry. Others such as Tembo and Moneybox rate highly for app ease and quick bonuses. These niche options target under-40s, but penalties deter casual use; compare via Wise for bonus-eligible deals without cannibalising standard ISA allowances.