Understanding high-interest savings accounts in the UK

High-interest savings accounts in the UK offer savers rates well above the national average, often exceeding 4% AER in 2025, allowing you to maximise earnings on your cash. These accounts come in various types to suit different needs, from flexible access to locked-in terms for higher yields. By choosing the right one, you can beat inflation and grow your savings effectively, but always consider access restrictions and tax implications.

Types of high-interest savings accounts

The main types include easy access accounts, where you can withdraw funds anytime without penalty, ideal for emergency funds. Fixed-rate bonds lock your money for a set period, like one year, in exchange for guaranteed rates up to 4.55%. Regular saver accounts reward consistent monthly deposits with boosted interest, such as up to 7.5%, but cap contributions at around £200 per month. For comparisons of high interest savings accounts UK, easy access suits liquidity needs, while fixed options maximise returns for sums you won’t touch.

Benefits and risks of high-interest savings accounts UK

These accounts provide superior returns compared to standard bank savings, with top rates around 4.56% AER for easy access as of October 2025, helping your money compound faster. Benefits include FSCS protection up to £85,000 per institution and potential tax-free earnings under the Personal Savings Allowance (PSA), where basic-rate taxpayers enjoy £1,000 interest tax-free annually. Risks involve variable rates dropping with the Bank of England base rate, now at 4.5% following a February cut, and penalties for early withdrawals in fixed terms. Always check for minimum deposits, which can start from £1.

FSCS protection and tax rules for UK savers

The Financial Services Compensation Scheme (FSCS) safeguards deposits up to £85,000 per person per institution if the provider fails, covering most UK high interest savings accounts. For tax, the PSA allows higher-rate taxpayers £500 tax-free interest, while additional-rate savers get none—consider a Cash ISA for tax-free growth. More on savings protection from Which? highlights the importance of spreading funds across providers for larger sums.

Best easy access savings accounts 2025

In 2025, the best easy access savings accounts UK deliver up to 4.56% AER, providing instant liquidity with competitive yields tied to the base rate. Providers like building societies often lead, offering variable rates that adjust monthly. For the best high interest savings accounts UK, prioritise those with no withdrawal limits to maintain access while earning more than inflation.

Top rates and providers for easy access

Leading options include accounts from smaller banks and societies, with rates hovering around 4.5-4.56%. For instance, select building societies offer 4.56% on balances over £1,000. Check MoneySavingExpert for Martin Lewis-recommended picks, which emphasise customer satisfaction alongside rates.

Comparison of high interest easy access savings accounts UK

| Provider | Rate (AER) | Min Deposit | Access | FSCS Protected |

|---|---|---|---|---|

| Nationwide Building Society | 4.50% | £1 | Instant | Yes |

| Lloyds Bank | 4.40% | £1 | Instant | Yes |

| Chip | 4.56% | £1 | Instant | Yes |

| RCI Bank | 4.52% | £100 | Instant | Yes |

| Trading 212 | 4.50% | £1 | Instant | Yes |

This table compares top high interest savings accounts UK based on October 2025 data from Money.co.uk and Moneyfacts. Rates are variable and may change; always verify current offers.

How to choose easy access for liquidity

Select based on your balance size—accounts often tier rates, with higher yields for larger deposits up to FSCS limits. For best savings account UK options, ensure online access for quick transfers. If planning for 2025, factor in potential base rate stability around 4.5%.

Top fixed-rate and regular saver options

Fixed-rate accounts guarantee yields up to 4.55% for one-year terms, outperforming variable rates if you can commit funds. Regular savers hit 7.5% but limit deposits, suiting disciplined savers building habits. These are ideal for high interest rate savings accounts UK when rates may fall.

Highest yields for locked savings

One-year fixed bonds from providers like Shawbrook Bank offer 4.55%, locking in against base rate cuts. For longer terms, two-year rates dip slightly to 4.3%. See Money.co.uk for expert comparisons of fixed high interest savings accounts UK.

Regular saver deals up to 7.5%

Accounts from Nationwide and First Direct cap at 7.5% for £200 monthly, earning £150 annually on max deposits. Restrictions apply, like no early withdrawals. Details from MoneySavingExpert guide the best high interest regular savings accounts UK.

Suitability for large sums in high interest savings accounts UK

For deposits over £85,000, split across institutions to stay FSCS-protected. High street banks like Lloyds offer business variants at around 4%, while specialist providers yield more for large personal sums. Explore savings account interest rates UK for projections.

Niche accounts: Business, children, and ISAs

Niche high interest savings accounts UK cater to specific needs, from business cash flow to family planning, often with tailored rates. Business accounts provide easy access at 3-4%, while children’s options build future funds tax-free. Cash ISAs wrap high yields in tax exemption, complementing regular savers.

Business savings rates

High interest business savings accounts UK from Metro Bank offer up to 4% on notice accounts, with no VAT complications. For small firms, regular business savers boost returns on surplus cash. Always confirm FSCS for business deposits.

Family and junior accounts

Children’s high interest savings accounts UK, like junior ISAs, yield 4-5% tax-free until age 18. Providers such as Coventry Building Society lead with flexible access. These teach saving while maximising growth.

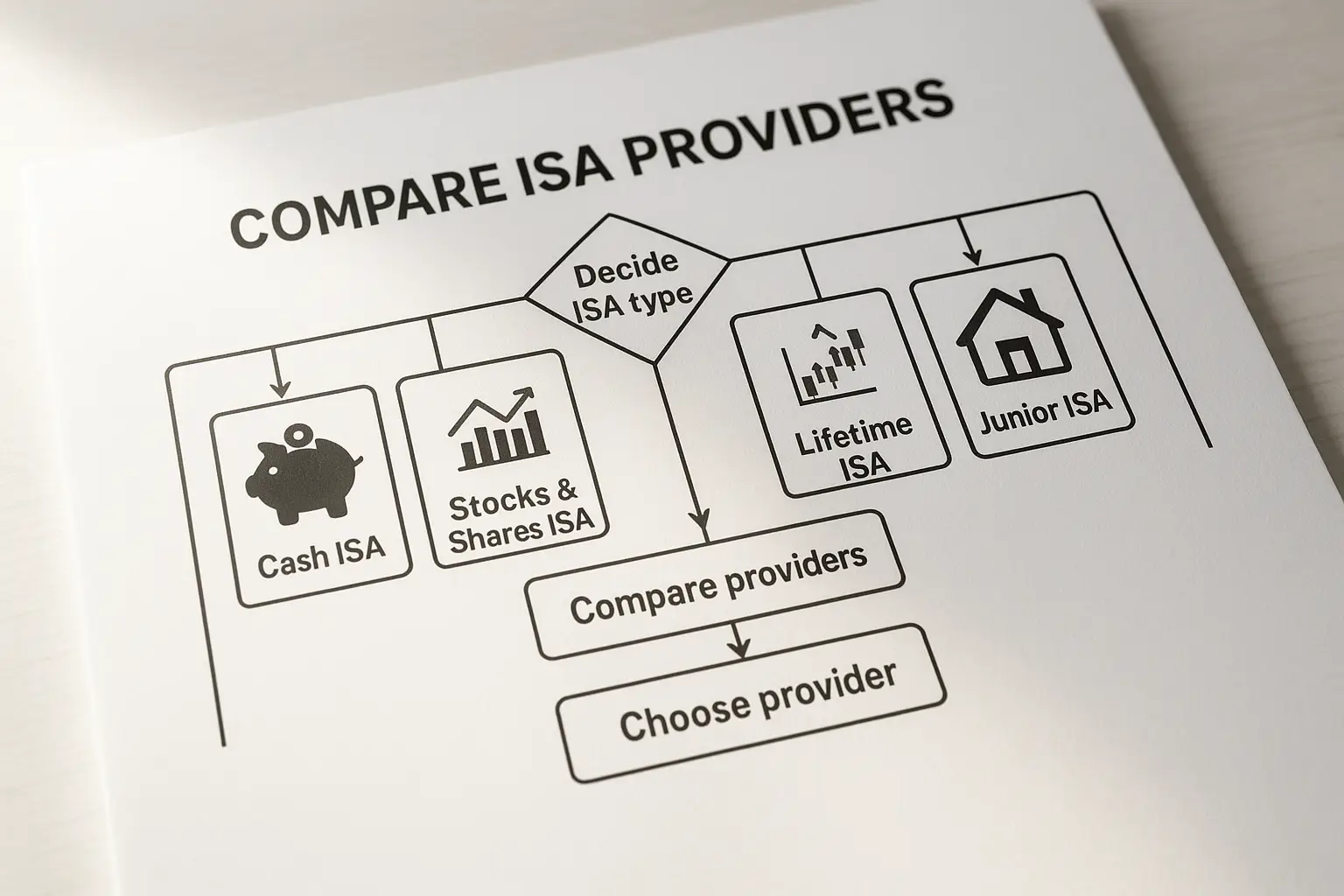

Tax-free alternatives with Cash ISAs

High interest ISA savings accounts UK mirror regular rates but shelter interest from tax, ideal if exceeding PSA. Easy access Cash ISAs hit 4.5% in 2025. For more, link to our guide on how to choose a savings account UK.

How to switch and maximise returns in 2025

Switching high interest savings accounts UK is straightforward via the Current Account Switch Service if bundled, often completing in seven days. To maximise, monitor rates quarterly and move to top yields before bonuses end. In 2025, with base rate at 4.5%, expect easy access around 4.2-4.5% if no further cuts.

Switching process for better rates

Compare via independent sites, then apply online—most require ID verification. Transfer funds directly to avoid gaps. Use CASS for seamless switches where applicable.

Rate forecasts based on Bank of England

Post-February cut to 4.5%, forecasts suggest stability unless inflation rises, keeping high interest rates savings accounts UK viable. Track via Yahoo Finance updates on BoE impacts.

Avoiding common pitfalls

Don’t chase introductory bonuses that drop sharply; read terms for fees. For large sums, diversify to protect beyond £85,000.

Frequently asked questions

What is the best high interest savings account UK 2025?

The best high interest savings accounts UK 2025 depend on access needs, but top easy access options like those from Chip or RCI Bank offer 4.56% AER with instant withdrawals and low minimums. For fixed terms, Shawbrook’s 4.55% one-year bond locks in yields amid potential rate drops. Experts from MoneySavingExpert recommend checking customer service ratings alongside rates, as satisfaction impacts long-term value—always verify current offers since markets fluctuate with BoE decisions.

Are high interest savings accounts safe in the UK?

Yes, high interest savings accounts UK are safe if FSCS-protected, covering up to £85,000 per person per institution against provider failure. The scheme, backed by the government, has compensated billions since 2001 without cost to savers. However, spread large deposits across multiple banks to avoid limits, and stick to authorised UK providers—avoid unregulated overseas options despite higher rates, as they lack this safety net.

How much interest can I earn on savings UK?

On £10,000 at 4.5% AER, you’d earn about £450 annually, compounded daily for maximum growth. Rates vary by type: regular savers can yield £150 on £2,400 yearly deposits at 7.5%, while fixed bonds guarantee more on larger sums. Factor in tax—basic-rate taxpayers pay nothing on first £1,000 interest under PSA—but higher earners may owe 40%, making ISAs preferable for optimisation.

What is the current best easy access savings rate?

As of October 2025, the best easy access savings rate is 4.56% AER from providers like Chip, accessible online with no penalties. This beats the 0.5% average high street rate, but variable nature means it tracks the 4.5% base rate closely. For comparisons, use tools from Moneyfacts to ensure the rate fits your liquidity needs without hidden fees.

How do ISAs compare to regular savings accounts?

Cash ISAs offer the same high interest rates as regular accounts but tax-free, crucial if your interest exceeds PSA limits—e.g., £20,000 at 4.5% generates £900, taxable for higher earners. Regular high interest savings accounts UK provide flexibility without annual £20,000 ISA allowance caps. ISAs suit long-term tax planning, while regulars work for short-term parking; hybrid strategies, like splitting funds, maximise both accessibility and shelter.

What are high interest business savings accounts UK?

High interest business savings accounts UK target SMEs with rates around 4% on easy access, often with higher limits than personal accounts—e.g., Metro Bank’s 3.75% notice account. They include features like unlimited transfers for cash flow but may require business verification. Compared to personal options, yields are similar yet tailored for VAT-free interest; consult providers like Starling Bank for seamless integration with current accounts.

How to compare high interest savings accounts UK for large sums?

For large sums over £85,000, compare high interest savings accounts UK by prioritising FSCS spread—e.g., divide into £85k chunks across providers like Lloyds and Nationwide for 4.4-4.5% AER. Use tables focusing on tiered rates, where bigger balances earn more, and check withdrawal terms to avoid penalties. Advanced strategies involve laddering fixed bonds for liquidity; tools from Which? aid in balancing yield and protection against rate changes in 2025.